Deed Requirements

The borrower must have the document notarized and submit it to the Clerk of the Circuit Court for recording.[1] To be eligible for recording, documents must meet the following guidelines:

- White paper only

- Black ink with a font size of at least 8pt[2]

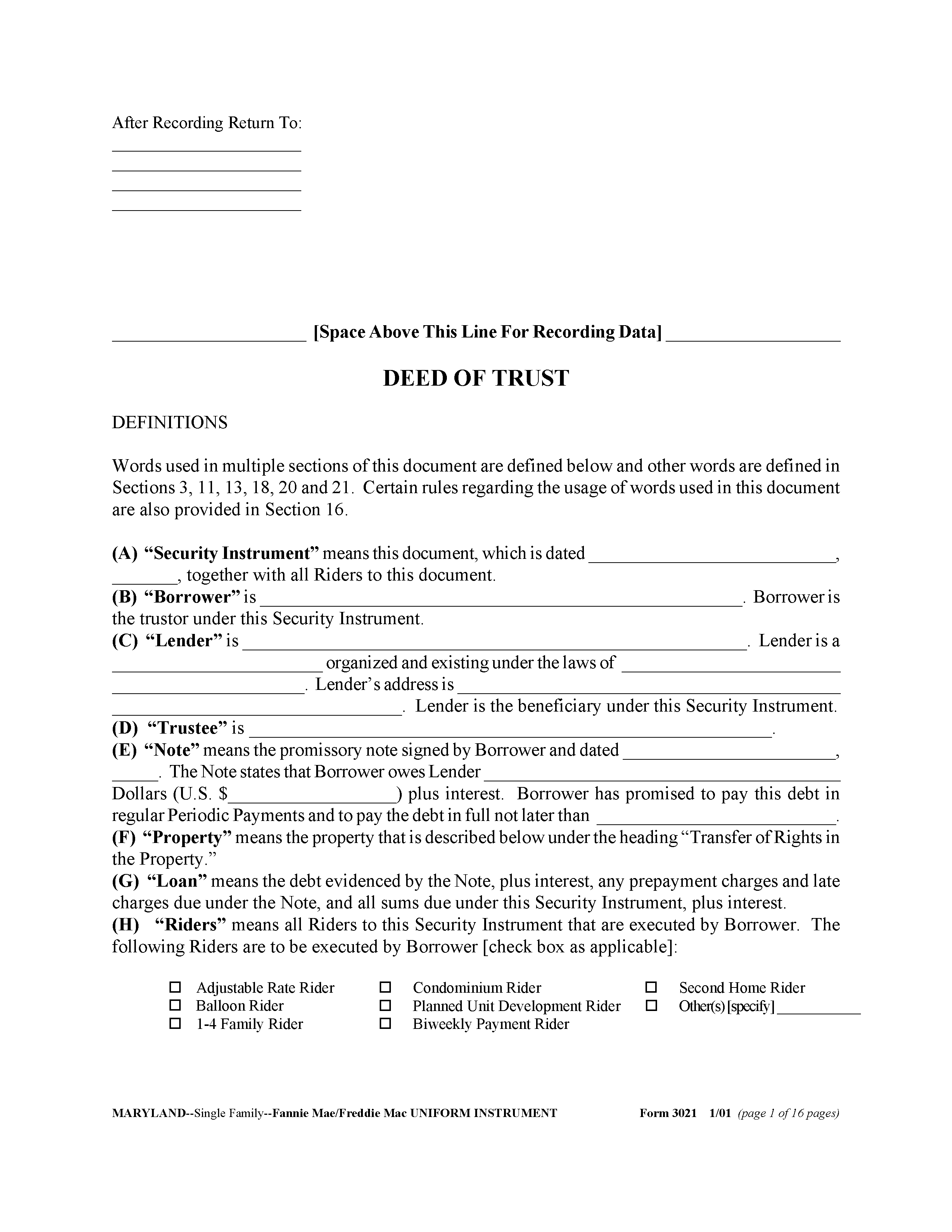

Deeds of Trust in Maryland

Maryland is a deed of trust state, recognizing both deeds of trust and mortgages as valid documents for real estate financing. There are no criteria in Maryland for who can serve as a trustee, though trustees are typically title companies, financial institutions, or escrow companies.

Deed of Trust (Preview)

Land Instrument Intake Sheet – Must be included in deed filings to submit essential information regarding the transaction and the involved parties.[3]