Although not legally required by the state of Michigan, an operating agreement is advisable as it allows the owners to structure their company as they see fit; without it, state law will govern the LLC business practices.

Contents |

Types (2)

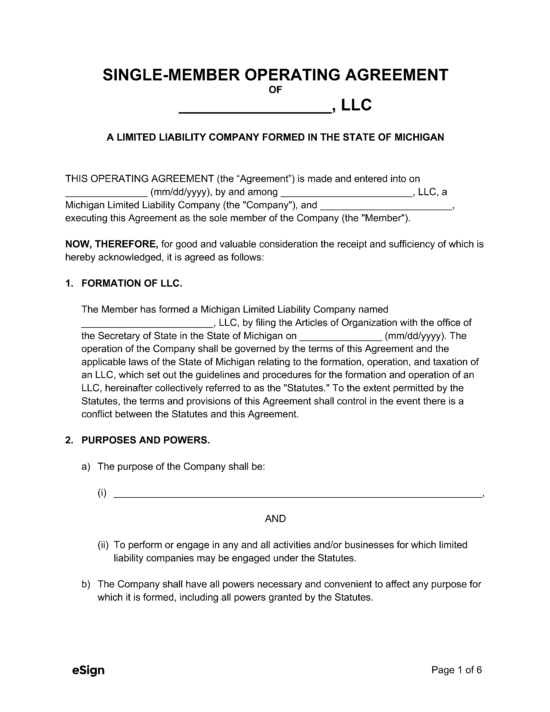

Download: PDF, Word (.docx), OpenDocument

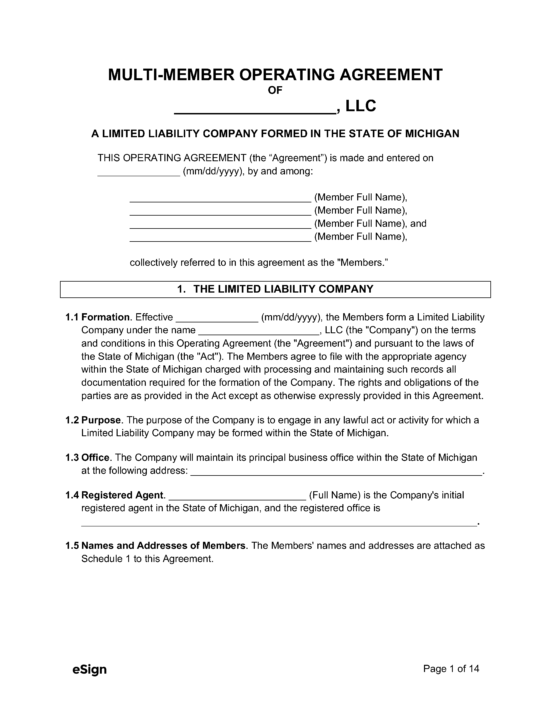

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: § 450.4101 to § 450.5200

- Definitions: § 450.4102

- Formation: § 450.4202

- Naming of LLCs: § 450.4204

How to File (6 Steps)

- Step 1 – Choose a Business Name

- Step 2 – Select a Registered Agent

- Step 3 – Filing Articles of Organization

- Step 4 – Create an Operating Agreement

- Step 5 – Obtain an EIN

- Step 6 – File Annual Statement

Step 1 – Choose a Business Name

Every LLC is required to register a name that is unique and is not registered to another company. Filers may use the Department of Licensing and Regulatory Affairs (LARA) Corporations Online Filing System to verify that their chosen name is unique.

Once a unique name has been chosen, the name may be reserved for up to six (6) months, either online or by mail.

- Online: Go to the LARA Application for Reservation of Name website and pay the $10 fee by credit card.

- Mail: Fill out the Application for Reservation of Name Form (Domestic | Foreign) with a $25 filing fee to the below address

Michigan Department of Licensing and Regulatory Affairs

Corporations, Securities & Commercial Licensing Bureau

Corporations Division

P.O. Box 30054

Lansing, MI 48909

Note on Expedited Applications:

LARA allows expedited filings of name reservation applications for the following fees:

- 24-Hour Review: $50

- Same-Day Review: $100

- 2-Hour Review: $500

- 1-Hour Review: $1000

Mail-in applications that wish for an expedited filing must also include an Expedited Service Request Form.

Step 2 – Select a Registered Agent

A registered agent must be appointed to receive legal documents, notices, and demands on behalf of the LLC. The selected agent must be one of the following:

- A legal Michigan resident over eighteen (18) years old;

- A Michigan corporation;

- A Michigan LLC;

- A foreign LLC authorized to do business in the state; or

- A foreign corporation authorized to do business in the state.

Step 3 – Filing Articles of Organization

Filing Articles of Organization must be filed with the Secretary of State for an LLC to operate in the state. The form can be filled out digitally and submitted online, or filed by mail.

Method 1 – File Online

Domestic companies should go to the LARA website select the Articles of Organization. Fill out the form and choose the expedited service time (if any), and then click the review button. Follow the prompts on the following pages to pay the filing fee ($50) and submit the file to the Secretary of State.

Foreign companies may file online by completing the Application for Certificate of Authority to Transact Business in Michigan. Follow the prompts on each page and submit the filing fee plus any additional fees to expedite the process and submit to the Secretary of State.

Method 2 – Mail or In-Person

Domestic companies that wish to apply by mail may download and fill out the Articles of Organization.

Note on Professional Services:

If the LLC provides services by a dentist, osteopathic physician, surgeon, physician, surgeon, doctor of divinity or clergy, or an attorney-at-law, then use form BCS/CD 701 in lieu of the Articles of Organization Form.

Foreign entities may download and complete out the Application for Certificate of Authority.

Both domestic and foreign entities can file by mail at:

Michigan Department of Licensing and Regulatory Affairs

Corporation, Securities & Commercial Licensing Bureau,

Corporations Division,

P.O. Box 30054, Lansing, MI 48909

Domestic and foreign LLCs wishing to apply in person may do so at:

2407 N Grand River Ave, Lansing, MI 48906

In either case, a $50 non-refundable fee is required and should be made out to the State of Michigan and include the company name and identification number.

Step 4 – Create an Operating Agreement

The state of Michigan does not require an operating agreement to be created; however, it is recommended as it allows for the company’s owners to limit their personal liability and have more control over the governance of their company. The operating agreement may be drafted and executed at any time before, during, or after the filing of the articles of organization.

Step 5 – Obtain an EIN

Almost every LLC will require an Employer Identification Number (EIN). It is necessary for every LLC with two or more members or if the LLC wishes to pay employees. An EIN may be obtained via the IRS Online Application or by submitting Form SS-4 by mail.

Step 6 – File Annual Statement

If an LLC is formed before October 1st, it must file an annual statement with the Department of Licensing and Regulatory Affairs by February 15th of the year following formation. If the LLC was formed October 1st or later, it need not file a statement by February 15th, and will submit its annual statement by February 15th of the following year. The Department will send a document to the registered office of the LLC no later than ninety (90) days before the statement due date.

The report can be filed online or by mail for a $25 filing fee.

ResourcesFiling Options: Online or by Mail Costs:

Forms:

Links:

|