The agreement also serves to relay the distribution of ownership percentage and list their initial capital contributions while limiting their liability to the amount of said contribution. The form may be completed by an individual creating a single-member LLC or used to create a multi-member company.

Contents |

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Title 30, Chapter 25

- Definitions: § 30-25-102

- Formation: § 30-25-201

- Naming of LLCs: § 30-21-301

How to File (6 Steps)

- Step 1 – Reserving the LLC’s Name

- Step 2 – Appointing an Agent

- Step 3 – Filing Articles of Organization

- Step 4 – Completing an Operating Agreement

- Step 5 – Obtaining an EIN

- Step 6 – Business Registration / Permits and Licenses

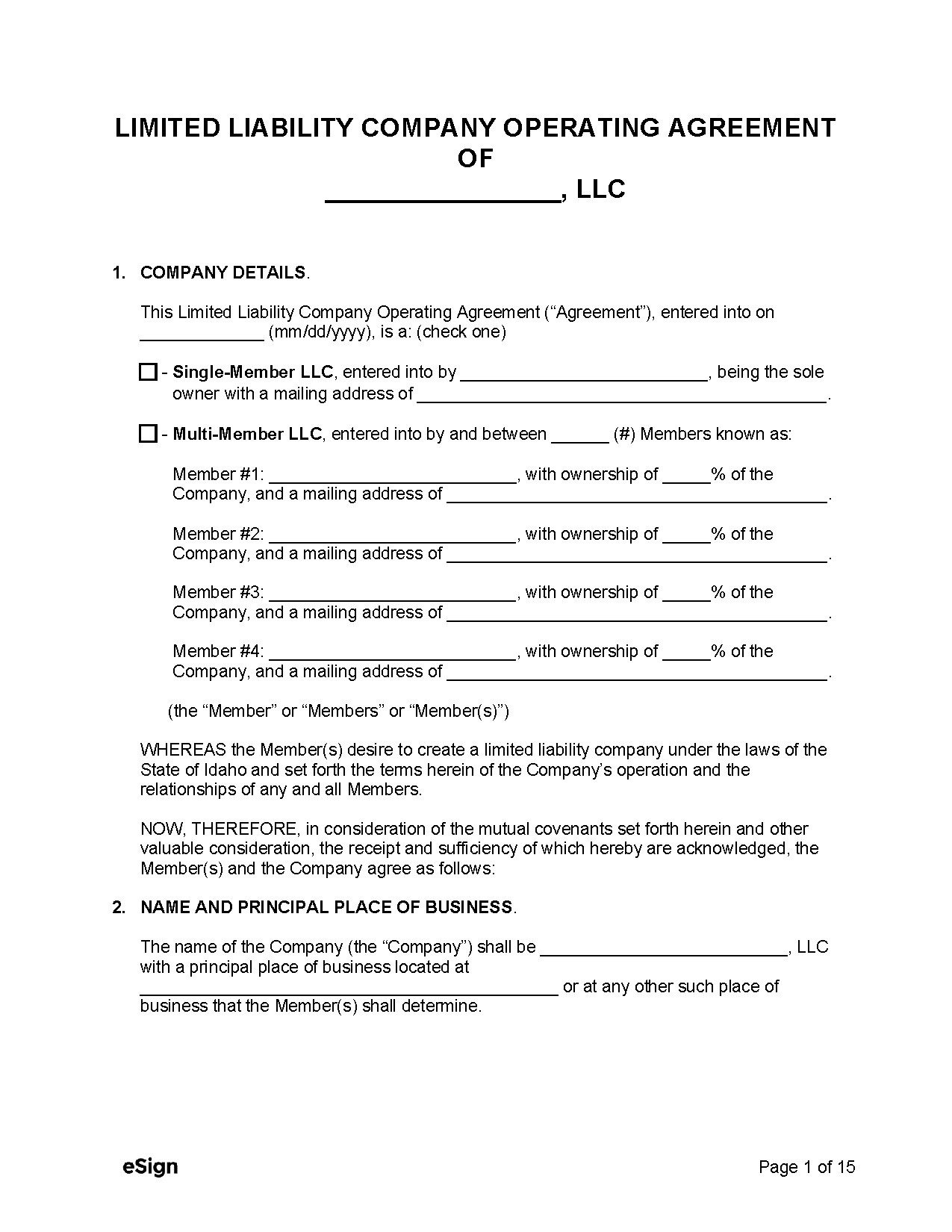

Step 1 – Reserving the LLC’s Name

The LLC must have a name distinct from other names registered in Idaho and contain “Limited Liability Company” or “Limited Company”. Abbreviations such as “L.L.C.,” “LLC,” “L.C.,” are also be accepted. To find an available name, the Secretary of State database may be used to search for businesses already registered.

LLCs may reserve their name for up to four (4) months. This filing can be done online for a $20 fee, or by mailing and delivering the Application for Reservation of a Legal Entity Name to the below address with a $40 fee attached thereto.

Office of the Secretary of State

450 N 4th Street

PO Box 83720

Boise, ID 83720-0080

Reserving a name is optional, and will otherwise be accomplished when submitting the LLC’s Certificate of Organization (Step 3).

Step 2 – Appointing an Agent

The LLC must appoint a registered agent who will receive service of process and legal notices on the company’s behalf. An eligible agent may be an individual residing in Idaho, an entity located or authorized to operate in the state, or a member of the LLC. The agent must have a physical street address in Idaho, which will be recorded on the Certificate of Organization (next step).

Step 3 – Filing Certificate of Organization

Once the name and the registered agent have been chosen, the entity will need to file the correct form to register with the Secretary of State.

Domestic LLC

Domestic LLCs will need to file a Certificate of Organization with the Secretary of State either online ($100 fee), or by mail ($120 fee) sent to the address below.

Foreign LLC

Existing LLCs that wish to expand to Idaho can complete the Foreign Registration Statement and submit the $100 processing fee. Foreign registrants must also submit a Certificate of Good Standing from their state of origin. A printable version of the Foreign Registration Statement can also be delivered to the address below.

Physical forms should be delivered to the following address along with an enclosed cheque made payable to the Idaho Secretary of State:

Office of the Secretary of State

450 N 4th Street

P.O. Box 83720

Boise, ID 83720-0080

For expedited filings, applicants must add an additional $40 to the filing fee, or an additional $100 for same-day service.

Step 4 – Completing an Operating Agreement

An operating agreement ensures all members are aware of, and sign off on, the internal structuring of the LLC. While completing the document is not mandated by Idaho state statutes, the lack of an operating agreement will result in the LLC being governed by default state regulations instead of provisions specific to the entity’s needs.

Step 5 – Creating an EIN

An EIN is required for LLCs of more than one owner, or for LLCs with a single member who intends to employ other individuals or file taxes as a corporation. This number can be obtained by completing the online application via the IRS website and does not require any processing fee.

Step 6 – Business Registration / Permits and Licenses

Businesses with employees or those involved in retail sales will need to register online in the Idaho Registration System for sales tax and insurance purposes. Alternatively, the registration may be completed by printing and submitting Form IBR-1 via mail to: Idaho Business Registration, PO Box 36 Boise, ID 83722-0410.

Certain businesses may require additional permits and licenses, which can be identified via the Idaho Business Wizard. If additional permitting is necessary, the company will need to contact the respective agencies to obtain more information.

ResourcesFiling Options: Online or by Mail Costs:

Forms:

Links:

|