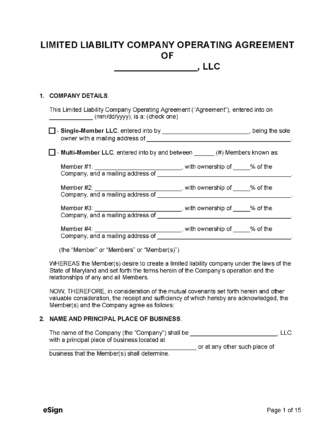

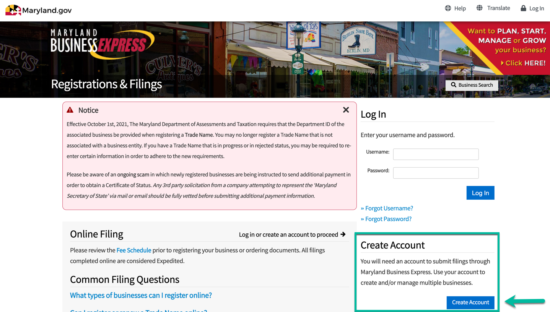

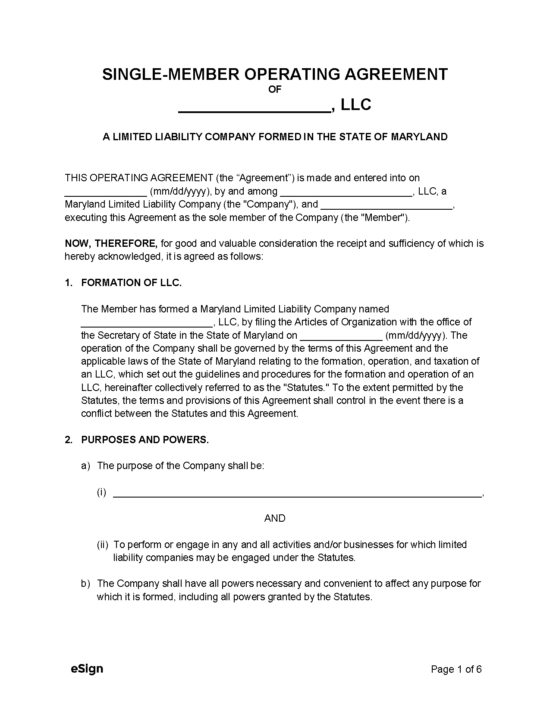

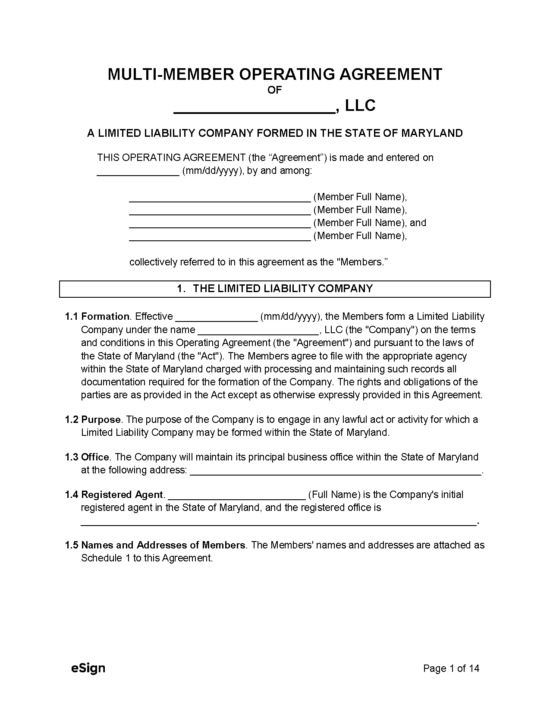

A Maryland LLC operating agreement is drafted by the owners (members) of a limited liability company to relay the entity’s management, membership, and financial structure. The document outlines the inner workings of the company, creating a definitive blueprint of how the business will operate. Executing an operating agreement allows members to ensure the entity will be taxed accordingly and to provide a buffer against financial and legal liability.

Contents |

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Title 4A – Limited Liability Company Act

- Definitions: § 4A-101

- Formation: § 4A-202

- Naming of LLCs: § 1-502

How to File (6 Steps)

- Step 1 – Select the LLC Name

- Step 2 – Appoint an Agent

- Step 3 – Register with the Department of Assessments and Taxation

- Step 4 – Create an LLC Operating Agreement

- Step 5 – Apply for an EIN

- Step 6 – File Annual Report

Step 1 – Select the LLC Name

To register an LLC, members thereof must ensure it has a unique name that can be distinguished from other entities already registered in the state. The Maryland Business Entity Search can be used to assist companies in finding an available name. To meet state naming requirements, the name must contain one of the following: “limited liability company,” “L.L.C.,” “LLC,” “L.C.,” or “LC.”

To prevent other companies from acquiring a desired name, LLCs can file the Corporate Name Reservation Application to reserve a name’s exclusive rights for a thirty (30) day period. The form must be mailed with a $25 fee or $45 for expedited service to:

301 W. Preston Street, Room 801

Step 2 – Appoint an Agent

A registered agent must be appointed to receive legal paperwork and notices on the company’s behalf. The selected agent can be an individual, a member of the company, or a domestic or foreign entity, provided that they have been authorized to conduct business in the state. Agents are required to have a physical address in Maine, which cannot be a P.O. box address.

Step 3 – Register with the Department of Assessments and Taxation

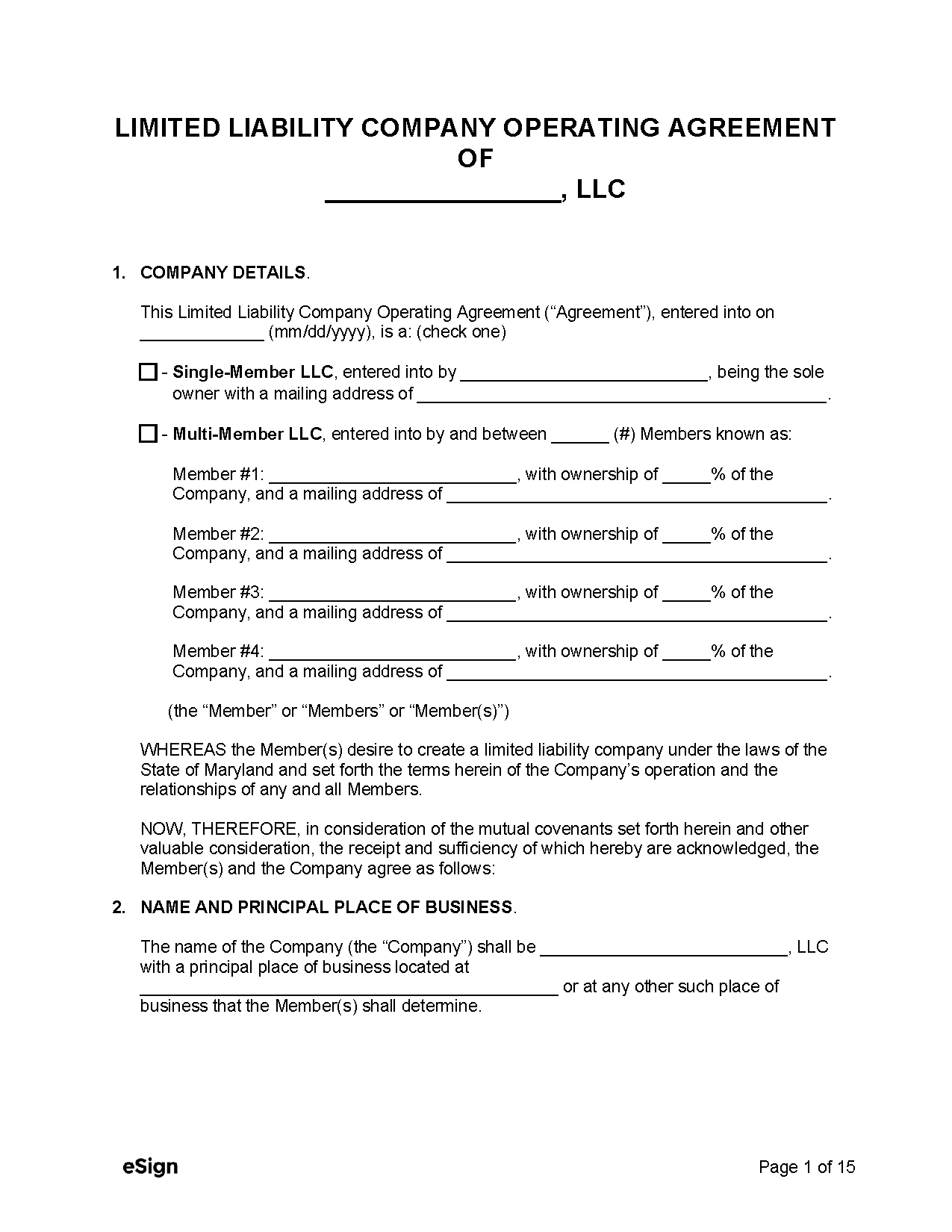

Members of both domestic and foreign LLCs can register their business with the Department of Assessments and Taxation via Maryland’s Business Express website or by mailing a printed application.

Online

- Create an account on the Business Express website.

- Select the Start a New Filing option, then Register a Business in the drop-down menu.

- On the following page, select “Maryland Limited Liability Company” as the business type if the company is registering as a domestic LLC, or “Foreign Limited Liability Company” if the company is a foreign LLC.

- Complete the information as required in the following steps.

- Submit the payment via credit card or Paypal. Applications for domestic and foreign LLCs require a $150 fee ($100 for filing and a non-optional $50 expedited processing fee) and an additional flat fee of $3 or 3% of the filing cost.

- Complete the Articles of Organization (for domestic LLCs) or the Foreign Limited Liability Company Registration (for foreign LLCs).

- Attach the filing fee of $100 (for both domestic or foreign) paid via check made payable to “State Department of Assessments and Taxation”.

- Mail the documents to: Department of Assessments and Taxation, 301 W. Preston Street Baltimore, MD 21201-2392

A Note on Filings:

Expedited service for mailed filings costs an additional $50. Online applications have a non-optional expedited service fee of $50 which can be upgraded to a rush processing service for $425 in addition to the base filing fee.

Step 4 – Create an LLC Operating Agreement

An operating agreement will allow the LLC to set forth the regulations that will govern the company’s structure, policies, and methods of operation. This is an optional form, but without it, the LLC’s inner organization will be governed by standardized state guidelines instead of its own policies optimized to the members’ needs.

Step 5 – Apply for an EIN

Obtaining an EIN (Employer Identification Number) is in most cases required to be seen as legitimate in the eyes of the IRS; all multi-member LLCs will require one, and most single-member LLCs will too. The IRS website can be used to verify if an EIN will be necessary.

An EIN can be obtained online or by mailing Form SS-4 to: Internal Revenue Service Attn: EIN Operation Cincinnati, OH 45999

Obtaining an EIN does not require any payment. Additional instructions and application methods can be found here.

Step 6 – File Annual Report

All LLCs must file an annual report online or via the Annual Report (Form 1) document. The filing fees can range from $0 to $300 depending on the business type, with an additional surcharge of $3 or 3% of the filing cost. Annual reports are due on April 15th every year.

ResourcesFiling Options: Online or by Mail Costs:

Forms:

Links/Information

|