Contents |

Types (2)

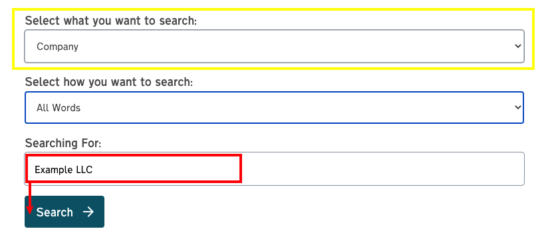

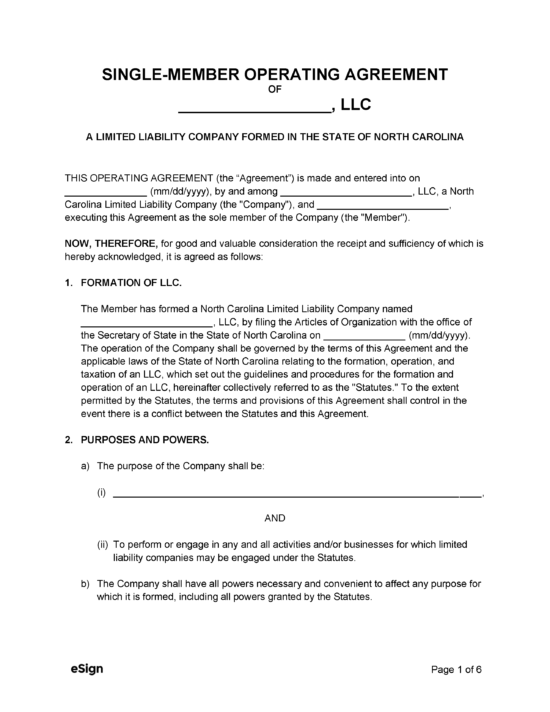

Single-Member LLC Operating Agreement – A simplified operating agreement to be used only by companies with one (1) member.

Single-Member LLC Operating Agreement – A simplified operating agreement to be used only by companies with one (1) member.

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Chapter 57D

- Definitions: § 57D-1-03

- Formation: § 57D-2-20

- Naming of LLCs: § 55D-20(a)(2)

How to File (5 Steps)

- Step 1 – Register Company Name

- Step 2 – File the Articles of Organization

- Step 3 – Execute Operating Agreement

- Step 4 – Register Company with the IRS and Department of Revenue

- Step 5 – File Annual Report

Step 1 – Reserve Company Name

To form an LLC in North Carolina, the company must choose a name that hasn’t already been registered in the state by another LLC. The name is required to include the words “limited liability company,” the abbreviation “LLC,” or “ltd. liability co.,” “limited liability co.,” or “ltd. liability company.”

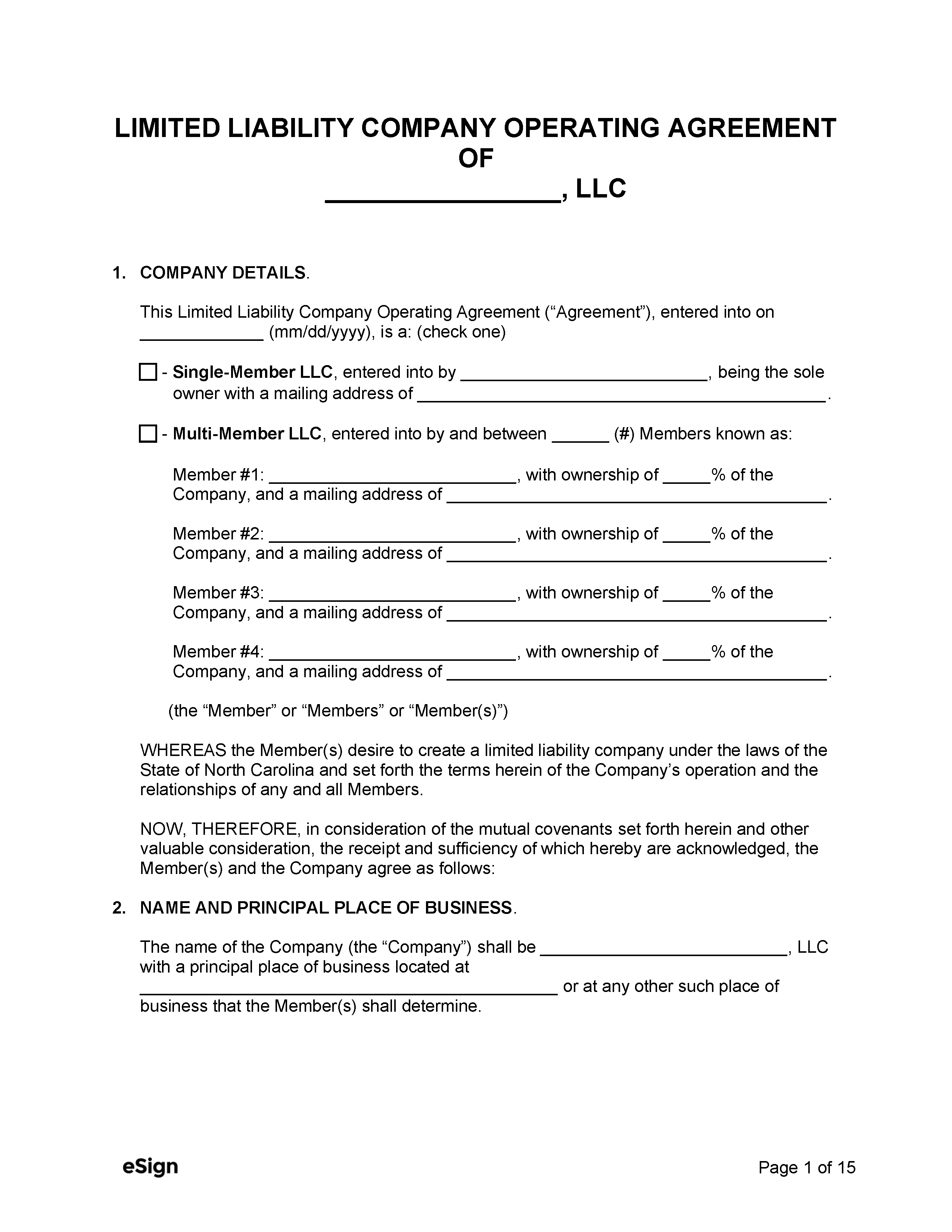

To find out if a name has already been taken, navigate to the Secretary of the State business search portal, select Company, enter the chosen name in the search field, and click Search.

Once a unique name has been selected, it can be reserved for a one hundred twenty (120) day period by mailing an Application to Reserve a Business Entity Name to the Secretary of State at the below address (filing fee: $30).

NC Secretary of State

Corporations Division

Post Office Box 29525

Raleigh, NC 27626-0525

Register an Assumed Name

LLCs are permitted under state law to use an “assumed name” that is different from their registered name. Companies may wish to use different name to differentiate their divisions or products, for marketing reasons, or to represent themselves in different regions. To adopt another name for business operations, the company will need to file a completed Assumed Business Name Certificate with the county register of deeds in the county where the LLC’s registered office is located. The filing fee is $26.

Step 2 – File the Articles of Organization

The forms and filing fees required to create an LLC will depend on the type of LLC that is being created. If the LLC is based in North Carolina it is considered a “domestic LLC.” If the LLC was founded in another state, it must file as a “foreign LLC.”

Domestic LLC:

- Required Form:

- Articles of Organization

- Filing Fee: $125

Foreign LLC:

- Required Forms:

- Certificate of Authority

- Certificate of Existence (issued by the state in which LLC is based)

- Filing Fee: $250

File Online

- Navigate to the Secretary of the State Business Registration webpage.

- Click Register Your Business ONLINE! (see below)

- Create user account and log in.

- Complete Articles of Organization (domestic LLC) or Certificate of Authority (foreign LLC).

- Submit Certificate of Existence (foreign LLCs only)

- Pay filing fee via credit card:

- Domestic: $125

- Foreign: $250

On the next page, the user will be prompted to sign in or create a new account. After creating an account and logging in, the Articles of Organization can be accessed, completed, and filed online.

File By Mail / In Person

- Download the Articles of Organization (Domestic LLC) or Certificate of Authority (Foreign LLC) Secretary of the State Business Forms webpage.

- Fill out and sign the forms

- Mail the completed form to the address below along with the requisite filing fee (Foreign LLCs must attach a Certificate of Existence).

NC Secretary of State

Business Registration Division

PO Box 29622,

Raleigh, NC 27626-0622

Alternatively, the documents can be filed in person by hand-delivering them at the following address between the hours of 8am and 5pm, Monday through Friday (excluding holidays): 2 South Salisbury Street, Raleigh, NC 27601

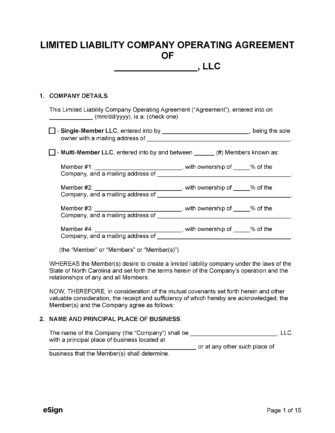

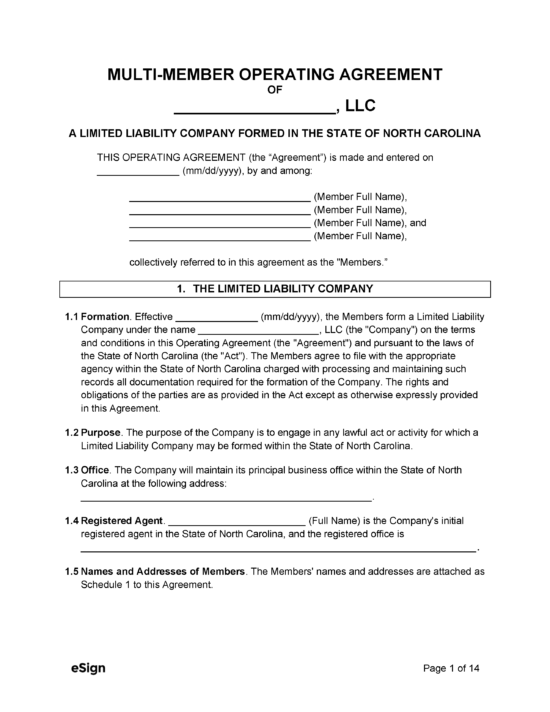

Step 3 – Execute Operating Agreement

State law doesn’t require LLCs to execute an operating agreement. However, drafting one is strongly advised, as it formalizes the company’s operations and regulations agreed to by the members and can protect them from liability.

Step 4 – Register with IRS and NCDOR

The majority of LLCs will need to be registered with the North Carolina Department of Revenue (NCDOR) and IRS to operate legally. Registration with the NCDOR can be accomplished at a taxpayer service center and state taxes can be filed online.

Companies are required to apply for an Employer ID Number (EIN) that identifies them for federal tax purposes. An EIN is not required if the company only has one member/owner. LLCs can apply for an EIN online or by completing Application for EIN (Form SS-4) and filing it by mail at the following address:

Internal Revenue Service

Attn: EIN International Operation

Cincinnati, OH 45999

Newly founded LLCs should hire a certified accountant to ensure that the company is properly registered for state and federal taxation.

Step 5 – File Annual Report

North Carolina LLCs are required to file an Annual Report on the fifteenth (15th) of April of each year that the company is in operation. The filing fee is $200 for filings by mail and $202 online.

ResourcesFiling Options: Online By Mail: NC Secretary of State In Person: 2 South Salisbury Street Costs:

Forms:

Links:

|