Recording Requirements

- The grantor’s signature must be notarized.[1]

- Many counties in Pennsylvania adhere to the PRIA standard for documents (although each county recorder may implement additional requirements)[2]:

- White paper with a size of 8.5 inches by 11 inches (8.5 by 14 inches is acceptable)

- Black text with a font size of 10 pt.

- 3″ margin in the top right corner of the first page and 1″ for all other margins.

Deeds must be filed at the Recorder of Deeds’ office for the county where the property being transferred is located.[3] State law specifies the filing fee as $11.50; however, it is advised to use the Recorder of Deeds fee calculator as counties establish their own recording fees.[4]

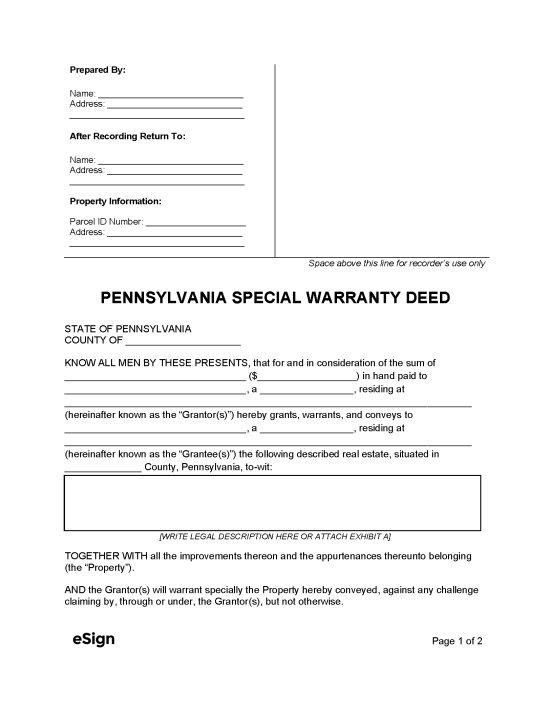

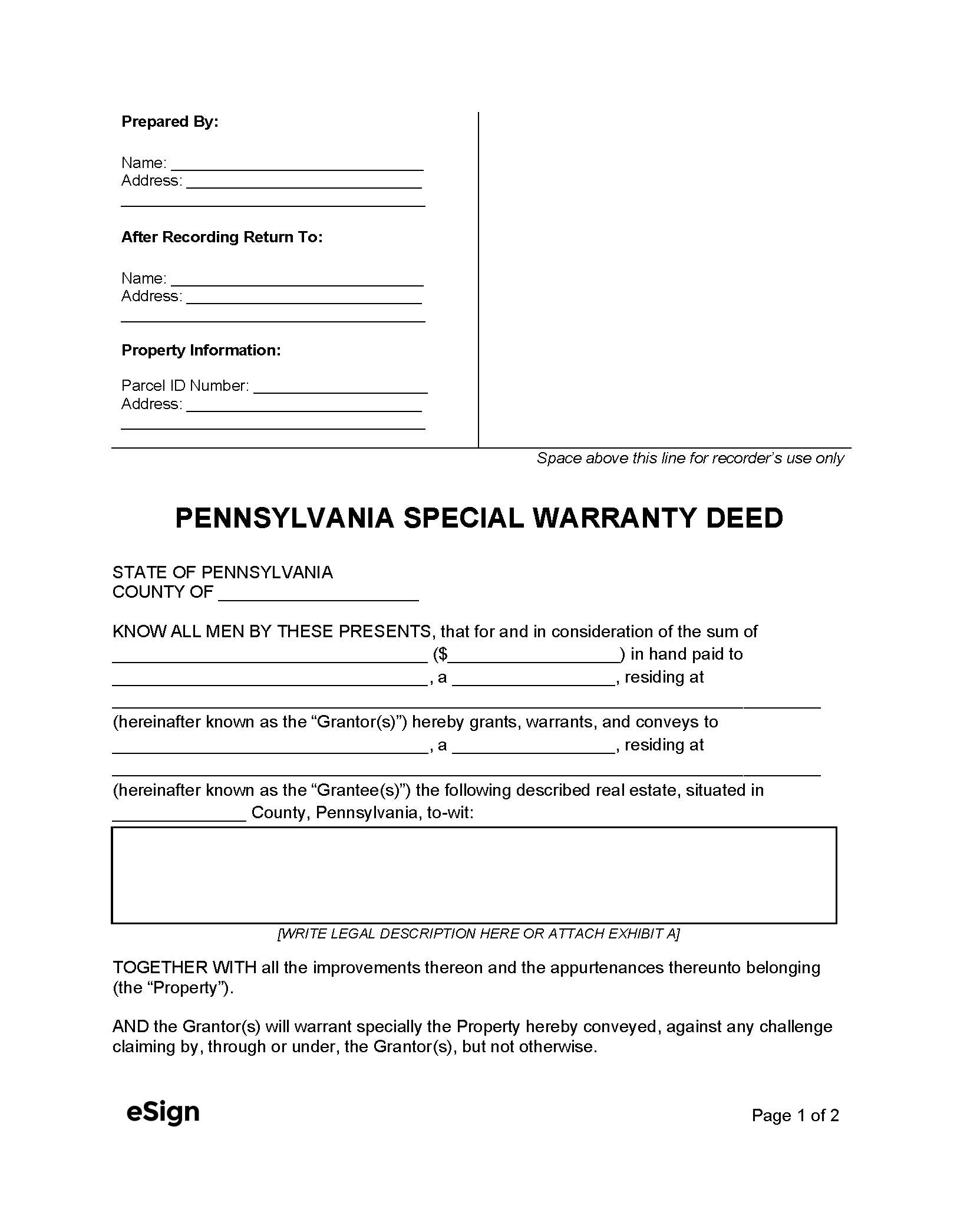

Special Warranty Deed (Preview)

Additional Forms

Form REV-183 (Realty Transfer Tax Statement of Value) – Must be filed with a deed if the transfer tax is not fully paid, or when the full consideration isn’t reported in the deed.[5]

Bituminous Coal Notice – If a property includes bituminous coal on its land and it is not disclosed in the deed, this notice must be submitted at the time of recording.[6]

Coal Severance Notice – This notice must be included in the deed if there has been a severance of coal below the property’s surface.[7]