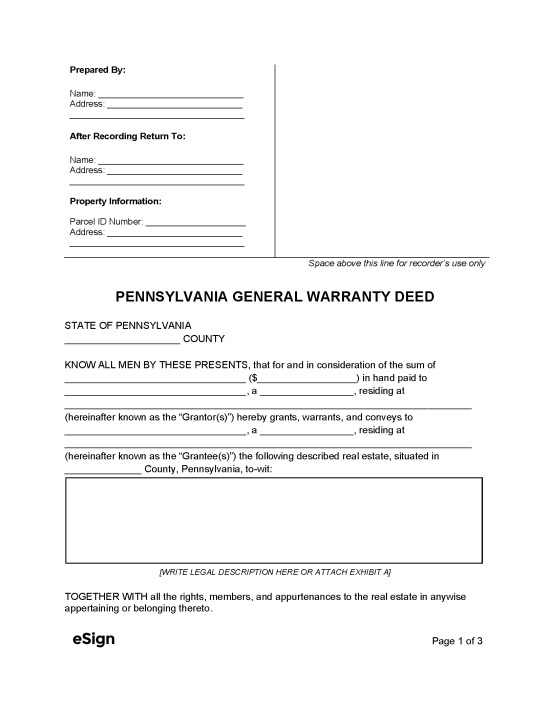

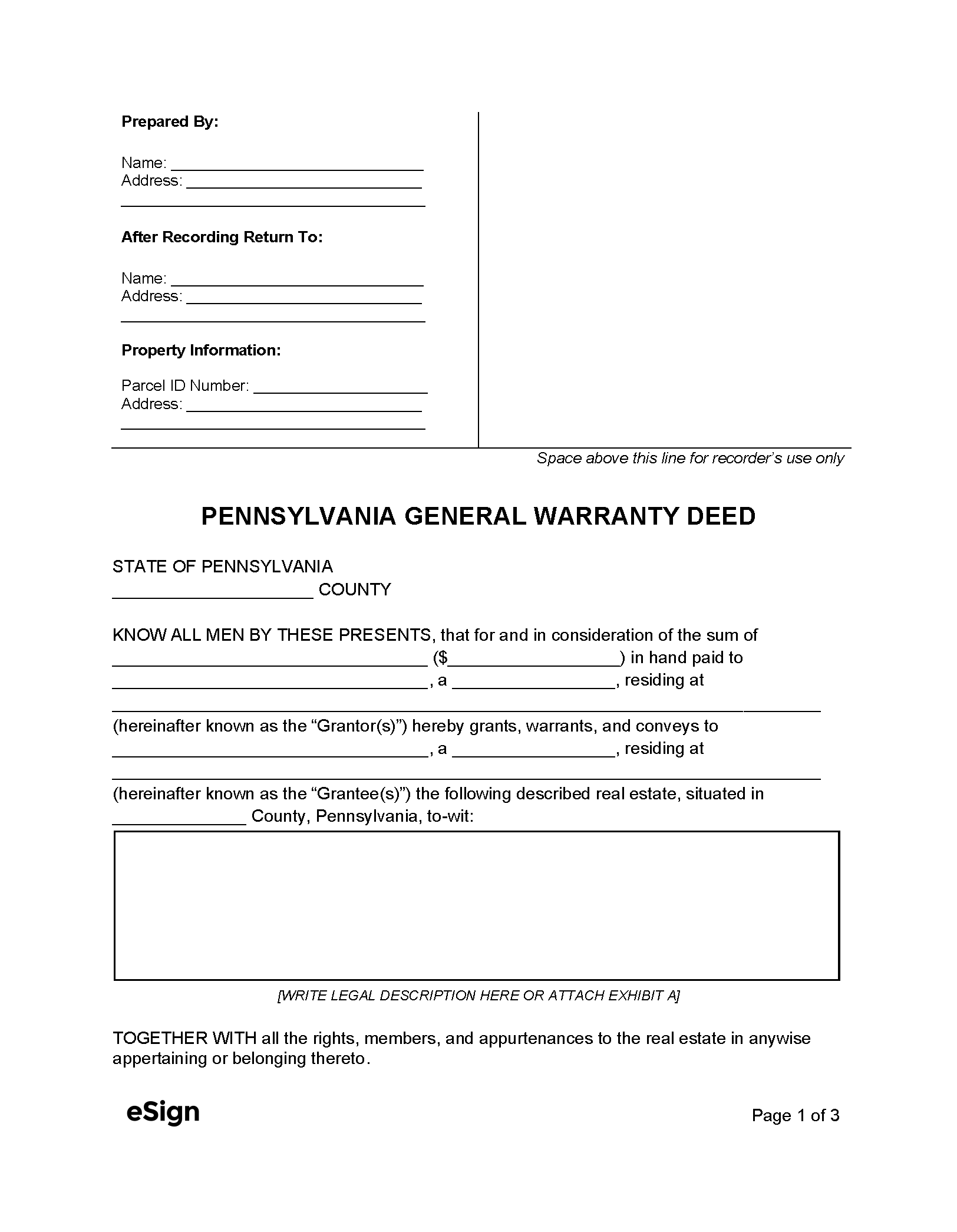

How to Format

Layout

There are no state-wide formatting requirements, but several counties have adopted the PRIA document standards (listed below). It’s important to check with the appropriate recorder of deeds to determine the proper formatting.

PRIA real estate document formatting[1]:

- Paper: White, 20lb paper maximum 8.5” x 14” (8.5” x 11” preferred)

- Margins: 3” at the top of the first page, 1” on all other sides

- Font: 10pt Times New Roman, or equivalent, in black ink

Signatures

The grantor must acknowledge their signature before a justice of the peace (or notary public or other authorized individual). If they are unable to acknowledge, at least two individuals who witnessed the execution of the deed must make the acknowledgment.[2]

Recording

Properly executed deeds can be filed with the Recorder of Deeds in the county where the property is located.[3]

By law, the fee for recording a deed is $11.50; actual fees tend to be higher and vary greatly by county.[4]

The Recorder of Deeds fee calculator can be used to quickly determine fees and transfer taxes.

Realty Transfer Tax Statement of Value – Form REV-183 must be recorded with a deed if it doesn’t include the value of the property, the property is a gift (or no consideration), or it is tax-exempt.[5]

Bituminous Coal Notice – This notice must be included with the deed when recording if there is bituminous coal on the land which was not mentioned in the deed.[6]

Coal Severance Notice – A coal severance notice shall be filed with a deed if there is or was a severance of coal underneath the property’s surface.[7]