By Type (4)

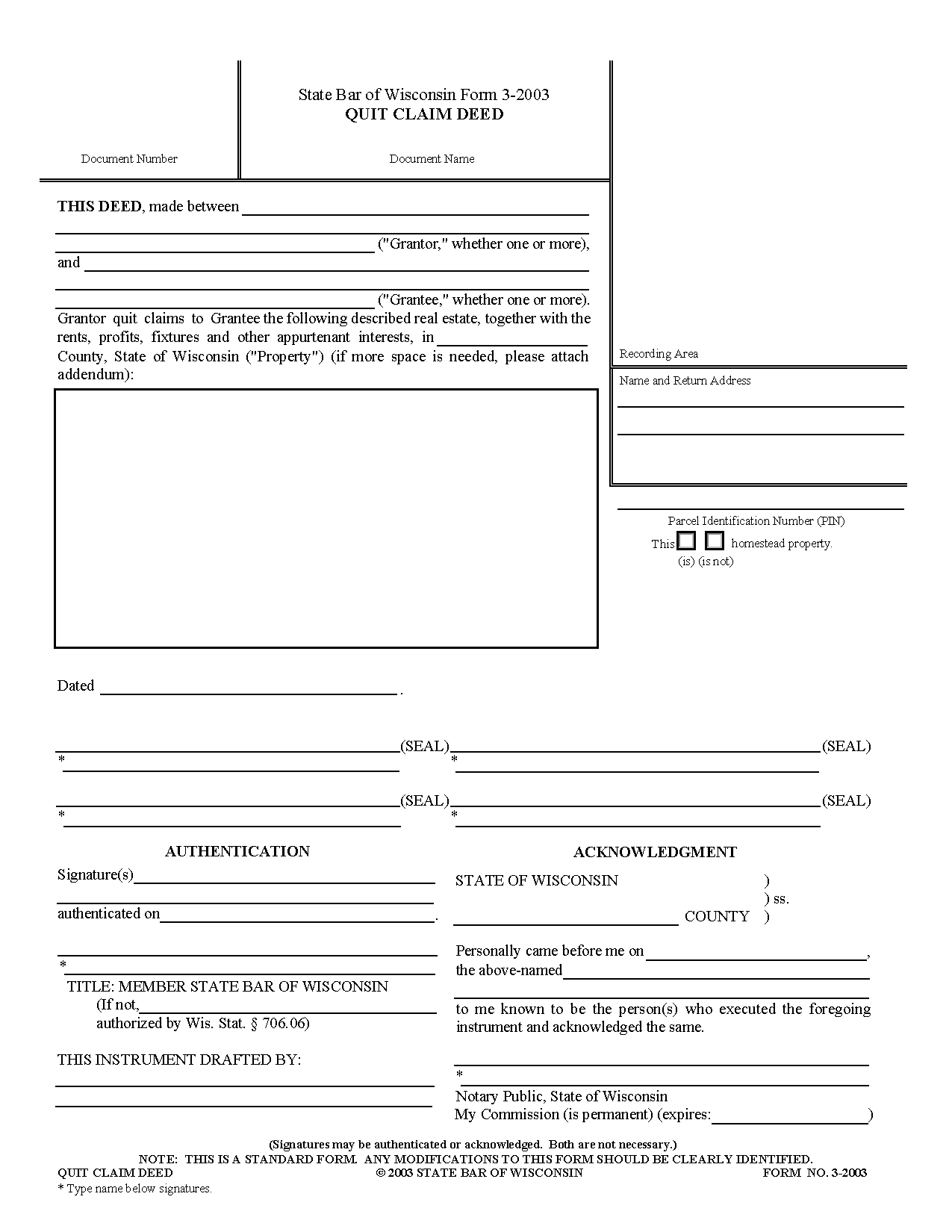

Quit Claim Deed – Transfers the grantor’s ownership, if any, without offering title warranties to the grantee. Quit Claim Deed – Transfers the grantor’s ownership, if any, without offering title warranties to the grantee.

Download: PDF |

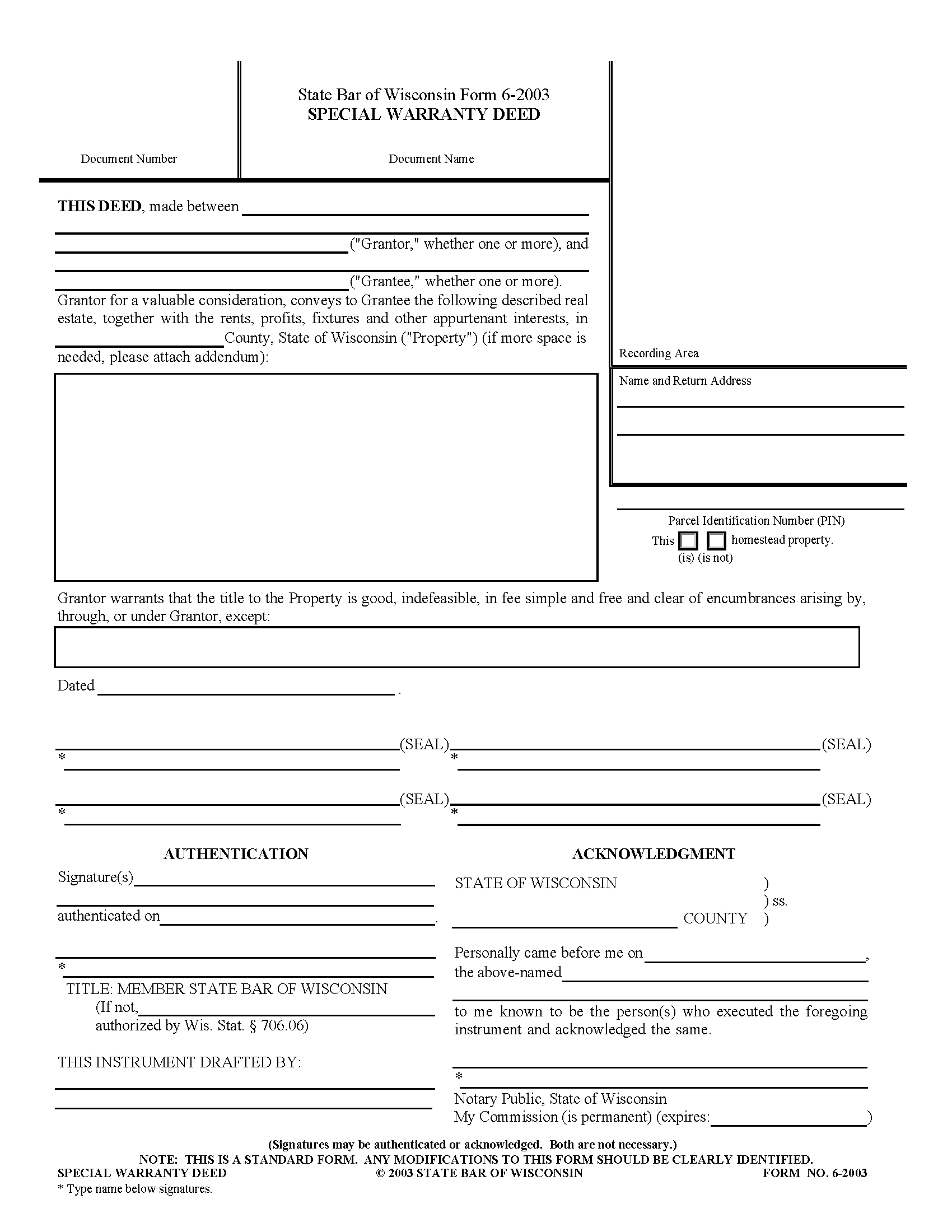

Special Warranty Deed – Provides a warranty against claims exclusive to the period when the grantor held title. Special Warranty Deed – Provides a warranty against claims exclusive to the period when the grantor held title.

Download: PDF |

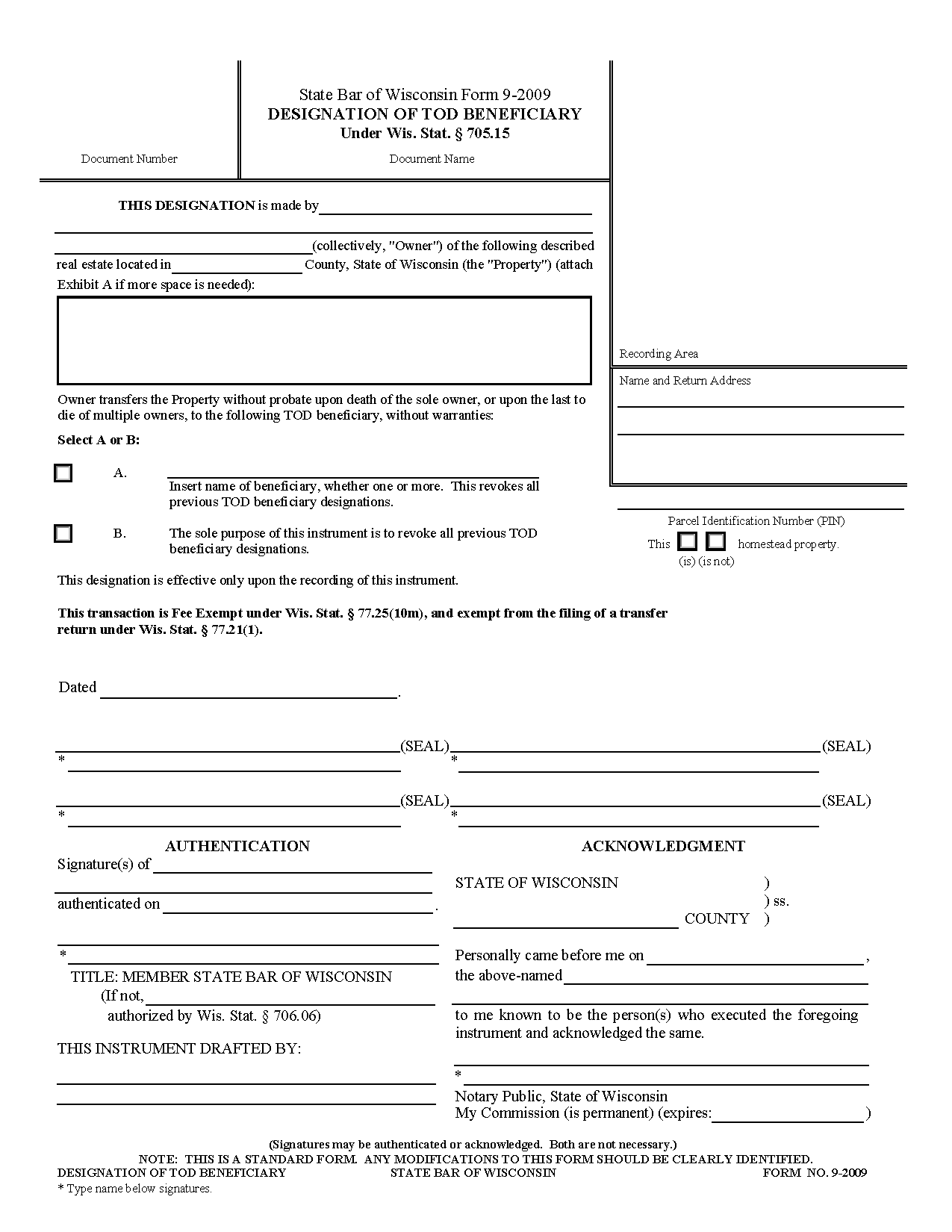

Transfer on Death Deed – Transfers property ownership to beneficiaries without probate upon the grantor’s death. Transfer on Death Deed – Transfers property ownership to beneficiaries without probate upon the grantor’s death.

Download: PDF |

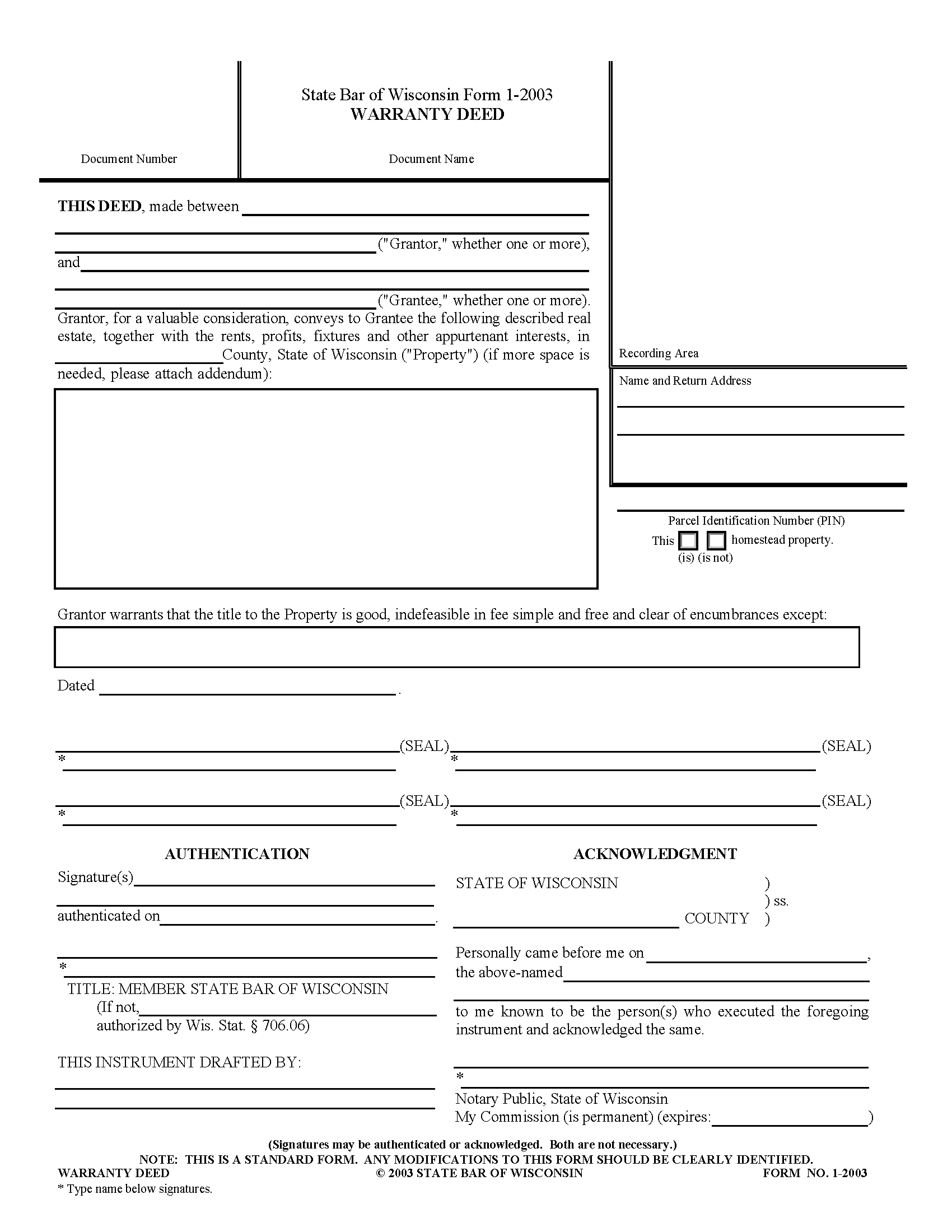

Warranty Deed – Holds the grantor responsible for all title claims, including those originating before their ownership. Warranty Deed – Holds the grantor responsible for all title claims, including those originating before their ownership.

Download: PDF |

Formatting

Paper – White, 20lb weight, 8.5″ by 11″ or 14″

Margins – 0.5″ on top, 0.25″ on sides and bottoms, additional spaces for recording info

Font – Black, blue, or red ink[1]

Recording

Signing Requirements – Wisconsin deeds need to contain the grantor’s signature and a notarial acknowledgment.[2]

Where to Record – Once signed and notarized, deeds must be recorded with the county Register of Deeds.[3]

Cost – $30 (as of this writing)[4]

Additional Forms

Real Estate Transfer Return (eRETR) – Grantors must complete an online return and file a copy of the provided eRETR receipt when presenting their deed for recording.[5]