Common Uses

A client questionnaire for financial planning can be used for any of the following reasons:

- Retirement planning

- Estate planning

- Tax planning

- Investment management

- College tuition preparation

- Monthly and annual budgeting

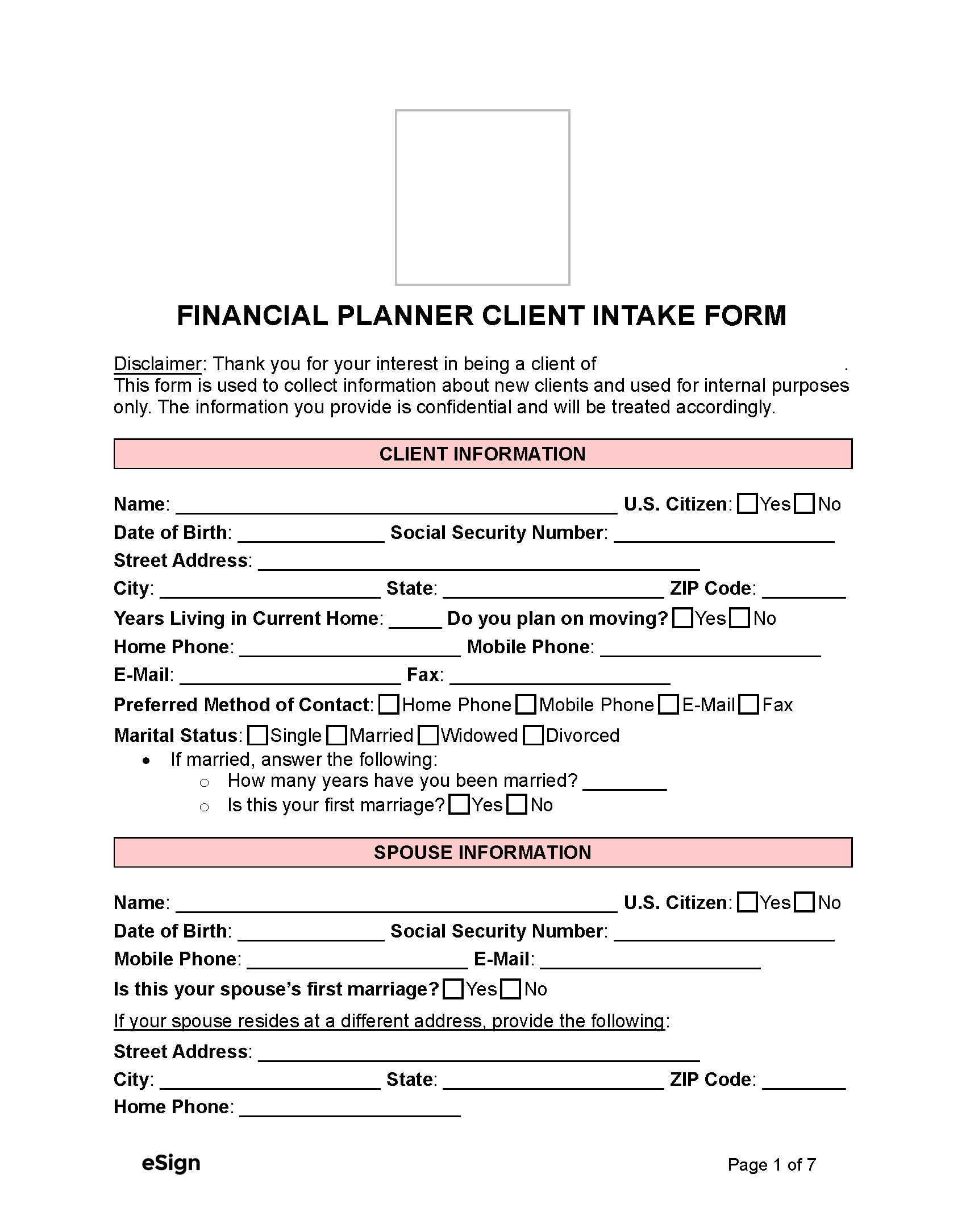

Essential Financial InformationAssetsThe intake form should include an asset report that details the client’s net worth and the resources available to them. Assets include investments, real estate, savings accounts, and any other valuable possessions or holdings they may have.

Income & ExpensesThe client’s income and expenses allow the planner to gauge their potential to save, invest, and attain their financial goals. This assessment also helps prepare a realistic budget and can pinpoint areas that may require adjustments. DebtClients will be asked to list their mortgages, loans, credit card debt, and other financial commitments. These details are crucial to understanding the client’s obligations and overall financial health.

Retirement GoalsBy understanding the client’s desired retirement age and lifestyle expectations, the planner can develop a suitable savings and investment strategy.

Children & DependentsThe planner will want a list of any children and other dependents. Family information plays an important role in financial planning, as clients may wish to set money aside for college tuition and other educational expenses.

|

Additional Documents

In order to provide a thorough evaluation of a client’s financial situation, they may be asked to attach some of the following documents to the intake form:

- Insurance Policies (life insurance, disability, and long-term care)

- Estate Planning Documents (powers of attorney, living will, trusts, and health care proxies)

- Tax Statements (federal and state, retirement statements)

- Retirement Statements – (pension statements, SPDs, benefit statements, plan and trust documents)