State Laws

Probate in Alaska

Request to Start Informal Probate

There are two types of probate in Alaska:

- Informal probate – The most commonly used process, which involves less court supervision.

- Formal probate – Generally reserved for situations where:

- The will is invalid or misplaced

- The personal representative’s appointment is challenged

- Too much time has passed since the decedent’s death

To begin informal probate, the testator’s personal representative must file the following at the local probate court and pay a filing fee:

- Request to Start Informal Probate (Form P-315)

- Statement Starting Informal Probate (Form P-316) – Leave Blank

- Acceptance of Duties by Personal Representative (Form P-335)

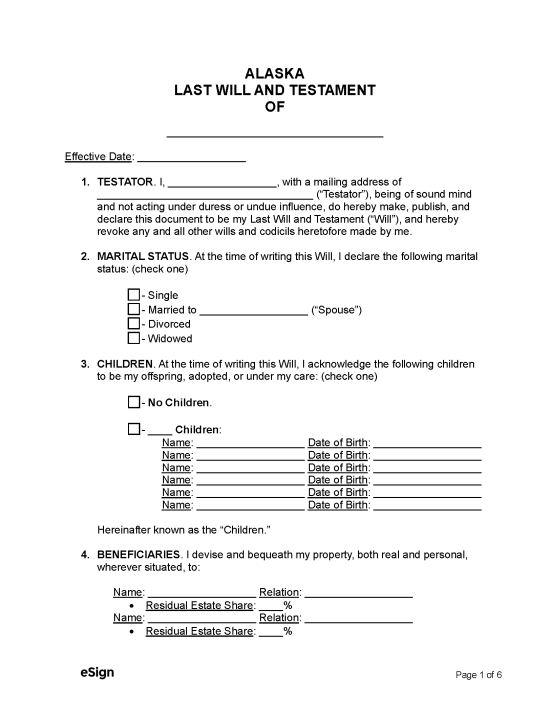

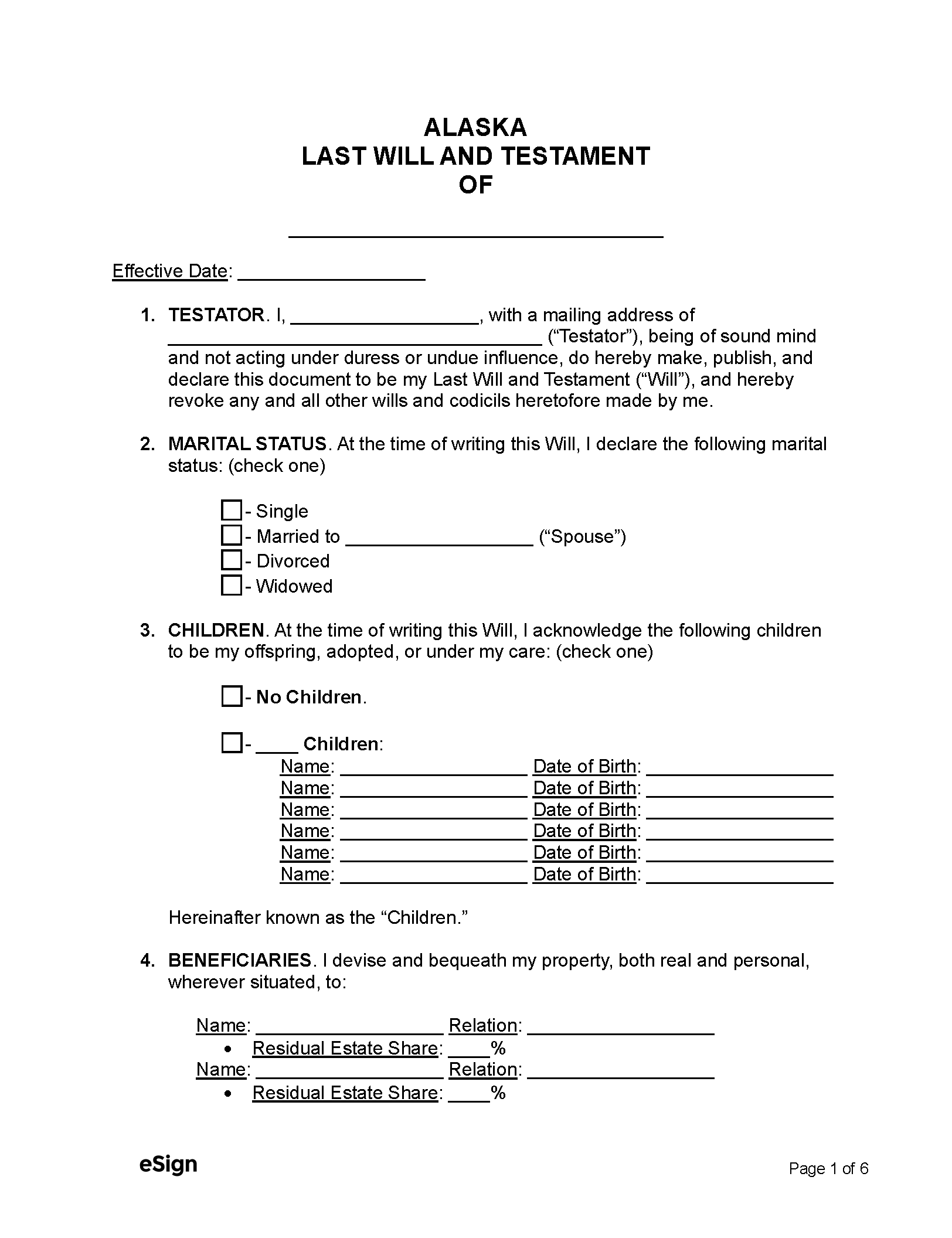

- Testator’s Last Will and Testament

- Certified copy of the testator’s death certificate

After the testator’s debts have been settled and their estate has been distributed, an informal probate case can be completed using one of the following options:

- Sworn Statement – The personal representative completes and files a Sworn Statement of Personal Representative to Close Informal Estate, in which case no court hearing is needed.

- Formal Request – The representative files a Request to Close Formal Estate and Approve Distribution. The court will set a hearing date, at which the judge will review the case and, upon approval, close it.

Small Estates

If the value of an individual’s estate is less than $100,000 in vehicles and $50,000 in personal property, the beneficiaries can file an Affidavit for Collection of Personal Property of Decedent (a “small estate affidavit”) to bypass the probate process.[4]

Special Payments

Alaska law states that special payments must be made to surviving family members of the decedent to make sure they receive proper financial support.[5] The following payments have priority over creditors’ claims, taxes, debts, and probate costs:

- Homestead Allowance – $27,000 to the surviving spouse or, if none, split between the decedent’s minor/dependent children.

- Family Allowance – $18,000 (could be more or less) to surviving spouse and minor children who were being supported by the decedent.

- Exempt Property – $10,000 to the surviving spouse or, if none, split between all decedent’s children (regardless of age or dependency).

These payments are in addition to any other portion of the estate the family will receive as per the will.