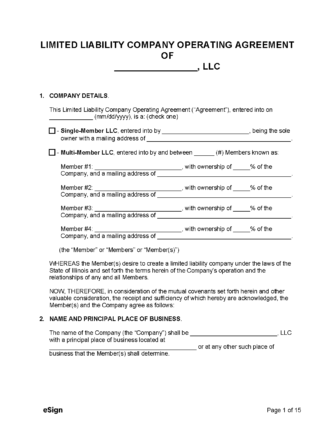

The completed document will define the company’s ownership, member contributions, and management structure. Operating agreements are not required for the creation of an Illinois LLC; however, companies without one will risk being taxed as a sole-proprietorship or partnership.

Contents |

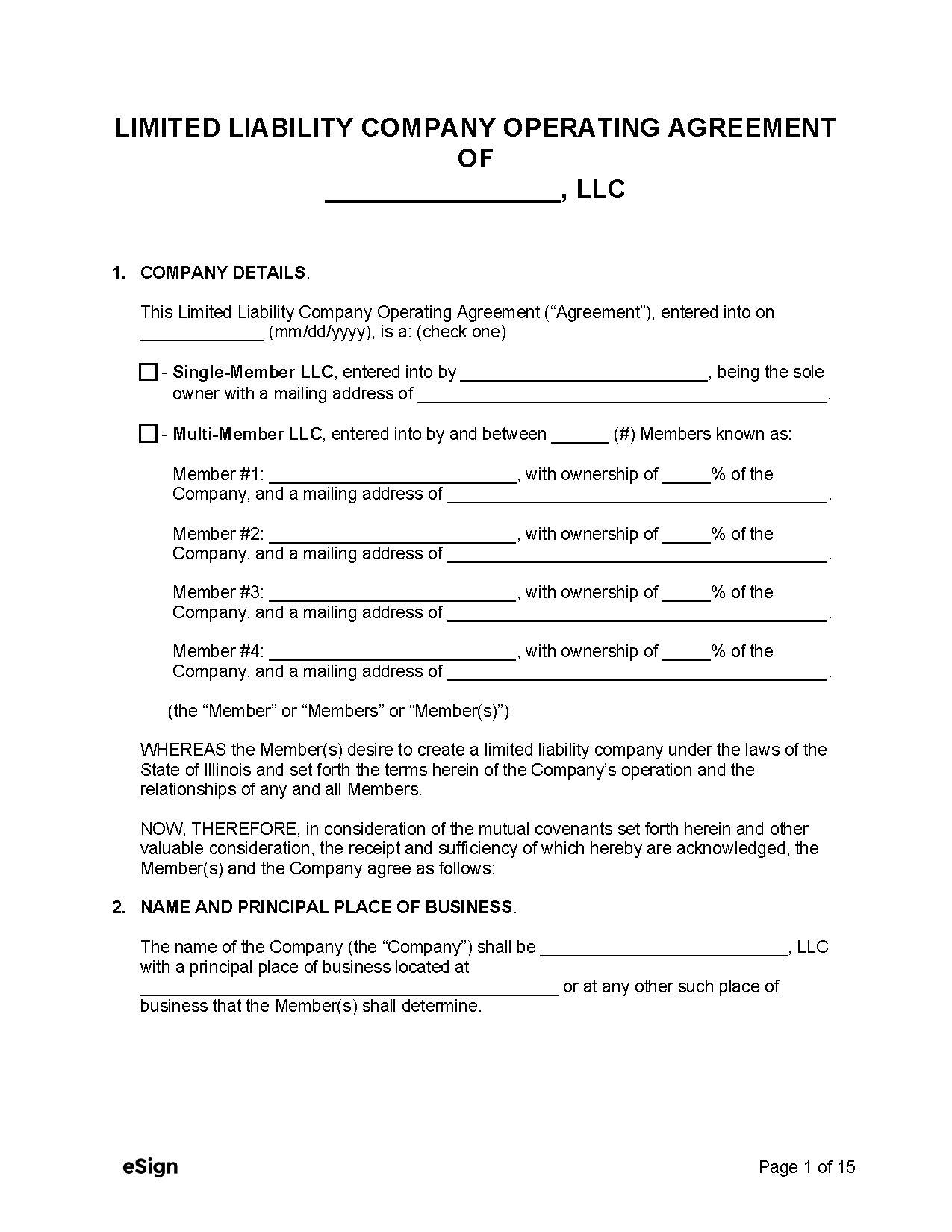

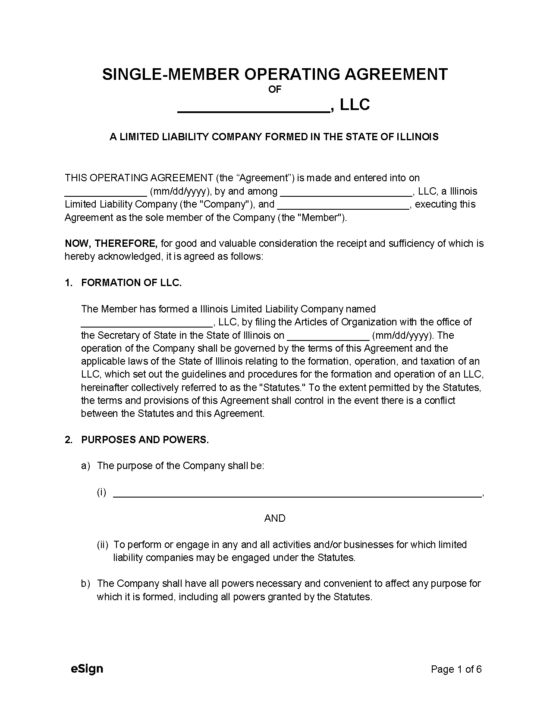

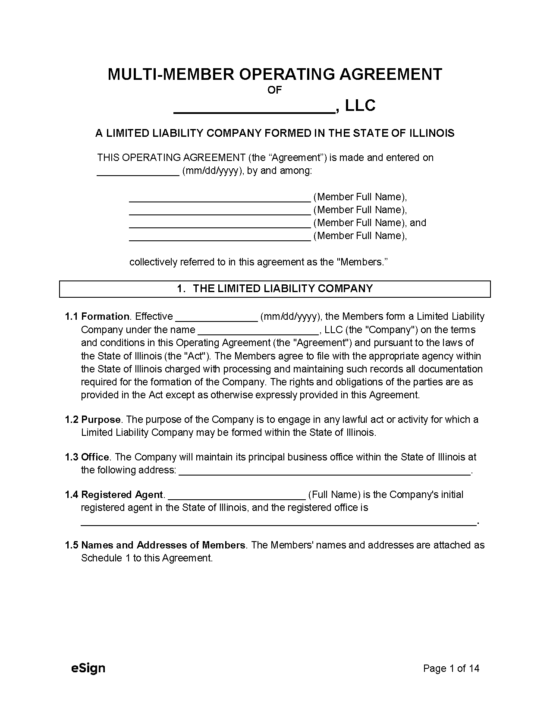

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: 805 ILCS 180

- Definitions: 805 ILCS 180/1-5

- Formation: 805 ILCS 180/5-1

- Naming of LLCs: 805 ILCS 180/1-10

How to File (5 Steps)

- Step 1 – Name the LLC

- Step 2 – Appoint a Registered Agent

- Step 3 – File with the Secretary of State

- Step 4 – Draft an Operating Agreement

- Step 5 – Apply for an EIN

Step 1 – Name the LLC

The first step in forming an LLC is selecting a name that meets the following criteria:

- It is not in use by another entity operating in Idaho;

- It must contain “limited liability company,” “L.L.C.,” “LLC,” or a similar abbreviation; and

- It cannot contain the terms “Corporation,” “Incorporated,” “Limited Partnership,” or any derivatives thereof.

A preliminary check for the availability of a name can be done through the Illinois Secretary of State website, or by contacting their office at 217-524-8008.

If desired, the name may be reserved before filing the Articles of Organization by submitting Form LLC-1.15, which will allow the name to be held for up to ninety (90) days.

The filing fee of $25 can be paid by check made out to the “Secretary of State.” Form and fee must be mailed to the following address:

Secretary of State

Department of Business Services

Limited Liability Division

501 S. Second St., Rm. 351

Springfield, IL 62756

Step 2 – Appoint a Registered Agent

A registered agent is required in order for LLCs to collect documents such as service of processes or tax forms. An individual or other legal entity may be appointed provided they have a physical address in Illinois and, if they are an entity, are authorized to act as an agent. The agent will be appointed by submitting their information when filling the LLCs Articles of Organization.

Step 3 – File with the Secretary of State

The members of an LLC will need to file with the Secretary of State to officially form/register their business and operate in Illinois.

Domestic LLC

Domestic LLCs, brand new entities forming in Illinois, must file the Articles of Organization online or by printing and mailing Form LLC 5.5. A series LLC (an organization comprised of various companies) can be registered via the same website or by mailing the Articles of Organization (Series) (Form LLC 5.5(S)).

Registration for standard LLCs requires a $150 fee, and series LLCs require a $400 filing fee. Mailed applications should include an enclosed check or money order made payable to the Secretary of State and can be sent to the address below.

Foreign LLC

An LLC formed outside of Illinois must file an Application for Admission to Transact Business (Form LLC-45.5) in order to conduct business operations within the state. A foreign series LLC can complete and mail the Application for Admission to Transact Business (Series) (Form LLC-45.5(S)).

The completed application form should be printed and mailed with the filing fee ($150 for regular, $400 for series) enclosed to the address below.

Secretary of State Mailing Address:

Secretary of State

Department of Business Services

Limited Liability Division

501 S. Second St., Rm. 351

Springfield, IL 62756

Step 4 – Draft an Operating Agreement

LLCs may wish to complete an operating agreement to establish their company policies and structure in a clear and precise format. An LLC can be formed without an operating agreement, although it is highly recommended that one be drafted to limit the financial liability of the members and enable the owners to organize the business as they see fit.

Step 5 – Apply for an EIN

All LLCs with multiple members, that plan to hire employees, or that wish to be taxed as a corporation will require an Employer Identification Number (EIN) from the IRS. Applying for an EIN can be done online through the IRS website at no cost.

An Application for Employer Identification Number (Form SS-4) is also available for printed filings. Completed applications may be delivered via the following methods:

- Fax: 855-641-6935

- Mail: Internal Revenue Service Attn: EIN Operation Cincinnati, OH 45999

ResourcesFiling Options: Online or by Mail Costs:

Forms:

Filing Delivery Methods:

Links

|