State Laws

If a person dies without a will (dying “intestate”), their assets will be transferred by the probate court in accordance with Kansas inheritance laws.[1]

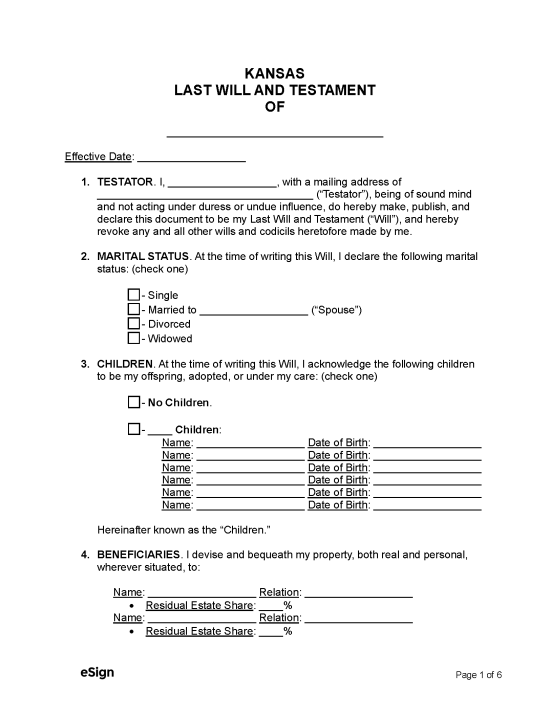

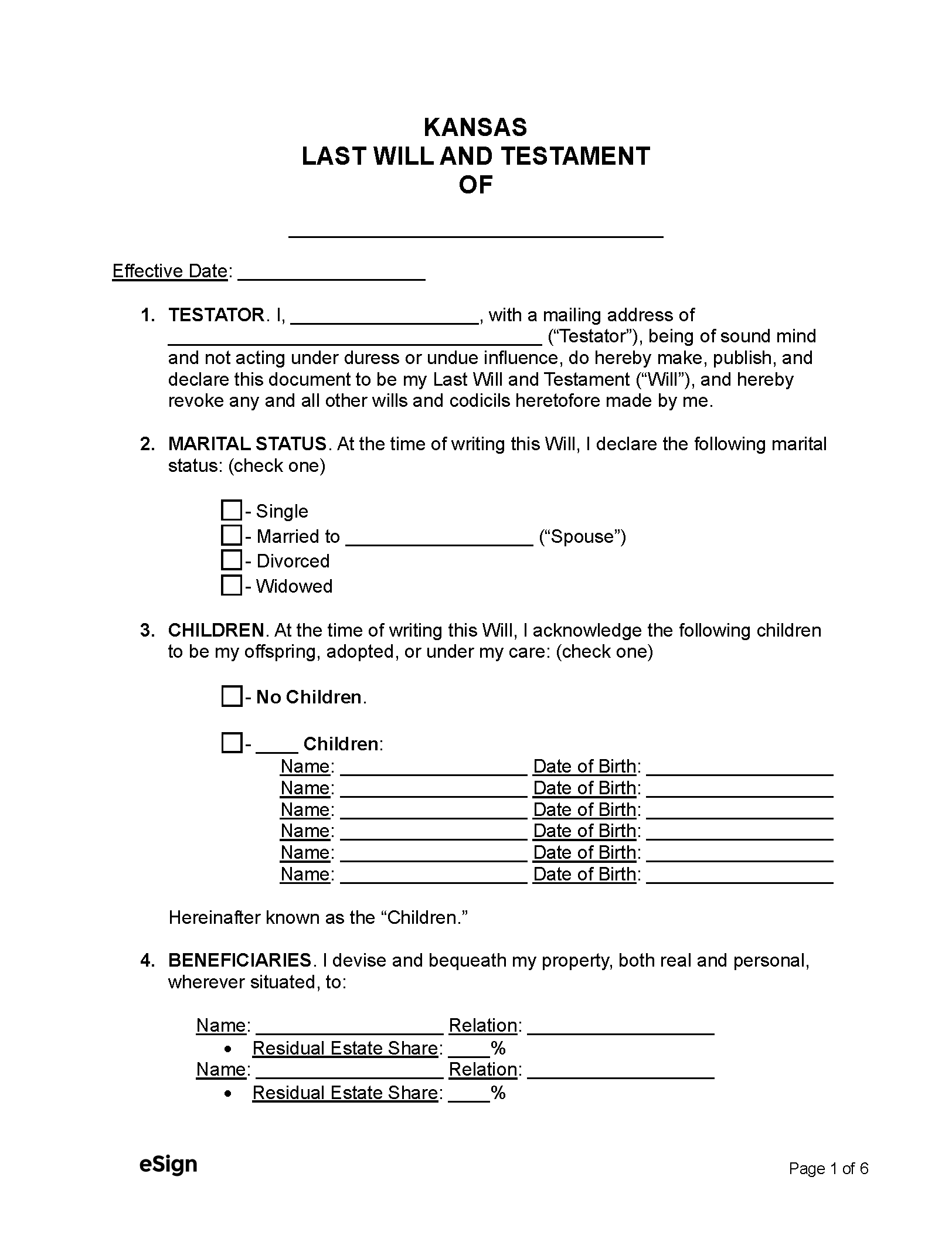

A will can be made by any person of sound mind and legal age (which is 18 in Kansas).[2]

Holographic Wills – A holographic will (handwritten and unwitnessed) is not valid in the state of Kansas. However, nuncupative wills are valid, which enable a terminally ill individual to create an oral will as long as it is put into writing within 30 days and subscribed by two witnesses.[3]

Revocation – To revoke a will, the testator must complete one of the following acts:

- Create a new will.

- Execute a declaration of revocation in writing in the same manner as the creation of the will.

- Destroy the original will document with the intent of voiding it.[4]

Signing Requirements – A will must be signed by the testator and two witnesses. In order to avoid proving the will is valid in probate court after the testator’s death, the parties may acknowledge their signatures in the presence of a notary public to make the will “self-proved.”[5]

Probate Process in Kansas (9 Steps)

In order to probate a will, it must be filed with the court within six months of the testator’s passing.[6]

- Small Estates (If Applicable)

- Will and Petition

- Notice of Hearing

- Hearing

- Inventory

- Homestead and Family Allowance (If Applicable)

- Debts and Taxes

- Accounting and Final Settlement

- Hearing and Final Decree

1. Small Estates (If Applicable)

If the value of a testator’s estate is $75,000 or less, a Small Estates Affidavit can be filed in order to transfer the assets to the heirs without having to probate the will.[7]

There are two other simplified probate procedures available in some estate distribution cases which are established by the Simplified Estates Act[8] and the Informal Administration Act.[9] Estates distributed under these acts will generally require very little or no court supervision.

The two processes differ slightly but, in general, the district court will want to know that the heirs/devisees are in agreement about the will and estate distribution, the estate is relatively small, and the costs related to estate administration will be low. To determine the eligibility of an estate for simplified or informal administration, the advice of a probate attorney should be sought out.

2. Will and Petition

At any time following the testator’s death, the original will can be filed with the district court in the county where they died by anyone who has access to the original document. An affidavit must be completed by this person and a copy of the affidavit and the will sent to each heir and devisee of the decedent.[10]

To commence probate proceedings, a Petition for Probate of Will and Issuance of Letters Testamentary must be filed with the district court in the county where the decedent died along with the original will (if not already filed).[11] Any interested person may file the petition, but it is often the executor named in the decedent’s will that handles this matter.[12]

The court will set a hearing date and provide an Order for Hearing and for Notice to Creditors.

3. Notice of Hearing

Once a hearing has been set, the petitioner (i.e., the executor) must publish a Notice of Hearing and Notice to Creditors in a newspaper in the county where the petition was filed. The first publication must be made within ten days of the petition being filed and must be published once a week for three weeks.[13]

Within seven days of the first publication, the executor must also send copies of the Notice and the will to each heir, devisee, and known creditor. Creditors have four months from the first notice publication date to demand a claim against the estate.[14]

4. Hearing

At the hearing of a petition for the probate of the will, the two witnesses who signed the will must acknowledge the validity of the will by attesting in person or by affidavit. However, if the will was made self-proved, their attestations are not required.[15]

Any interested party may oppose the probate of the will at the hearing. If the will is successfully submitted to probate, the executor will receive Letters Testamentary from the court authorizing them to manage and settle the estate.[16]

5. Inventory

The executor must complete and file an Inventory and Valuation within 30 days of receiving the Letters Testamentary. The document should include all of the estate’s assets such as real estate, personal property, stocks, bonds, and any mortgages or debt.[17] Non-probate assets don’t need to be included but it is often recommended for organizational and informational purposes.

After an inventory of the estate has been filed, the surviving spouse or children can file a petition with the court to claim the homestead, certain personal property of the decedent, and a family allowance. If accepted, the court will order the executor to transfer such assets and exclude them from the list of probate assets.[18]

6. Homestead and Family Allowance (If Applicable)

In Kansas, the title of the decedent’s homestead (residence where they lived with their family) can be transferred to their surviving spouse and minor children without passing through probate.[19] The family is also entitled to certain personal items and an allowance of up to $50,000 in cash (or personal or real property of similar value) without the need for probate.[20]

7. Debts and Taxes

After four months have passed and creditors may no longer come forward with demands, the executor can pay off any debts to creditors.[21] If assets have to be sold to cover the decedent’s debts, they shall be sold off in the order set by state law.[22]

The state of Kansas does not levy an estate tax, but the decedent’s estate may owe federal estate tax. However, the deductions and exemptions provided are large enough that most estates will not owe any federal estate tax either. The executor will typically consult with a tax accountant to find out which taxes the estate is subject to.

8. Final Settlement and Accounting

After debts and taxes are settled, the executor must create an account of the estate establishing what debts and expenses were paid and how the remaining assets will be distributed.[23] A Petition for Final Settlement shall be completed and filed with the court that includes the statement of the account and other information as required by state law.[24]

The court will provide an Order for Hearing of Petition for Final Settlement and will often, but not always, require that the executor send a Notice of Hearing to all interested parties (the same notice requirements from Step 3 will apply in this situation).