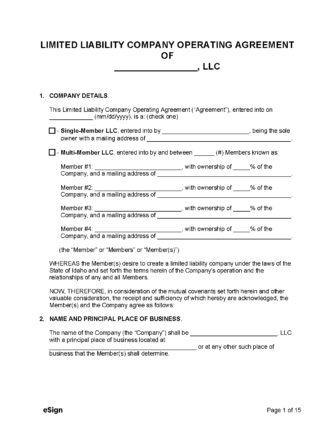

Is an Operating Agreement Required in Idaho?

No – Idaho LLCs aren’t legally required to implement an operating agreement, but it’s considered common practice.

Types (2)

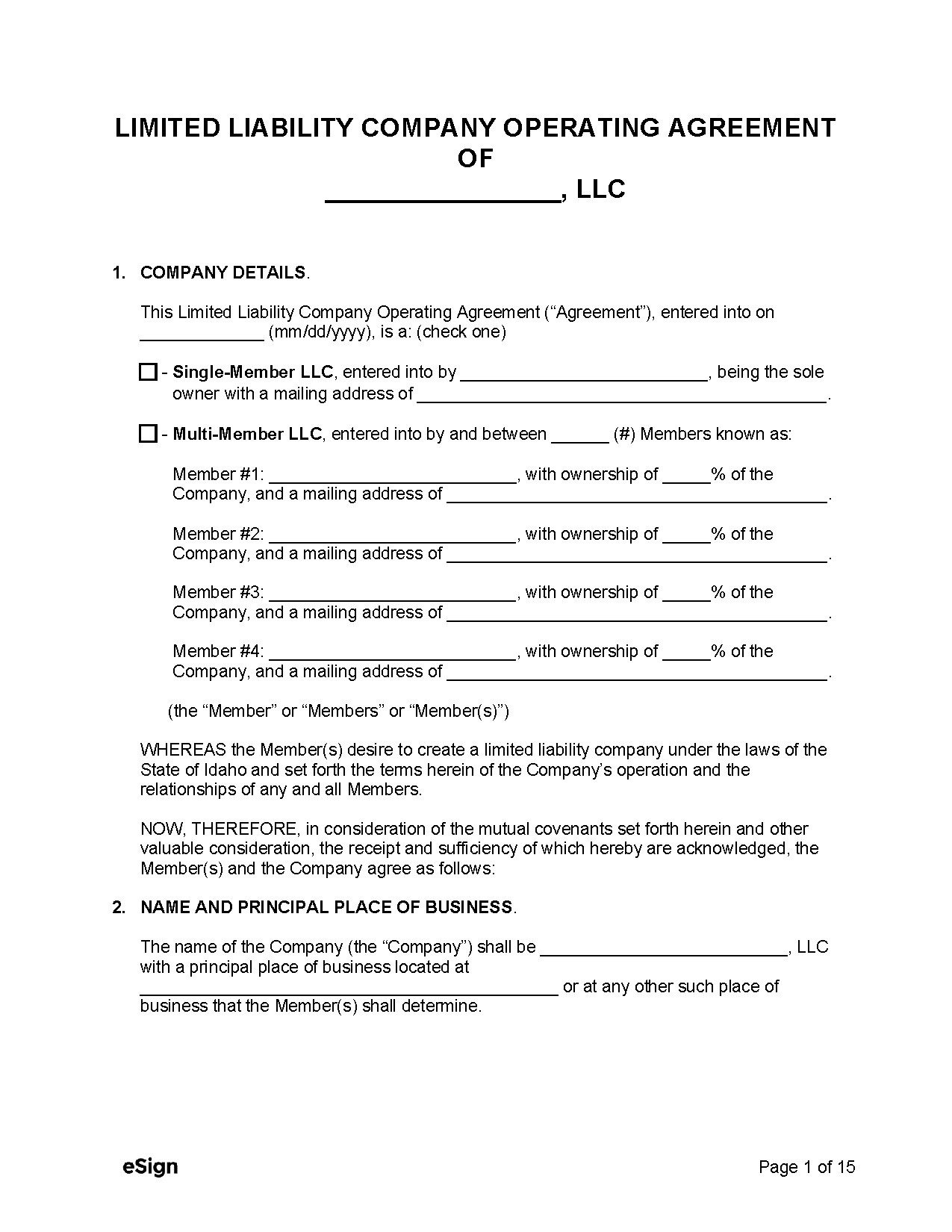

Single-Member LLC Operating Agreement – Establishes the management procedures of an LLC with one owner. Single-Member LLC Operating Agreement – Establishes the management procedures of an LLC with one owner.

|

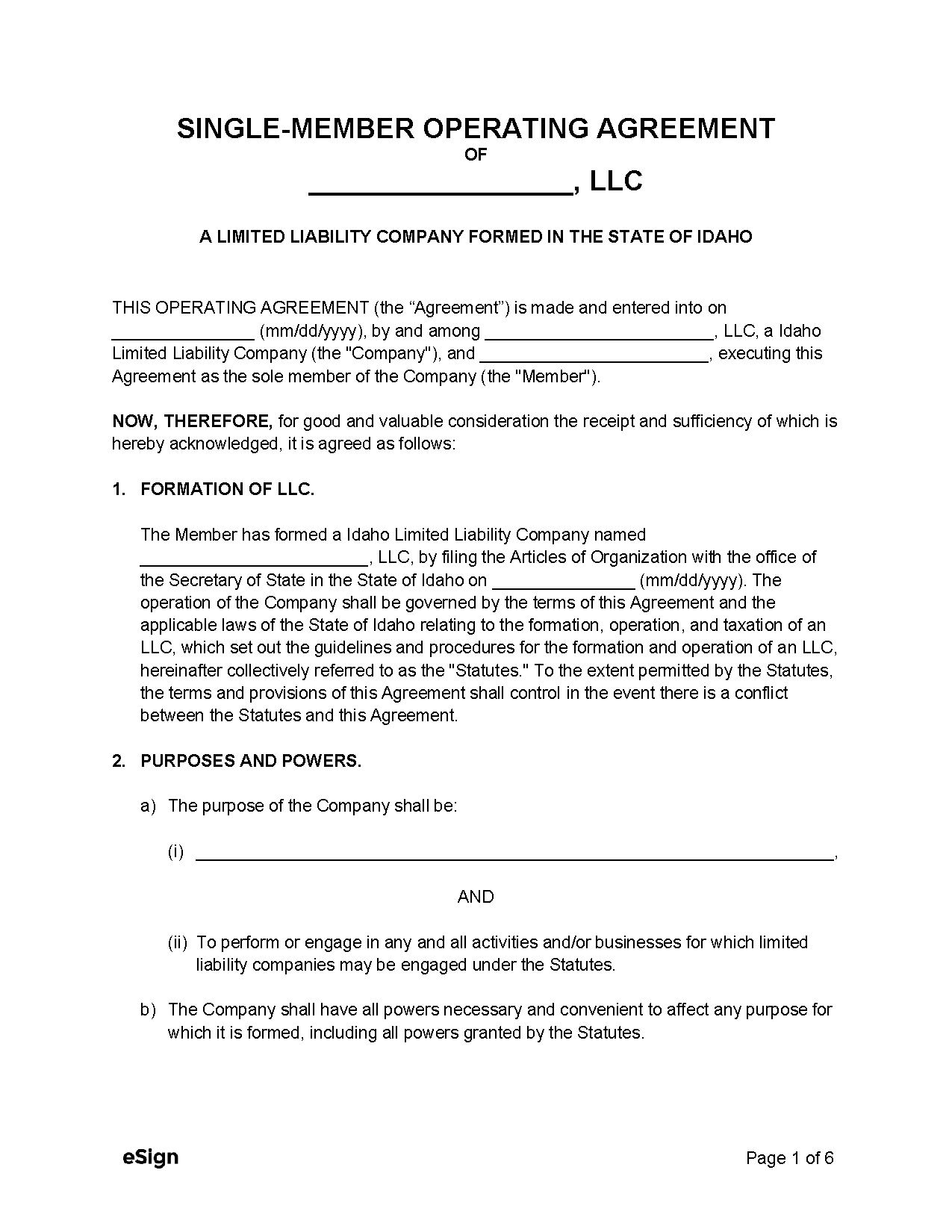

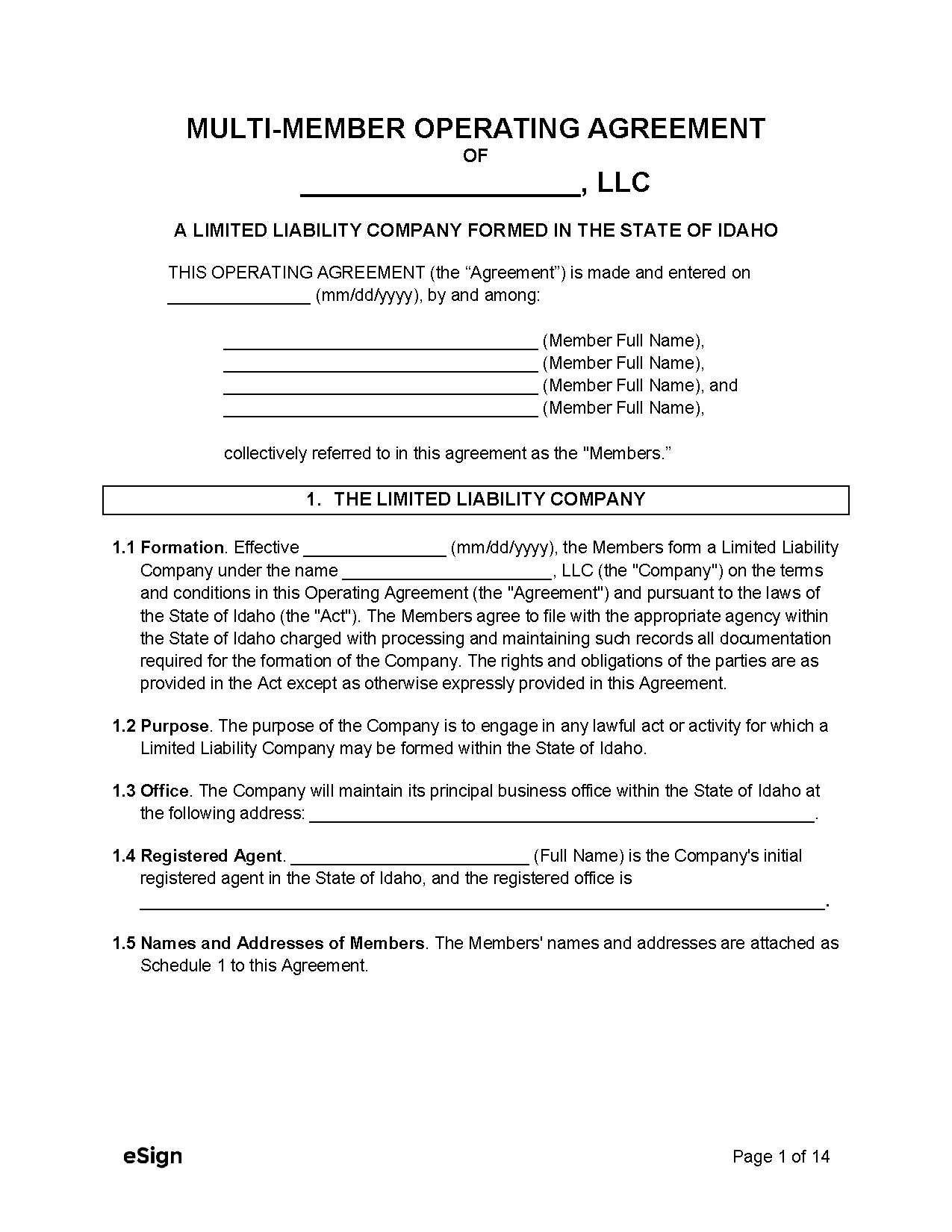

Multi-Member LLC Operating Agreement – Binds members of an LLC to the rules for how their company will operate. Multi-Member LLC Operating Agreement – Binds members of an LLC to the rules for how their company will operate.

|