Is an Operating Agreement Required in Indiana?

No – State law does not require LLCs to adopt an operating agreement. However, creating one is standard practice during the early stages of formation.

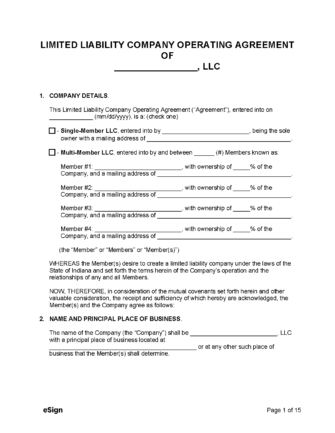

Types (2)

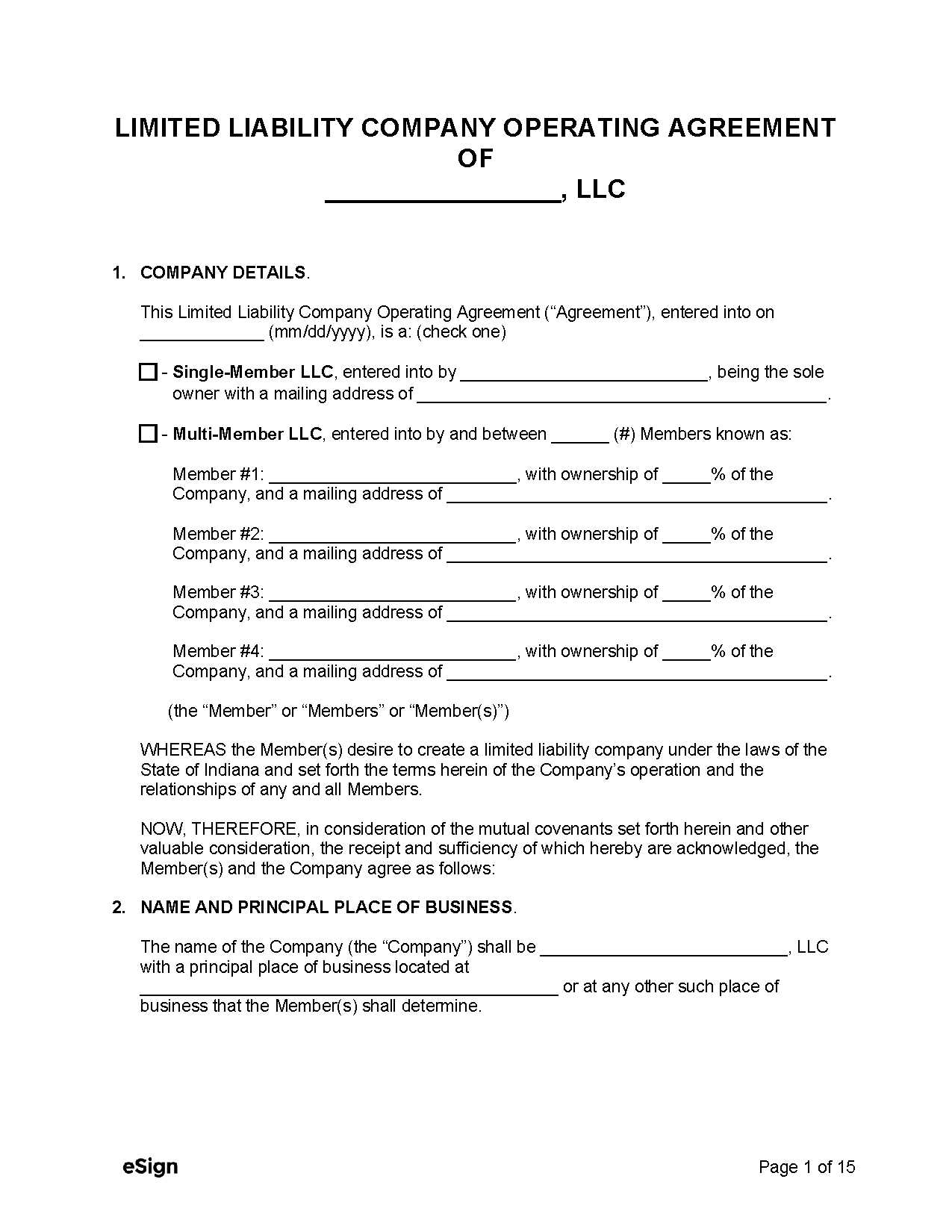

Single-Member LLC Operating Agreement – Designed for limited liability companies owned by a single person. Single-Member LLC Operating Agreement – Designed for limited liability companies owned by a single person.

|

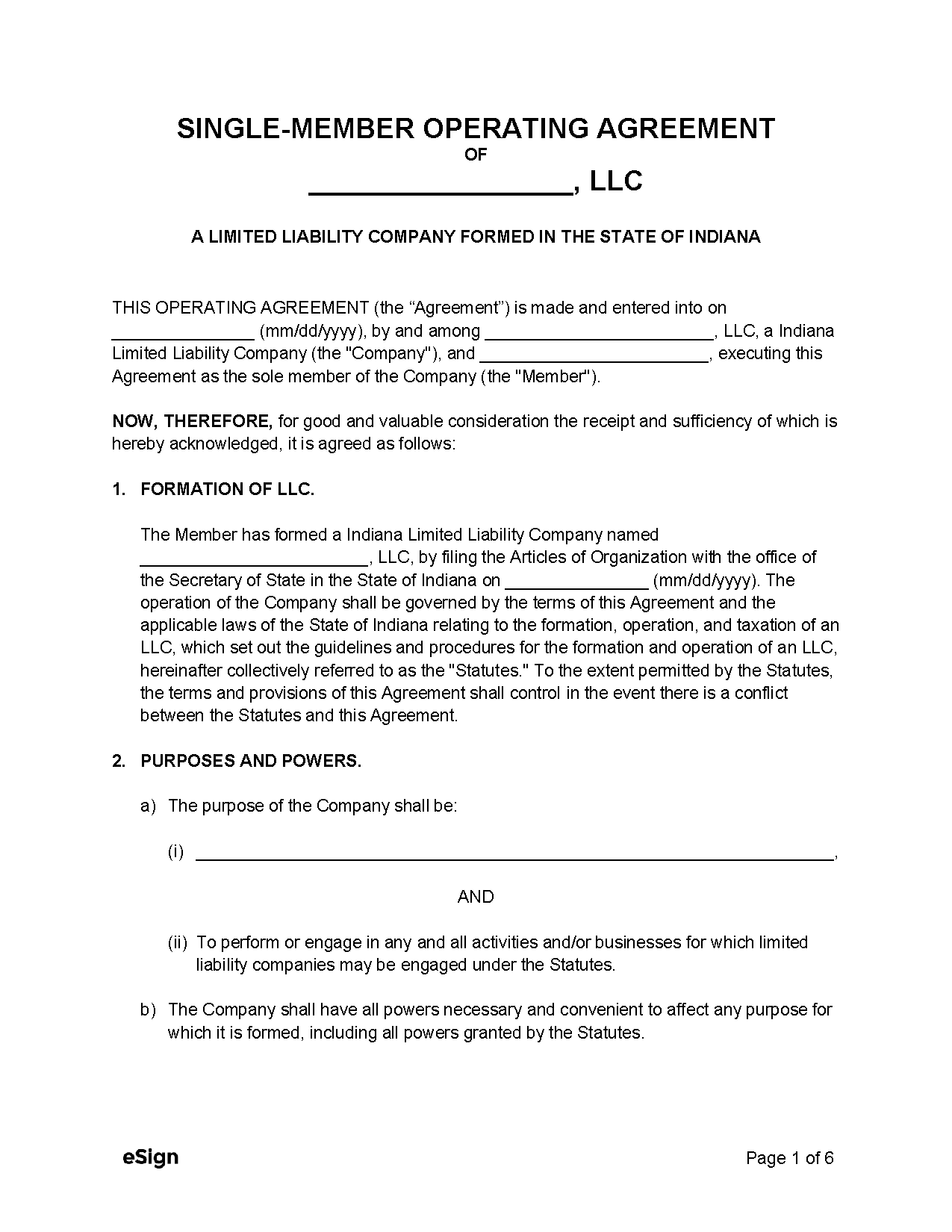

Multi-Member LLC Operating Agreement – To be used by LLCs that divide ownership among two or more members. Multi-Member LLC Operating Agreement – To be used by LLCs that divide ownership among two or more members.

|