Although an operating agreement is not legally required in Connecticut, LLCs are strongly advised to draft one immediately after receiving approval to conduct business within the state.

Contents |

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Title 34, Chapter 613a

- Definitions: § 34-279

- Formation: § 34-247

- Naming of LLCs: § 34-243k

How to File (4 Steps)

- Step 1 – Choose the Entity’s Name

- Step 2 – Appoint a Registered Agent

- Step 3 – File with the Secretary of State

- Step 4 – Create an LLC Operating Agreement

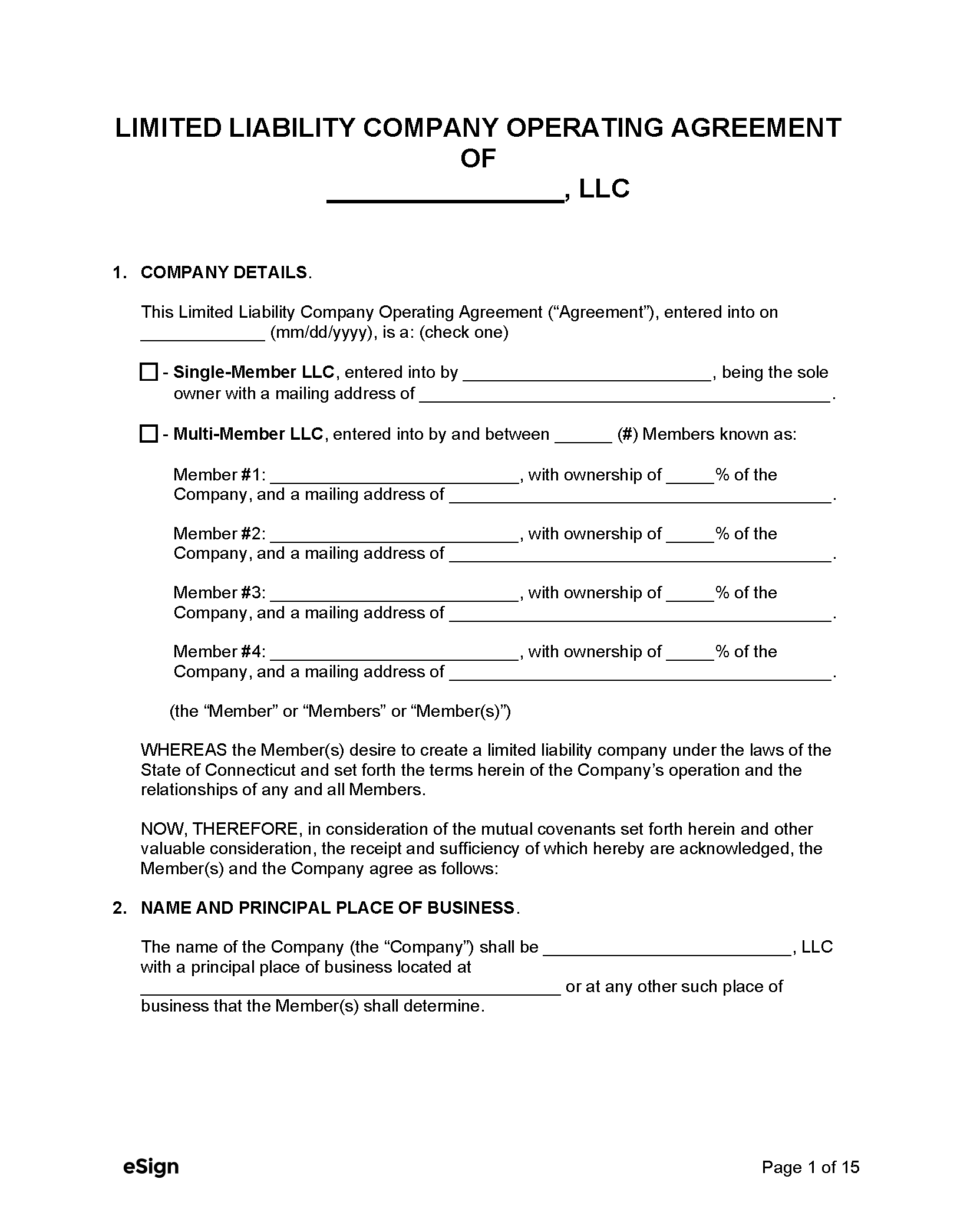

Step 1 – Choose the Entity’s Name

Business filers will need to choose a company name that is distinguishable from all others currently recorded with the Secretary of State. Perform a Business Records Search to determine whether the proposed entity name is unique.

Connecticut statute § 34-243k indicates that the company name must include a proper business designation, such as “LLC,” “L.L.C.,” or “Limited Liability Company.”

Name Reservation (Optional):

Filers have the option of reserving the intended name for one hundred and twenty (120) days. For reservations, fill out the Application for Reservation of Name, attach a check for $60 made payable to the “Secretary of State,” and mail or deliver the items to the applicable address below:

- Mailing Address – Business Services Division, Connecticut Secretary of the State, P.O. Box 150470, Hartford CT 06115-0470

- Delivery Address- Business Services Division, Connecticut Secretary of the State, 165 Capitol Avenue, Suite 1000, Hartford, CT 06106

Step 2 – Appoint a Registered Agent

A registered agent is an individual or entity that acts on behalf of the LLC to receive notices, demands, and service of process (court documents). In Connecticut, a registered agent may be either of the following:

- An individual resident of Connecticut (including any member or manager of the company); or

- A business entity that has a Connecticut address and is registered with the Secretary of State (an LLC can’t serve as its own registered agent).

Step 3 – File with the Secretary of State

Registering the business entity with the Secretary of State is accomplished by filing the Certificate of Organization (for domestic LLCs) or the Foreign Registration Statement (for out-of-state LLCs).

File Online

- Access the Online Business Services.

- Click Sign-in here to get started.

- Create an online account.

- Fill out the Certificate of Organization or Foreign Registration Statement.

- Submit the requisite credit card information to pay the $120 filing fee.

File by Mail or In Person

- Complete the paper application.

- Domestic LLCs – Certificate of Organization

- Foreign LLCs – Foreign Registration Statement

- Attach a check for $120 payable to the “Secretary of State.”

- File the application with the Secretary of State.

- Mailing Address – Business Services Division, Connecticut Secretary of the State, P.O. Box 150470, Hartford CT 06115-0470

- Delivery Address- Business Services Division, Connecticut Secretary of the State, 165 Capitol Avenue, Suite 1000, Hartford, CT 06106

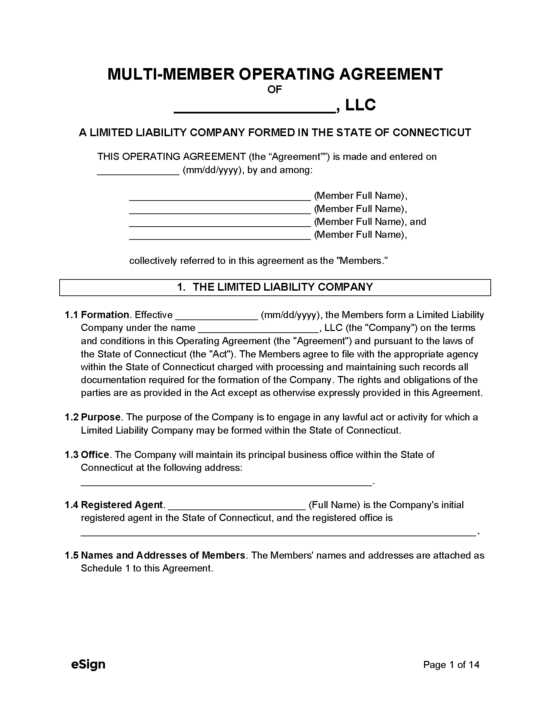

Step 4 – Create an LLC Operating Agreement

Limited liability companies are not required to file an operating agreement with the Secretary of State. Despite this fact, LLCs are advised to draft one to establish the company’s rules, regulations, and ownership structure.

ResourcesFiling Options: Online, Mail, & In Person Costs:

Forms:

Links:

|