Is an Operating Agreement Required in Connecticut?

No – Connecticut law does not require an operating agreement. Nevertheless, without an agreement, certain aspects of the LLC’s operations will not be self-governed.

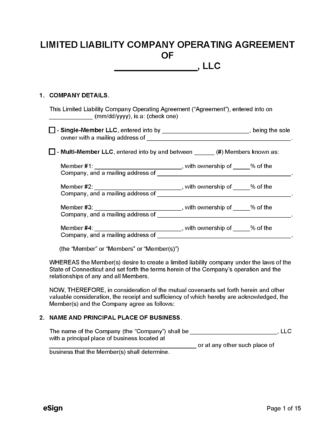

Types (2)

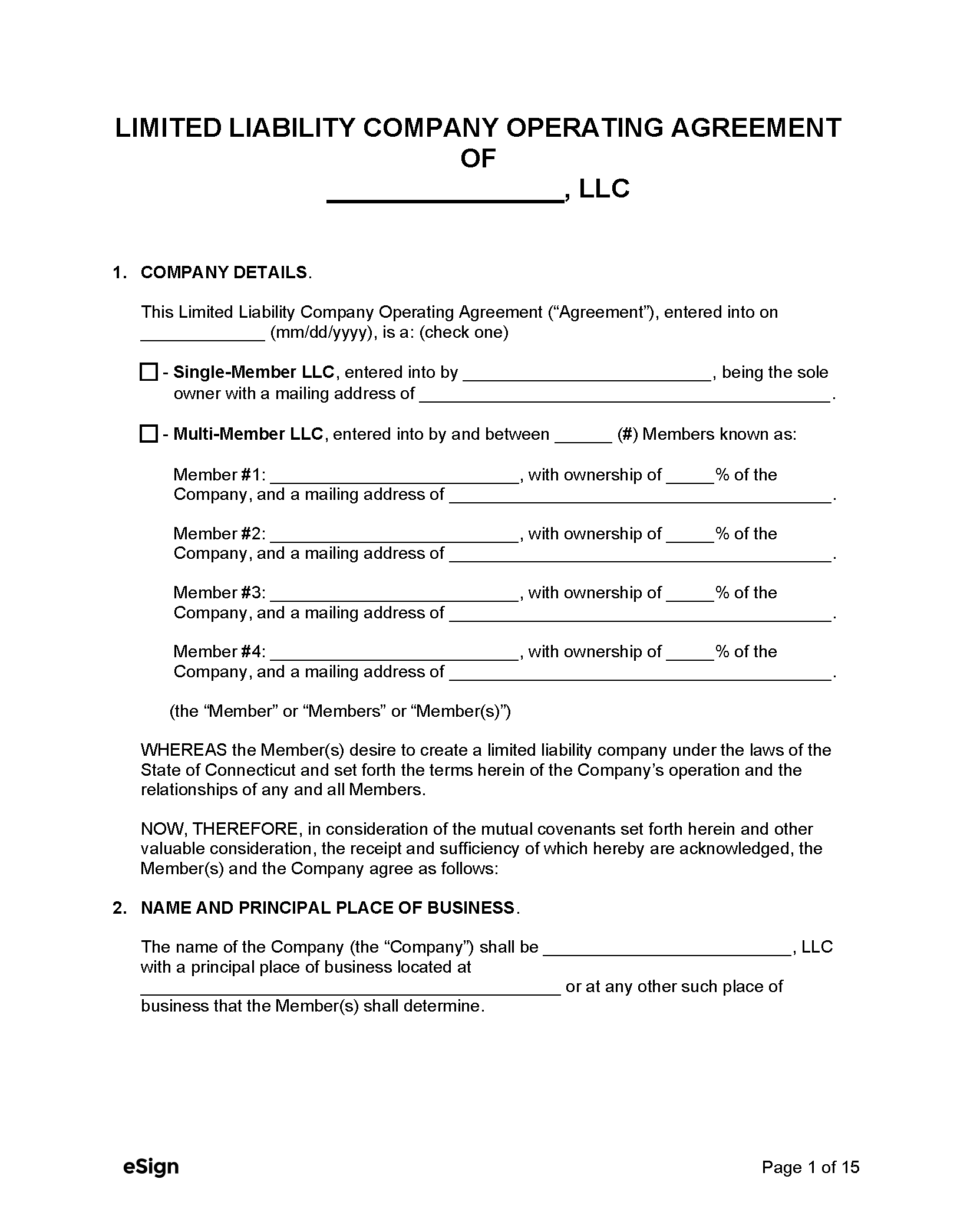

Single-Member LLC Operating Agreement – This operating agreement should be used if the LLC has one owner. Single-Member LLC Operating Agreement – This operating agreement should be used if the LLC has one owner.

|

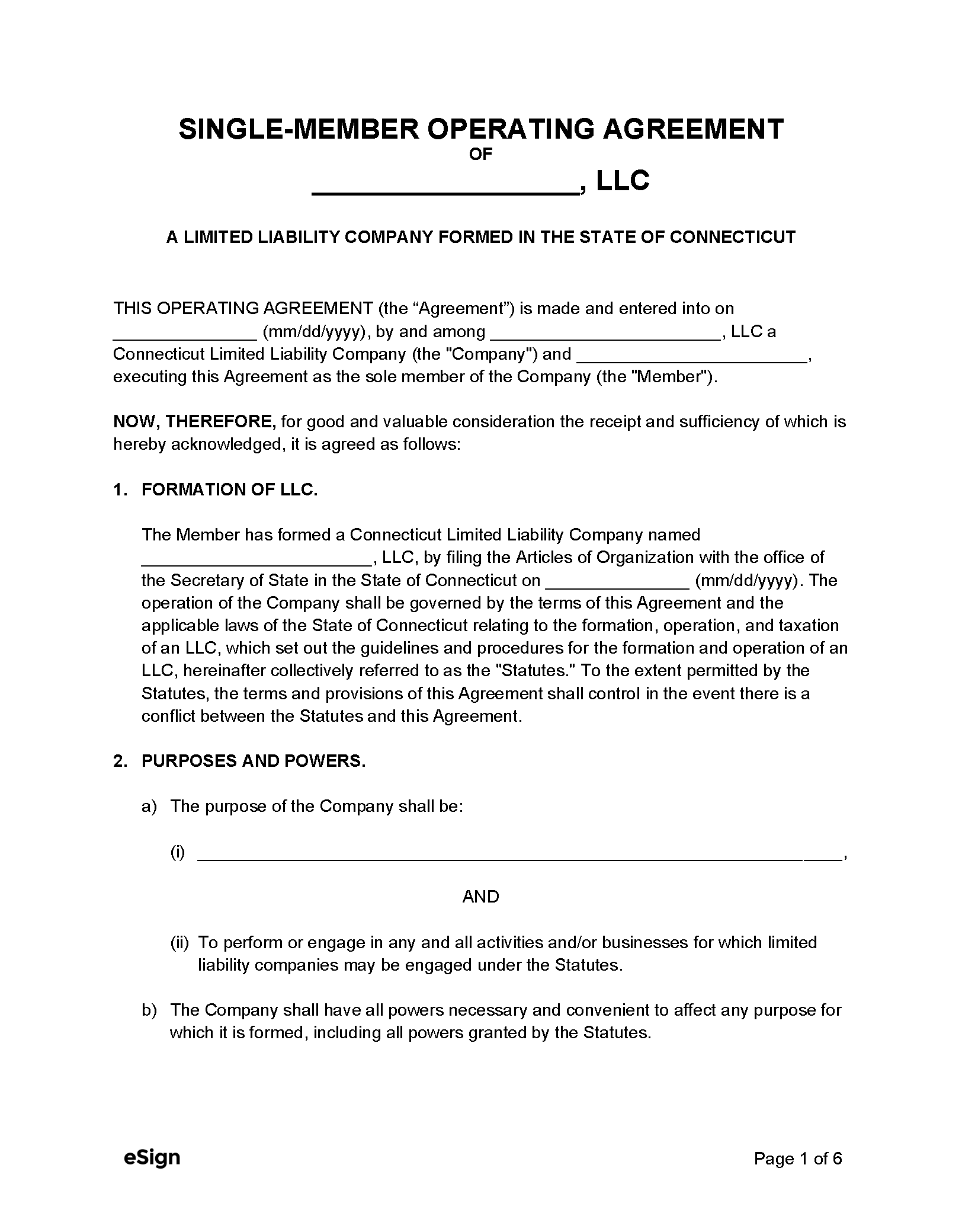

Multi-Member LLC Operating Agreement – LLCs may use this operating agreement if the company has more than one owner. Multi-Member LLC Operating Agreement – LLCs may use this operating agreement if the company has more than one owner.

|