LLCs are not required by law to draft an operating agreement; nevertheless, executing the document establishes an important foundation and administrative guideline for the organization, and without one, the limited liability status of the company may be less defined in the eyes of the IRS and Iowa Department of Revenue.

Contents |

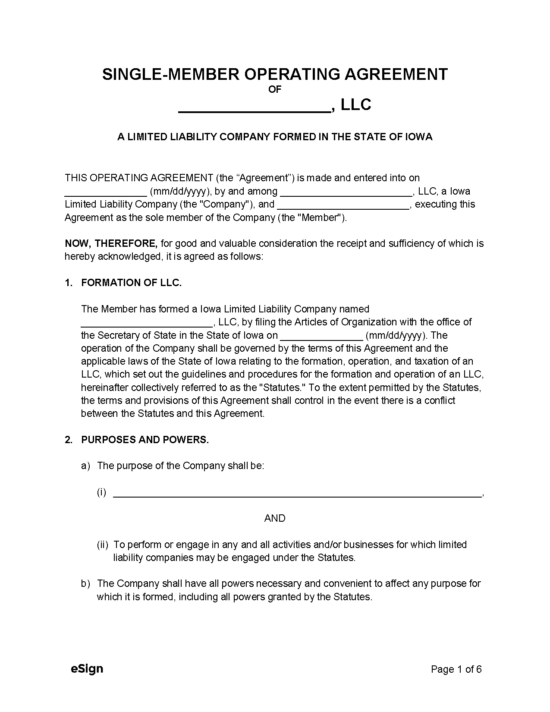

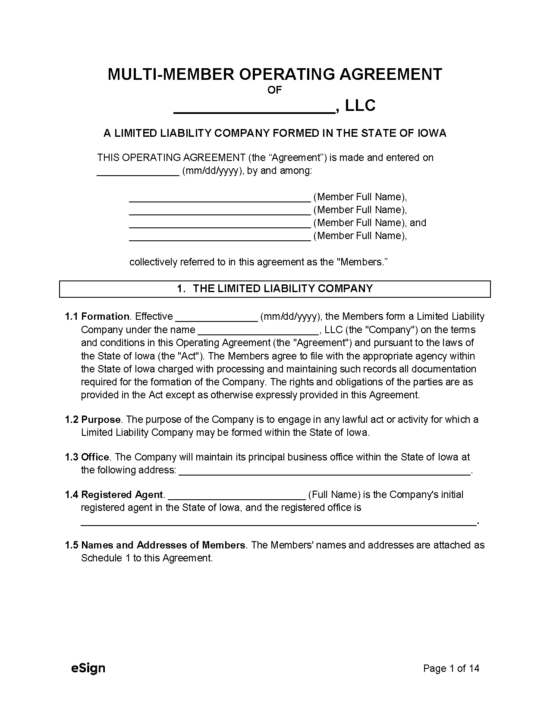

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Chapter 489

- Definitions: § 489.102

- Formation: § 489.201

- Naming of LLCs: § 489.108

How to File (4 Steps)

- Step 1 – Naming the LLC

- Step 2 – Filing with the Secretary of State

- Step 3 – Creating an Operating Agreement

- Step 4 – Applying for an EIN

Step 1 – Naming the LLC

LLCs are required to operate with a name that is not shared by another entity in Iowa. To test name availability, the online Secretary of State database can be researched here.

Iowa LLC names must comply with the following statute to be accepted by the SOS: § 489.108 Name.

A company may reserve a name’s use for a one hundred and twenty (120) day period by:

- Completing the Application for Reservation of Name;

- Enclosing a $10 filing fee paid by check made to SECRETARY OF STATE; and

- Mailing the application and payment to: Business Services Division, Lucas Building, 1st Floor, Des Moines, Iowa 50319.

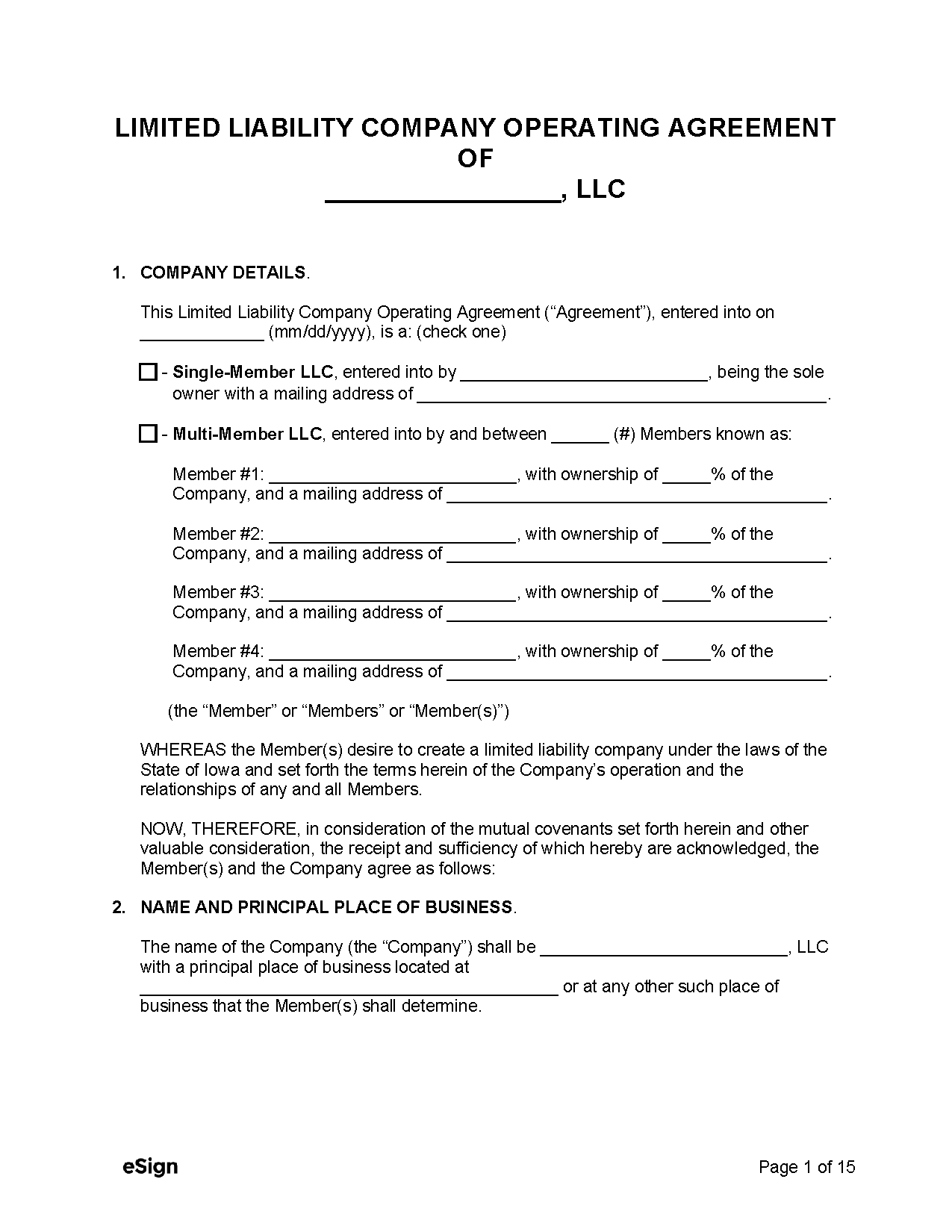

Step 2 – Filing with the Secretary of State

Filing with the Secretary of State authorizes a limited liability company to begin its business operations as a legal entity.

- Domestic LLCs must draft a Certificate of Organization that complies with §489.201 (no gov-issued form available). Foreign LLCs will require completing the Application for Certificate of Authority (Form 635 0010).

- Forms may be submitted online on the SOS website or mailed to: First Floor, Lucas Building, 321 E. 12th St. Des Moines, IA 50319.

- The filing fee of $50 for domestic LLCs or $100 for foreign LLCs can be submitted at the end of the online application or by check enclosed with the mailed filing. Checks should be made payable to “SECRETARY OF STATE.”

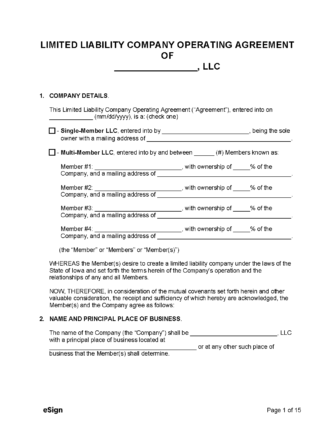

Step 3 – Creating an Operating Agreement

Creating an operating agreement is not a legally required step in the formation of an LLC; however, the document allows the company to customize their structure and organization without defaulting to state law. The operating agreement can be drafted at any point during the filing process.

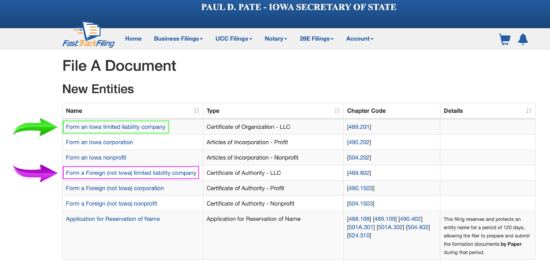

Step 4 – Applying for an EIN

The final step in forming an LLC is applying for an Employer Identification Number (EIN). An EIN is required for all multi-member LLCs and for single-member LLCs with employees or those who wish to be taxed as a corporation. The IRS website provides an online application form and does not charge a fee for filing.

A printable application (Form SS-4) may be used for those hesitant to submit info online. Instructions for mailed filings can be found here.

ResourcesFiling Options: Online or by Mail Costs:

Forms:

Links

|