LLCs are not obliged to complete the form to be considered a legal entity, although, without an operating agreement, state regulations will determine how the company will operate rather than the owners.

Contents |

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Title 12 (RS 12:1301 – RS 12:1369)

- Definitions: RS 12:1301

- Formation: RS 12:1304

- Naming of LLCs: RS 12:1306

How to File (4 Steps)

- Step 1 – Choosing the LLC’s Name

- Step 2 – Applying for an EIN

- Step 3 – Appointing a Registered Agent

- Step 4 – Submitting the Articles of Organization

- Step 5 – Completing an Operating Agreement

Step 1 – Choosing the LLC’s Name

To meet state requirements, the chosen name of an LLC must be distinct from other legal entities registered in the state, and must have the words “limited liability company” or the abbreviations “L.L.C.” or “L.C.” The Louisiana Business Filings website provides a search engine to check against the names of entities that have already been registered.

The member(s) can reserve an LLC name for a one hundred and twenty (120) day period prior to registration. A name reservation can be applied for on the Louisiana Business Filings website or by delivering the Name Reservation form by mail to the below address. A $25 fee is required for online and mailed applications.

P. O. Box 94125,

Baton Rouge, LA

70804-9125

Step 2 – Applying for an EIN

LLCs must obtain an EIN (Employment Identification Number) if they have multiple members or wish to hire employees. If an LLC owned by an individual does not intend to hire employees for their company, they will only need to obtain an EIN if they choose to file their business taxes as a corporation rather than a sole proprietor.

An EIN may be obtained through the IRS’s website and does not require any fees. Members also have the option of applying for an EIN via mail by delivering Form SS-4 as per the instructions stated here.

Note on Online Filings:

LLCs opting to submit their Articles of Organization to the Secretary of State online (step 4) must obtain an EIN beforehand to complete the application process.

Step 3 – Appointing a Registered Agent

A registered agent is responsible for receiving the LLC’s legal notices, paperwork, and service of process. The appointed agent can be an entity or individual that has a physical street address (not including P.O. boxes) in Louisiana. The agent can be any individual, including members of the LLC, as long as they are over the age of eighteen (18).

Step 4 – Submitting the Articles of Organization

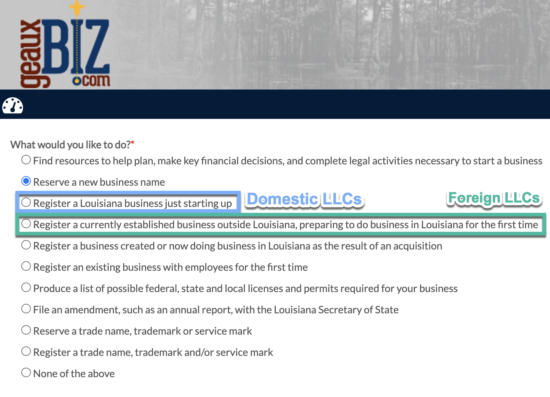

LLCs have the option to submit their registration documents to the Secretary of State either online or by mail. Domestic LLCs must file the Articles of Organization; foreign LLCs must file the Application for Authority to Transact Business. Registration costs $100 for domestic LLCs, and $125 for foreign LLCs.

Online

To register a domestic or foreign LLC online, filers must first create an account with the Louisiana Business Filings online. Once logged in, the user can start their application by selecting the Get Started button and either “Register a Louisiana business…” for domestic applications, or “Register a currently established business outside of Louisiana…” for foreign applications.”

The payment for filing is processed at the end of the application.

For mailed business filing, domestic LLCs will need the Articles of Organization form, and foreign LLCs will require the Application for Authority to Transact Business form along with a Certificate of Good Standing issued by their state. The document should be sent with a check or money order (made payable to “Secretary of State”) to the following address: Commercial Division, P. O. Box 94125, Baton Rouge, LA 70804-9125.

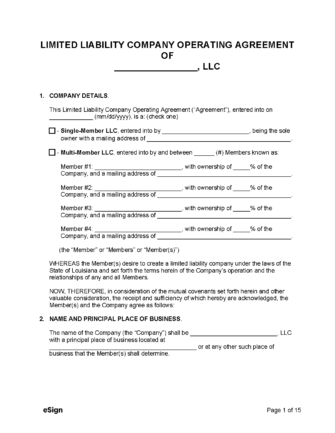

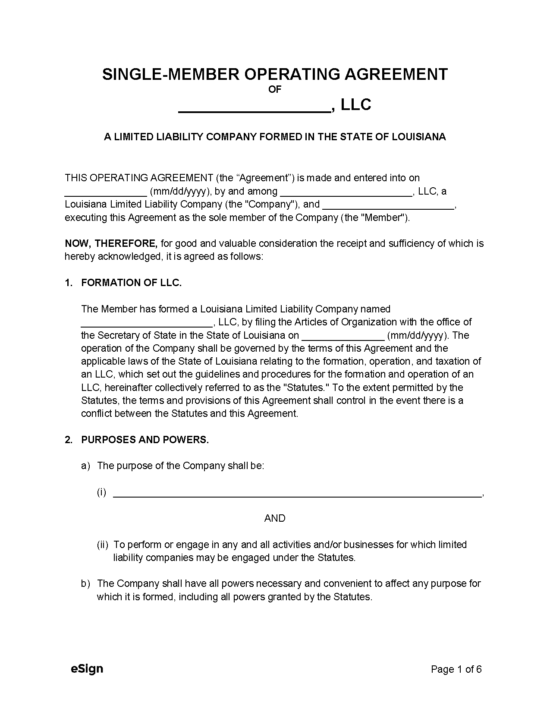

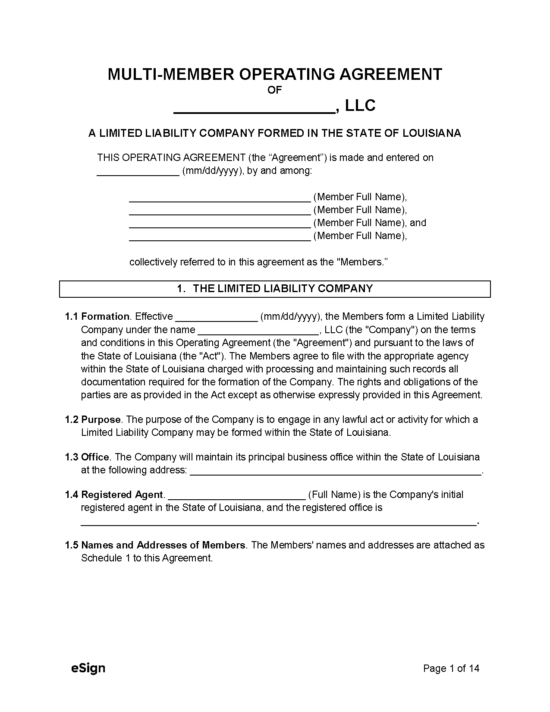

Step 5 – Completing an Operating Agreement

An operating agreement is created during the formation of the LLC to set in place membership/company rules and regulations. While completing an operating agreement is not required, without one, the members may not receive all the benefits of the LLC structure.

ResourcesFiling Options: Online or by Mail Costs:

Forms:

Links:

|