An Alaska LLC operating agreement is a document that governs the relationships between owners in a limited liability company and establishes how the company will be run. It can be thought of as the blueprint for a company, containing all of its essential details in one place. This provides anyone who reads it with a clear understanding of the ins and outs of the entity.

Although the state of Alaska does not require the drafting of an operating agreement, it is strongly advised that all LLCs, regardless of size, do so.

Contents |

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Art. 1, Ch. 50

- Definitions: § 10.50.990

- Naming of LLCs: § 10.50.020

How to File

- Step 1 – Choose the Business’ Name

- Step 2 – File the Articles of Organization

- Step 3 – Create an Operating Agreement

- Step 4 – Obtain an EIN

- Step 5 – File an Initial Report

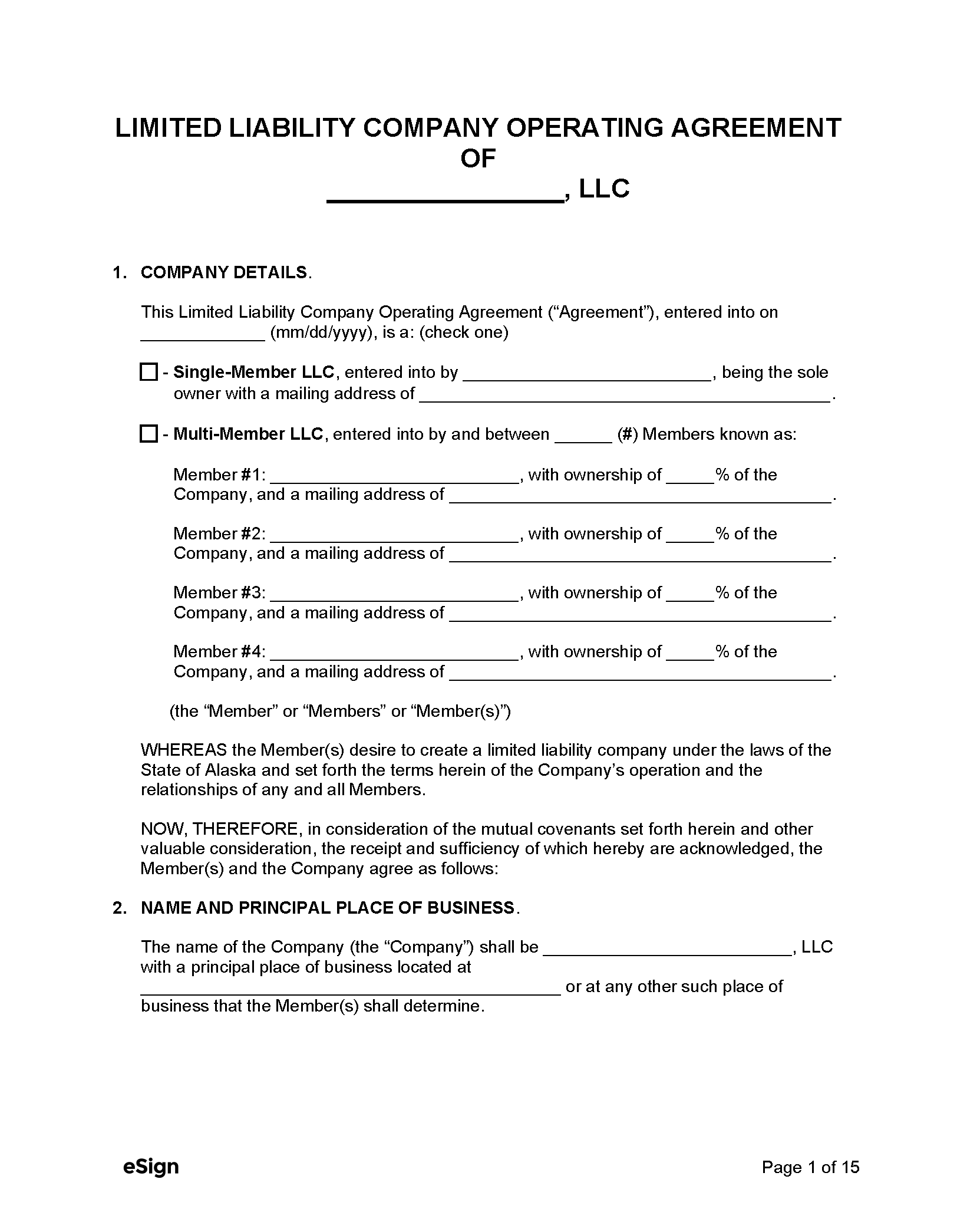

Step 1 – Choose the Business’ Name

The individual forming the LLC needs to ensure the business name they plan to use has not already been taken. Use the state’s business search tool to confirm that the intended name is available.

Entity names can be reserved by filing a Business Name Reservation ($25 filing fee). By doing so, the entity gains exclusive use of the name for a total of one hundred and twenty (120) days. Name reservations must be mailed to: PO Box 110806, Juneau, AK 99811-0806.

Note on Naming an LLC:

Per § 10.50.020, the name of the entity must include one (1) of the following three (3) words or phrases: “Limited Liability Company,” “L.L.C.,” or “LLC.”

Step 2 – File the Articles of Organization

Filing the Articles of Organization (for Alaskan entities) or the Certificate of Registration (for foreign entities) can be done online or by mail. The online filing method is recommended due to it being the faster and simpler option.

Method 1 – Online

- Domestic – Articles of Organization ($250)

- Foreign – Certificate of Registration ($350)

Method 2 – By Mail

- Domestic:

- Download the Articles of Organization (Form 08-484).

- Complete all required fields.

- Enter credit card information (for the $250 filing fee).

- Mail the completed packet to: State of Alaska, Corporations Section, PO Box 110806, Juneau, AK 99811-0806

- Foreign:

- Download the Certificate of Registration (Form 08-497).

- Fill in all applicable areas of the form.

- Input the credit card information needed to pay the $350 fee.

- Mail all items to: State of Alaska, Corporations Section, PO Box 110806, Juneau, AK 99811-0806.

Registered Agent Information:

Both domestic and foreign LLCs must choose a registered agent, which is an individual or corporation that receives legal documents and other official paperwork on behalf of the company. The LLC cannot act as its own registered agent. In Alaska, a registered agent must satisfy the following qualifications:

- Be a resident of Alaska (if an individual);

- Be authorized to conduct business in Alaska (if a corporation);

- Have a physical address and mailing address.

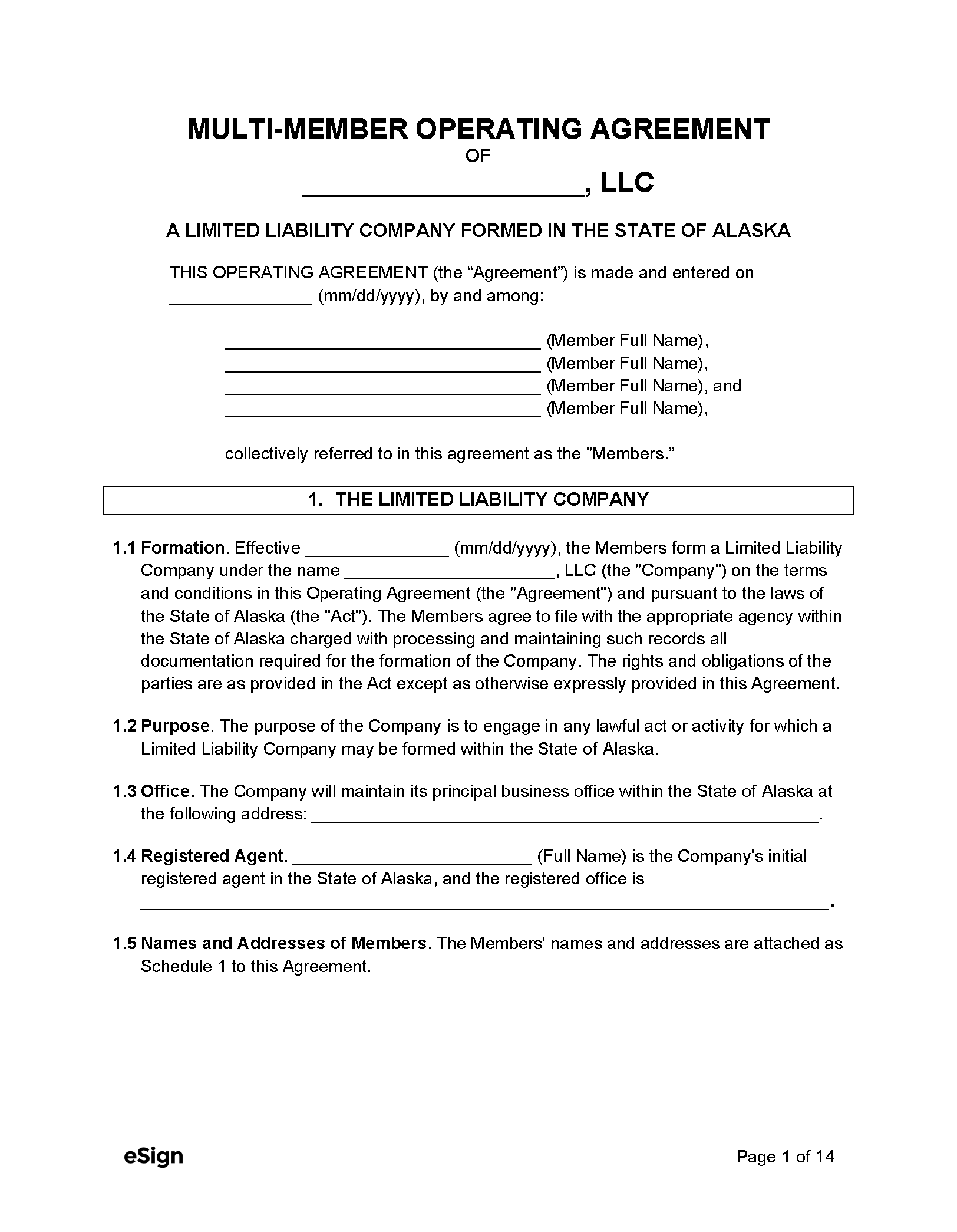

Step 3 – Create an Operating Agreement

Although state law doesn’t require an operating agreement to be filed, creating one is well worth the effort due to the benefits it provides.

Step 4 – Obtain an EIN

An EIN (“Employer Identification Number”) is a string of numbers unique to a company, giving the entity the ability to open a business bank account, hire employees, and conduct other important tasks.

It can only be obtained through the IRS. The easiest way of receiving an EIN is to apply online (click Apply Online Now). The application must be completed in one go, as it expires after fifteen (15) minutes of inactivity.

Step 5 – File an Initial Report

Limited liability companies must file an initial report within six (6) months of receiving approval to conduct business in Alaska. Reports are filed online and come at no cost to the filer. LLCs must also file a biennial report (every two (2) years) before January 2nd of the year of filing ($100 filing fee).

ResourcesFiling Options: Online & by Mail Costs:

Forms:

Links:

|