How Mileage Reimbursement Works

Employees can be reimbursed if they use a personal vehicle for work related purposes. To be compensated, they must:

- Track Mileage. Employee uses the odometer to track the mileage used for business purposes.

- Complete form. Employee fills out the mileage reimbursement form, multiplying the number of miles driven in the period by the IRS standard rate.

- Submit to employer. The form is submitted to the employer, who files the form in their records.

- Employee reimbursement. The amount is reimbursed on the paycheck but listed separately from wages and is non-taxable. The employer can list it as a business expense when they file company taxes.

IRS Standard Mileage Rate: Explained

The IRS updates the mileage reimbursement rate annually, set in cents per mile. The rate is the maximum amount per mile an employee can be reimbursed without it being reflected as wages and in turn becoming taxable income.

The standard mileage rate approximates the average cost of using a personal vehicle for business trips, including gas, maintenance, and depreciation. The same rate is used for electric vehicles (EVs), covering electricity, battery wear, and maintenance expenses.[1]

Mileage vs. Actual Expenses

Employees can choose to calculate using actual vehicle expenses and exceed the standard mileage rate without being taxed, so long as it is documented under an accountable plan.[2] Employees cannot calculate their commute to and from work as a reimbursable expense.[3]

IRS Mileage Rates (2025)

- Business: $0.70[4]

- Medical/Moving: $0.21

- Charity: $0.14

Mileage Reimbursement Calculator

Sample

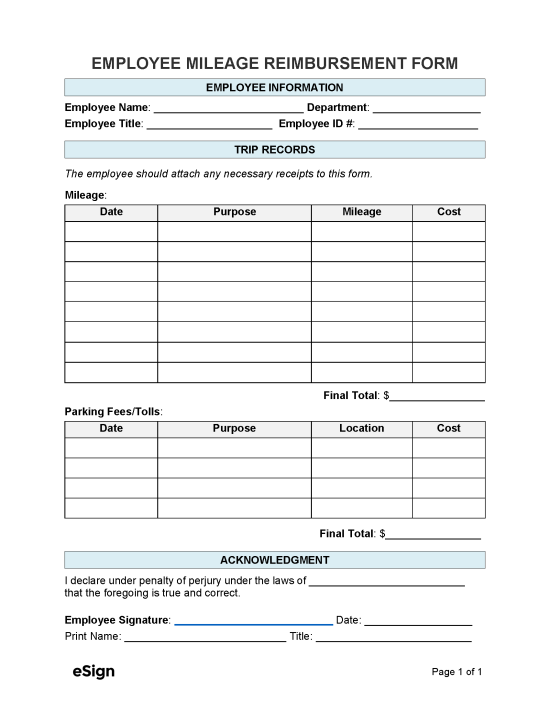

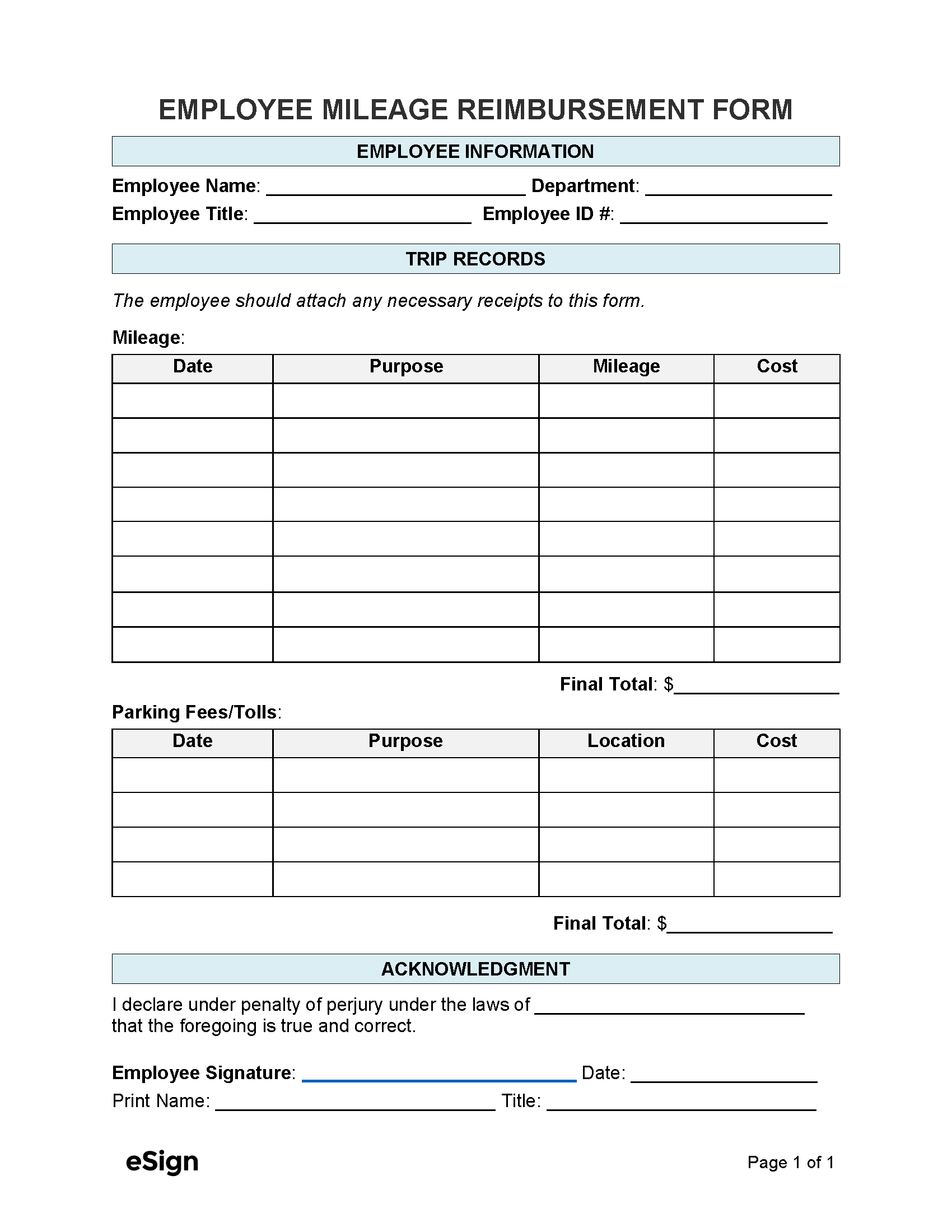

Employee Name: [EMPLOYEE NAME] Employee Department: [EMPLOYEE DEPARTMENT]

Employee Title: [EMPLOYEE TITLE] Employee ID #: [EMPLOYEE ID #]

Business Trips:

Date: [MM/DD/YYYY] Purpose: [TRIP REASON]

Mileage: [TOTAL MILES] Mileage Cost: [TOTAL MILES X 0.70¢]

Date: [MM/DD/YYYY] Purpose: [TRIP REASON]

Mileage: [TOTAL MILES] Mileage Cost: [TOTAL MILES X 0.70¢]

Date: [MM/DD/YYYY] Purpose: [TRIP REASON]

Mileage: [TOTAL MILES] Mileage Cost: [TOTAL MILES X 0.70¢]

Parking Fees/Tolls:

Date: [MM/DD/YYYY] Purpose: [PARKING/TOLL REASON]

Parking Fees/Tolls Cost: [PARKING/TOLL COST]

Date: [MM/DD/YYYY] Purpose: [PARKING/TOLL REASON]

Parking Fees/Tolls Cost: [PARKING/TOLL COST]

Date: [MM/DD/YYYY] Purpose: [PARKING/TOLL REASON]

Parking Fees/Tolls Cost: [PARKING/TOLL COST]

I declare under penalty of perjury under the laws of [STATE] that the foregoing is true and correct.

Employee Signature: Date: ______________

Print Name: [EMPLOYEE NAME] Title: [EMPLOYEE TITLE]