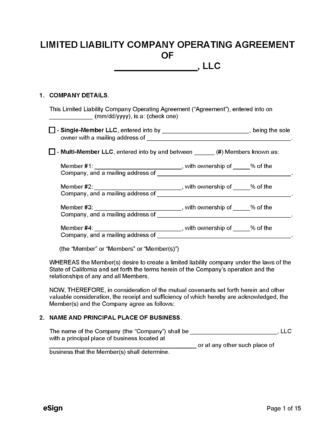

Is an Operating Agreement Required in California?

Yes – LLCs in California are required to have an operating agreement, which can be written, oral, or implied.[1] If written, the agreement must be stored at the LLC’s designated office.[2]

Types (2)

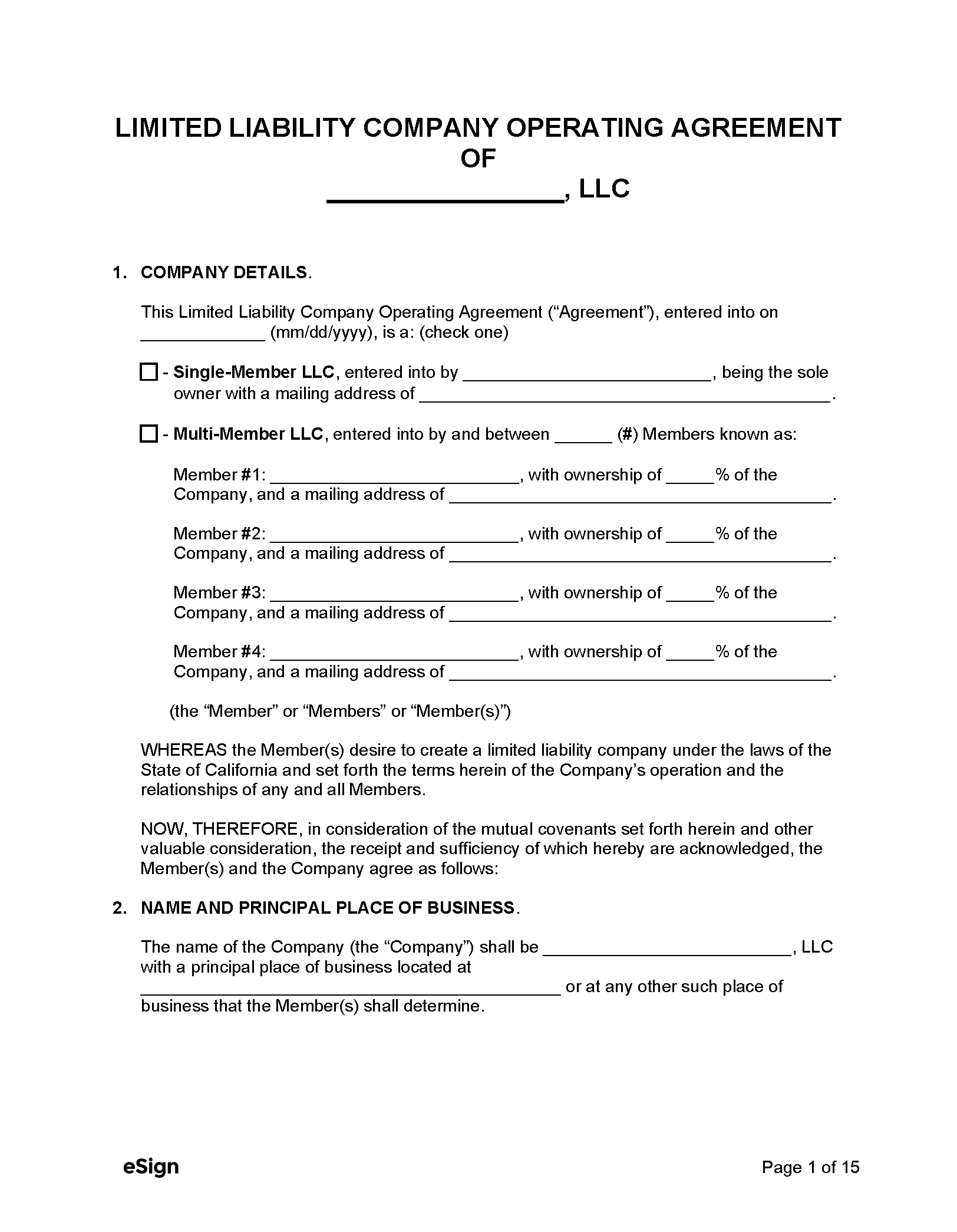

Single-Member LLC Operating Agreement – Establishes the operating procedures of an LLC that has one owner only. Single-Member LLC Operating Agreement – Establishes the operating procedures of an LLC that has one owner only.

|

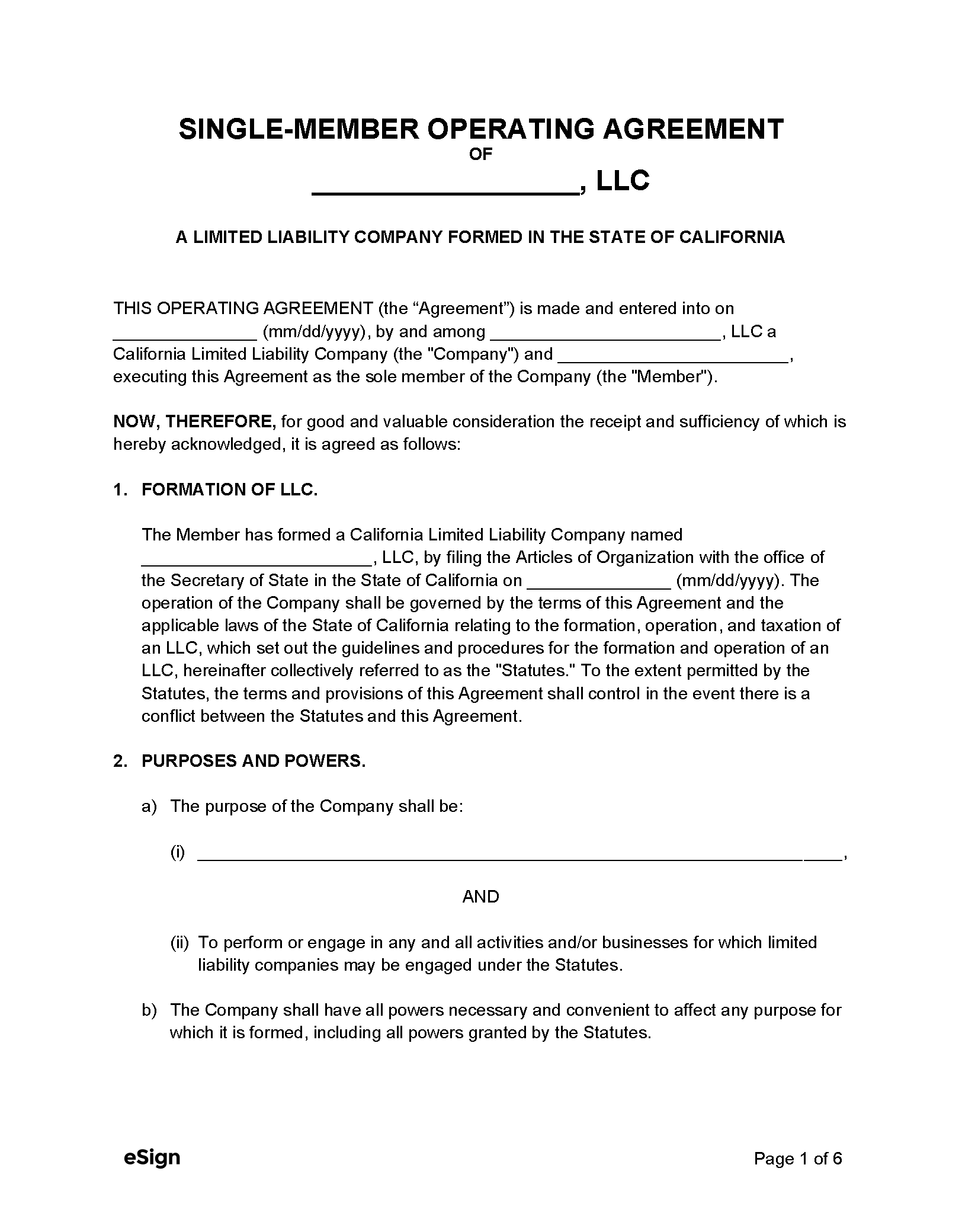

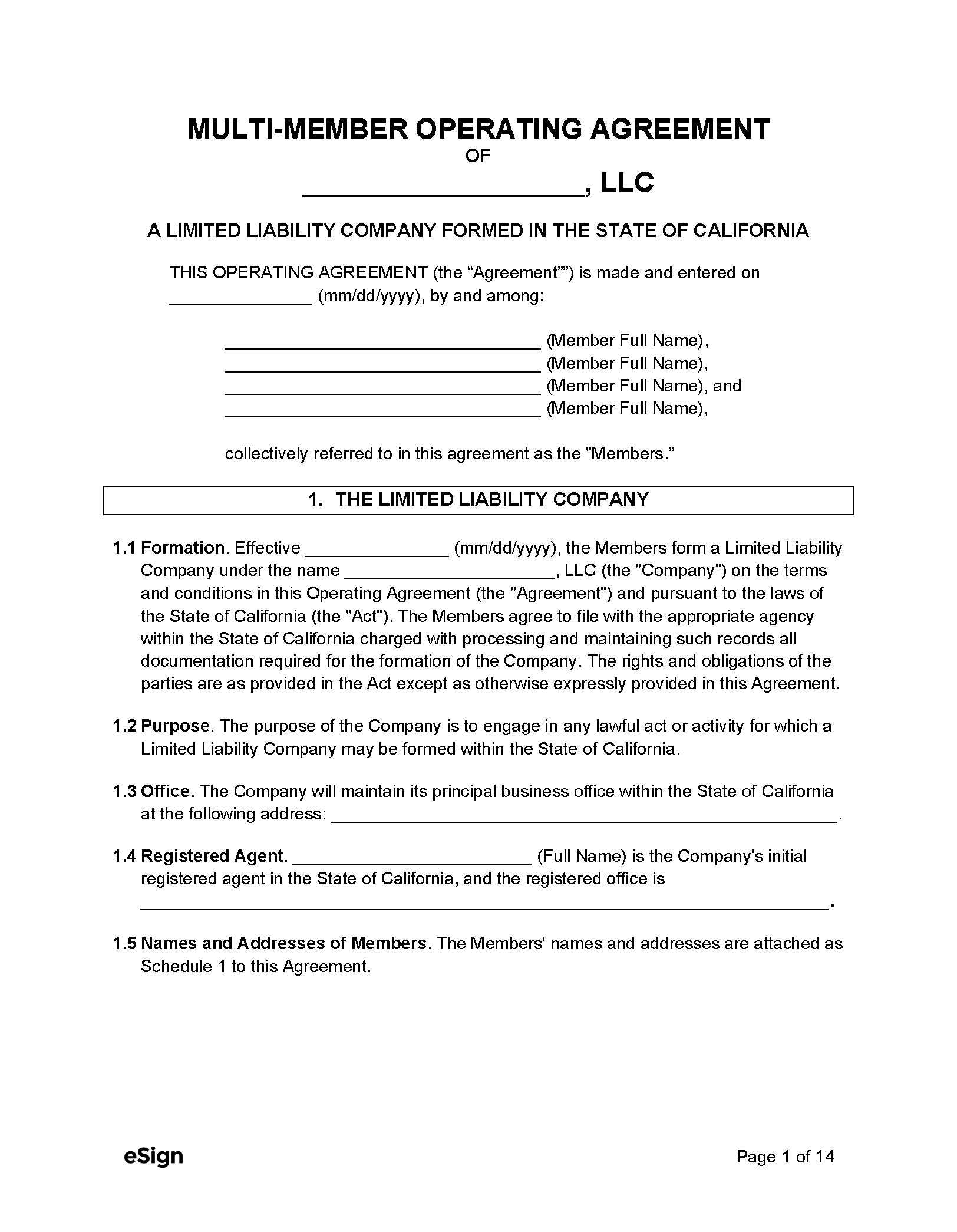

Multi-Member LLC Operating Agreement – Sets out the internal operating policies of an LLC with more than one owner. Multi-Member LLC Operating Agreement – Sets out the internal operating policies of an LLC with more than one owner.

|