What to Include

Investment LOIs are drafted by the individual who is making an investment proposal. The form will generally include the below information and proposed terms.

- Investor and company information – The letter must identify the investor and the business that they wish to invest in.

- Shareholder information – The principal shareholders should be identified.

- Investment information – The letter will need to state the amount that the investor is prepared to invest, as well as the timeline and method of payment.

- Shares – The document will include the number of shares that the investor is expecting in exchange for their investment.

- Financing – The investor should state if their investment is contingent on them obtaining financing.

- Information access – The letter should indicate that the investor and their agents will have access to sensitive company information, which must be kept confidential.

- Closing terms – Investment LOIs will typically relay a proposed closing date and who would be responsible for closing costs.

- Signatures – The letter should be signed, but the signatures do not bind the parties to the proposed terms.

When to Use

An investment LOI is used when beginning negotiations for one party to invest in another’s company. Before drafting a formal purchase agreement, the letter is delivered to the company’s shareholders following the initial discussions regarding the investment.

Due to most LOIs being non-binding, there is often no guarantee that an agreement will be made. However, drafting and signing an LOI shows the investor’s commitment, improving the likelihood of reaching a successful deal.

Sample

Download: PDF, Word (.docx), OpenDocument

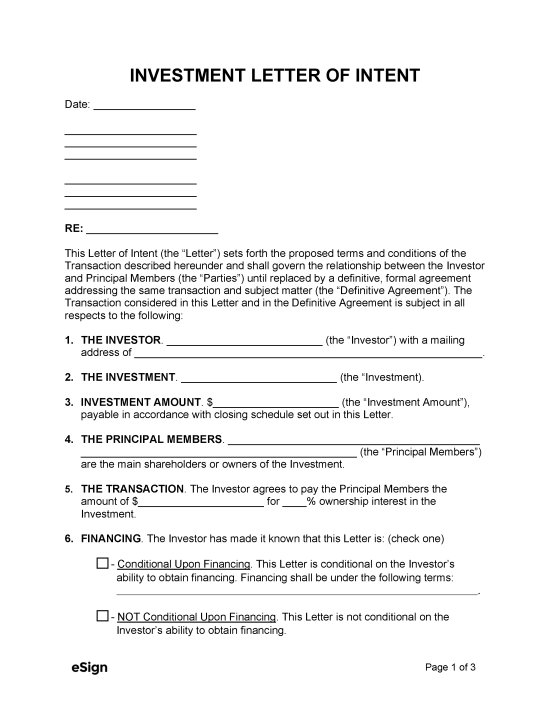

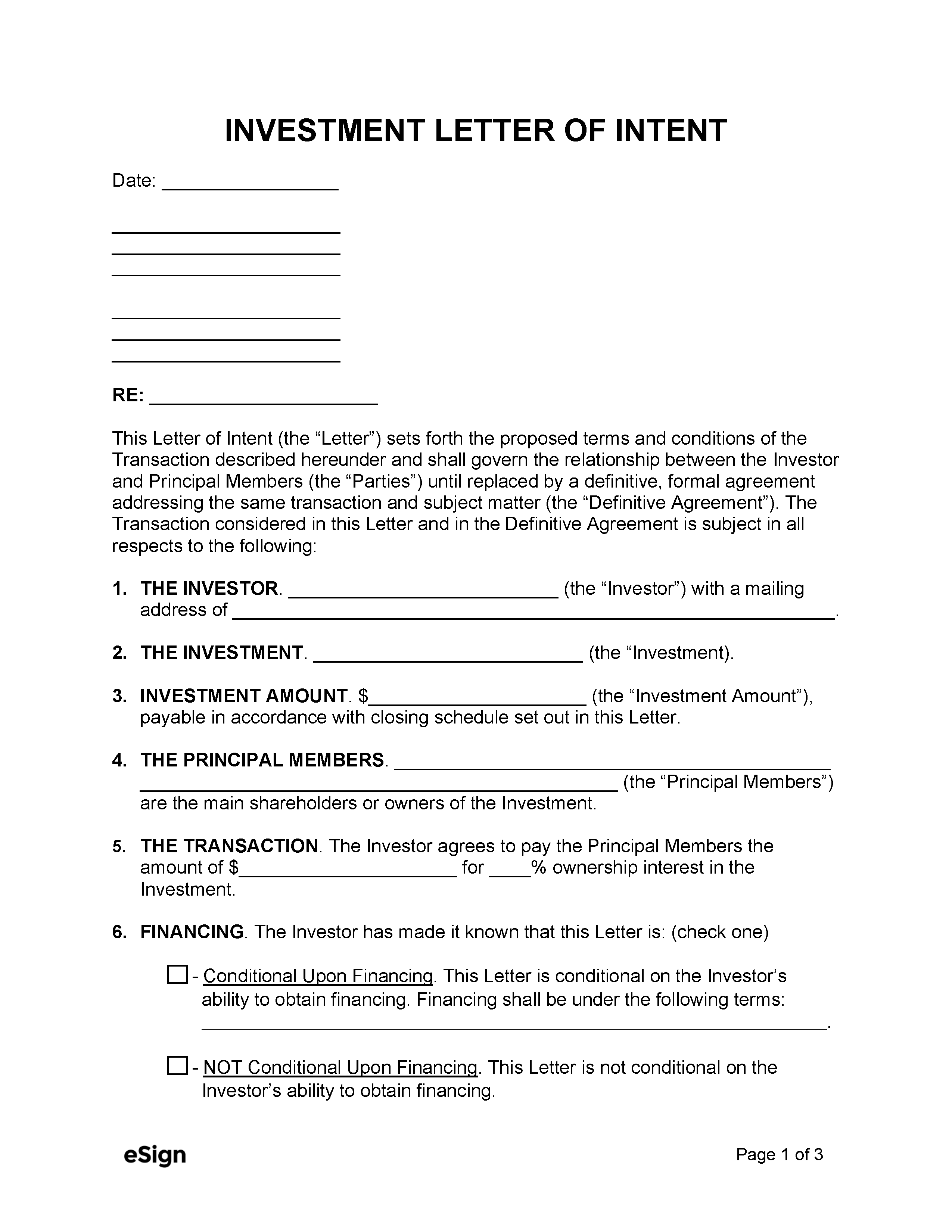

INVESTMENT LETTER OF INTENT

[SENDER (e.g., INVESTOR) NAME]

[SENDER STREET ADDRESS]

[SENDER CITY, STATE, ZIP]

Date: [MM/DD/YYYY]

[RECIPIENT (e.g., BUSINESS OWNER) NAME]

[RECIPIENT STREET ADDRESS]

[RECIPIENT CITY, STATE, ZIP]

Dear [BUSINESS OWNER NAME],

This Letter of Intent (the “Letter”) sets forth the proposed terms and conditions of the transaction described hereunder and shall govern the relationship between the Investor and Principal Members (the “Parties”) until replaced by a definitive, formal agreement addressing the same transaction and subject matter (the “Definitive Agreement”). The transaction considered in this Letter and in the Definitive Agreement is subject in all respects to the following:

1. THE INVESTOR. [INVESTOR NAME] (the “Investor”) with a mailing address of [INVESTOR MAILING ADDRESS].

2. THE INVESTMENT. [INVESTMENT NAME] (the “Investment”).

3. INVESTMENT AMOUNT. $[AMOUNT] (the “Investment Amount”), payable on the Closing set out in this Letter.

4. THE PRINCIPAL MEMBERS. [PRINCIPAL MEMBERS NAMES] (the “Principal Members”) are the main shareholders or owners of the Investment.

5. THE TRANSACTION. The Investor agrees to pay the Principal Members the amount of $[INVESTMENT AMOUNT] for [OWNERSHIP PERCENTAGE]% ownership interest in the Investment.

6. ACCESS TO INFORMATION. After the execution of this Letter, the Investor and its advisors shall be granted full access to any and all information about the Investment.

7. RETURN OF MATERIALS. Any information that is obtained by the Investor through the Principal Members shall be returned if a formal agreement cannot be reached.

8. INVESTMENT CONDITIONS. It shall be the obligation of the Investor to review all materials provided and, subject to the satisfaction of the Investor, enter into a formal agreement within [NUMBER] days after receiving all necessary materials. The conditions of the investment also include: [ADDITIONAL CONDITIONS].

9. CLOSING. The Closing (the “Closing”) is the act of closing the transaction where the Principal Members exchange the Investment for the Investment Amount. The Closing shall occur: [CLOSING TERMS].

10. CONFIDENTIALITY. All negotiations and information regarding the Investment between the Investor and Principal Members shall be confidential and not be disclosed to anyone other than the parties, their staff, advisors, and necessary third parties. No public release will be issued concerning the proposed Investment without mutual consent or as required by law, and then only upon prior written notice to the other party unless otherwise prohibited.

11. GOOD FAITH NEGOTIATIONS. The Investor and the Principal Members agree to enter into good faith negotiations to execute a formal agreement or close the transaction.

12. EXCLUSIVE OPPORTUNITY. After the execution of this Letter, the parties agree to not negotiate or enter discussions with any other party unless there are existing agreements in place.

13. STANDSTILL AGREEMENT. After the execution of this Letter, and until Closing, the Principal Shareholders, agree not to sell any portion of the Investment.

14. GOVERNING LAW. This Letter shall be governed under the laws of the State of [STATE NAME].

16. ACCEPTANCE. If the aforementioned terms are agreeable, please sign and return a duplicate copy of this Letter by no later than [DATE].

17. SIGNATURES.

Investor Signature: _____________________

Date: [MM/DD/YYYY] Print Name: [INVESTOR PRINTED NAME]

Principal Member Signature: _____________________

Date: [MM/DD/YYYY] Print Name: [MEMBER PRINTED NAME]