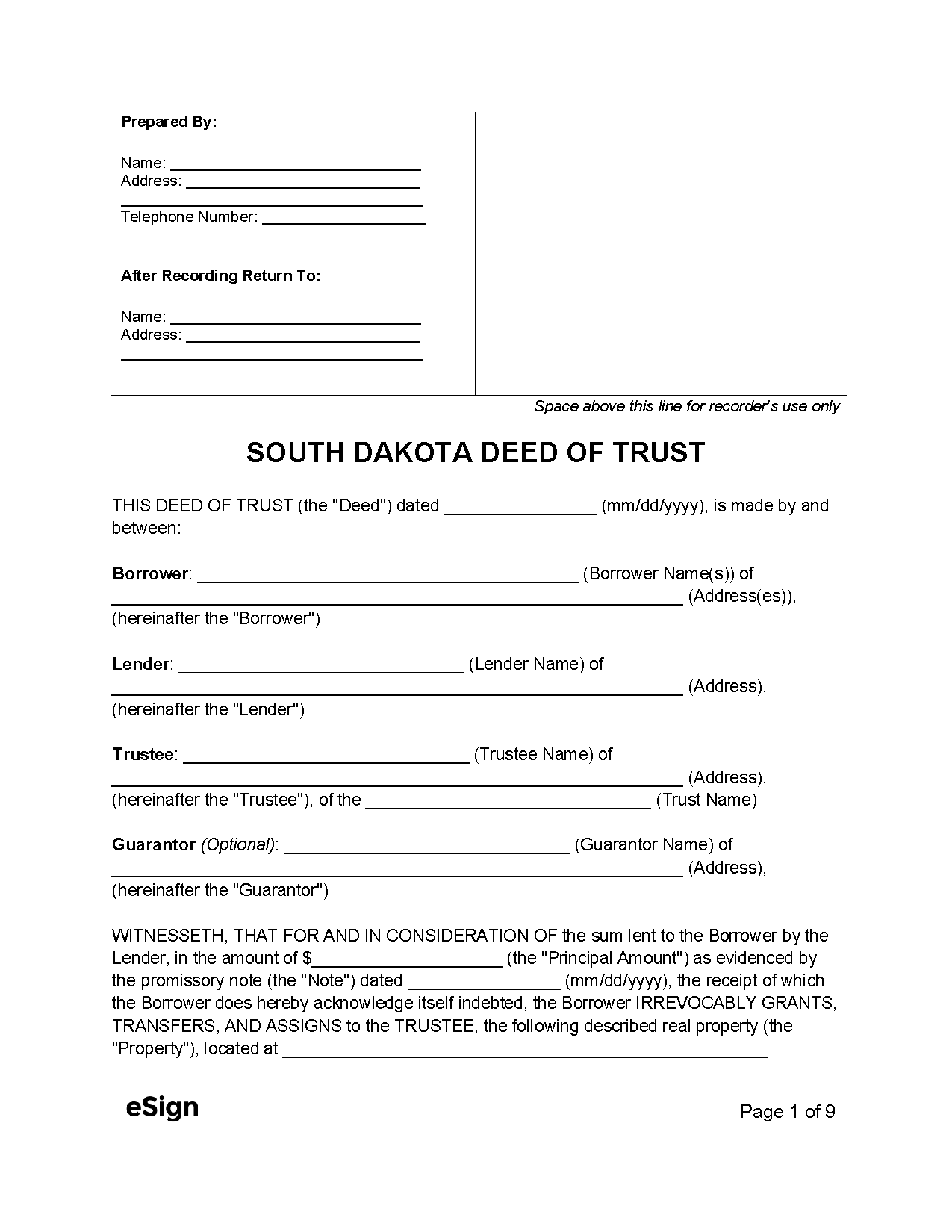

Formatting Requirements

South Dakota trust deeds are recorded with the Register of Deeds.[1] The document must be notarized and adhere to the following recording standards[2]:

- 3″ top margin, right half for the register of deeds, left half for document preparer

- 1″ margin on all other sides

- Black ink, minimum 10pt font size

- White, 20lb paper between 8.5″ x 11 and 8.5″ x 14″

Mortgage vs Deed of Trust

South Dakota permits the use of trust deeds and mortgages.

Mortgage – Involves two parties: the borrower and the lender. If the borrower defaults on the loan, the foreclosure process will usually pass through the court.

Deed of trust – Made between the lender, borrower, and a neutral trustee. In the event of default, the lender initiates a non-judicial foreclosure process, which means they can foreclose on and sell the property without the court’s involvement.