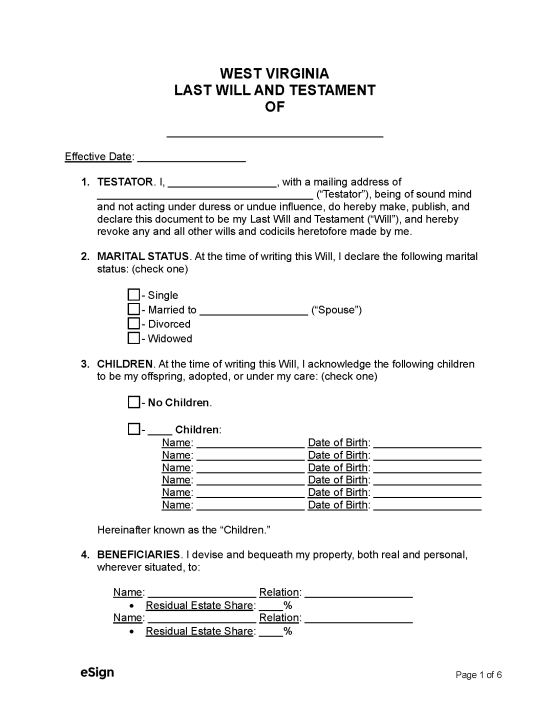

A West Virginia last will and testament gives instructions on what will happen to an individual’s estate after they die. The document will allow the individual (called the “testator”) to declare their marital status, name children and beneficiaries, and appoint a personal representative to act as the will’s executor. Having a detailed will allows the testator’s assets to be distributed in the manner they choose, rather than letting the state decide.

Anyone 18 years or older and of sound mind may make a will.[1]

State Laws

Holographic Will – A holographic (handwritten) will must be totally in the testator’s handwriting and signed to be considered valid. No witnesses are required.[2]

Revocation – A will may be revoked if the original will is destroyed or if a new version is executed.[3] If the testator’s marriage ends by divorce or annulment, their former spouse will not be entitled to any property, special power of appointment, or nomination as executor unless the will says otherwise.[4]

Signing Requirements – To be valid, the testator must sign the will in the presence of two witnesses, who must also sign the document.

Probate Process in West Virginia (7 Steps)

The person with the will must deliver it to the executor named in the will or the county clerk where probate will take place within 30 days of the testator’s death.[5]

- File Court Forms

- Qualify the Personal Representative

- Obtain a Probate Bond (If Applicable)

- Appraise the Estate

- Publish Notice

- Pay Debts and Taxes

- Close the Estate

1. File Court Forms

A small estate affidavit may be used if the testator’s estate is valued at less than $50,000 in personal property and under $100,000 in real property.[6]

The will’s custodian must deliver the original will to the county clerk’s office where the testator died. Failure to do so within 30 days is a misdemeanor offense in West Virginia.

Many counties will also require a copy of the death certificate to be filed along with the will. The death certificate may be obtained through the West Virginia Vital Registration Office by filling out the Application for Copy of West Virginia Death Certificate. Requests can be made by:

- Mail/In-person:

Vital Registration Office350 Capitol Street, Room 165Charleston, WV 25301-3701

-

Phone: 877-448-3953

-

Fax: 866-870-8723

- Internet: www.vitalchek.com

The names and addresses of the estate’s heirs or beneficiaries must also be supplied to the clerk.

3. Obtain a Probate Bond (If Applicable)

In many cases, the personal representative will be required to post bond. A probate bond protects estate beneficiaries and creditors against any fraud or negligence on the part of the personal representative.

A surety bond is usually required unless the will specifically waives it or the personal representative is the only beneficiary or distributee.[9] If bond must be posted, it must equal the value of the decedent’s personal property or, if the will authorizes the sale of real estate, the value of personal and real property.[10]

4. Appraise the Estate

Once the personal representative is appointed, their next task will be to file an inventory of all real estate, all probate and non-probate property, and all non-probate personal property with the county clerk.[11]

The West Virginia State Tax Department provides an Estate Appraisement & Nonprobate Inventory packet that includes the required forms and detailed instructions for the personal representative. The appraisement and inventory forms must be notarized and filed with the country clerk within 90 days of the personal representative’s appointment.

If the appraised value of the decedent’s probate assets (excluding real estate) exceeds $200,000, the estate will be referred to a Fiduciary Commissioner.[12]

5. Publish Notice

Once the appraisement has been recorded, the county clerk will publish a notice of estate administration.[13] This notice will be published within 30 days of the recording of the appraisal or 120 days if the personal representative does not file the appraisal. The notice will run in a local newspaper once a week for two consecutive weeks.

If the estate is referred to a Fiduciary Commissioner, they will assist the personal representative in publishing the notice.

Any creditors who wish to file a claim against the estate will have 60 days to do so once notice is published.

6. Pay Debts and Taxes

Before the personal representative can distribute the assets to the beneficiaries, all claims against the estate must be paid. The decedent’s final income tax return, and, in some cases, an estate tax return must be filed by the personal representative.

If there are not enough assets to pay the debts on the estate, the personal representative may be required to sell the decent’s property and pay the obligations in the following order:[14]

- Costs and expenses of administration

- Expenses relating to the funeral

- Unpaid child support due when the decent died

- Debts and taxes

- Medical and hospital expenses

- Everything else

7. Close the Estate

When all other claims and debts are satisfied and assets distributed to the appropriate parties, the personal representative may close the estate. The representative will need to file one of the following two forms:

- Waiver of Final Settlement (Monroe County SAMPLE) – States that beneficiaries know what they are getting and that no debts or taxes remain. This requires the notarized signatures of all beneficiaries or heirs unless the beneficiary is left with tangible personal property or cash.[15] This document may be filed with the county clerk once at least 90 days have passed since the notice was published.

- Report of Receipts and Disbursements (Preston County SAMPLE) – This report includes all receipts from the probate process and describes how the personal representative paid expenses and distributed the assets. It must be accompanied by an affidavit that states that all debts and claims have been paid. Once filed, the report will be mailed to each beneficiary and creditor, who will have ten days to object.[16] This report may be submitted to the court after the 60-day waiting period where creditors can file a claim once notice is published.

If the estate has been referred to a Fiduciary Commissioner, they will prepare the final settlement based on the information provided by the personal representative.