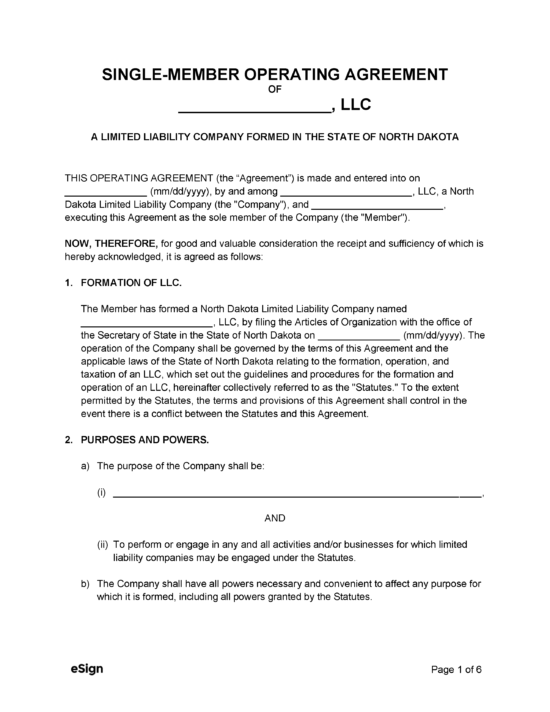

Although state law doesn’t require companies to create operating agreements, they are extremely important in protecting the members from liability and internal disagreements.

Contents |

Types (2)

Download: PDF, Word (.docx), OpenDocument

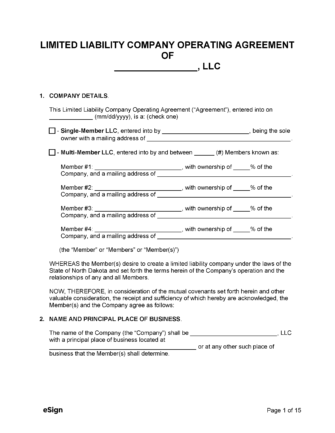

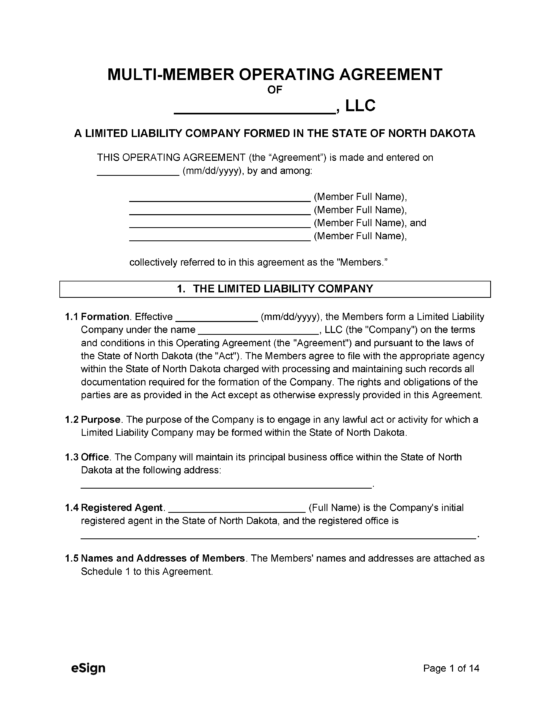

Multi-Member LLC Operating Agreement

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Chapter 10-32.1

- Definitions: § 10-32.1-02

- Formation: § 10-32.1-20

- Naming of LLCs: § 10-32.1-11

How to File (5 Steps)

- Step 1 – Reserve Name

- Step 2 – Select Registered Agent

- Step 3 – File Articles of Organization

- Step 4 – Create Operating Agreement (Optional)

- Step 5 – File Annual Report

Step 1 – Select Business Name

To create an LLC in North Dakota, the company must select a business name that is not already registered in the state. To verify if a name is already in use, it can be entered into the “Search by name or system ID” field on the Business Search webpage to search for any matches. If an exact match of the name is already taken, another one will need to be tried.

Companies have the option of reserving a name for twelve (12) months by filing a Reserved Name Application with the North Dakota Secretary of State for a $10 fee.

Step 2 – Select Registered Agent

State law requires that companies appoint a Registered Agent to receive legal process on their behalf once the LLC has been created. The agent must be one of the following:

- A resident of in North Dakota; or

- A domestic corporation or LLC that is registered with the North Dakota Secretary of State and has a registered office in the state; or

- A foreign corporation or LLC that is registered with the North Dakota Secretary of State and has a registered office in the state.

Step 3 – File Articles of Organization

LLCs must be registered with the Secretary of State. The exact forms that a company will need to file to create an LLC will depend on the type and nature of the business.

Domestic LLCs

New companies forming in North Dakota will be required to complete and file the Articles of Organization with the Secretary of State and pay the $135 filing fee.

Foreign LLCs

If the company is already registered as an LLC in another state, they will need to file the Certificate of Authority Application and a Certificate of Existence (or other equivalent document) that was issued by their state within ninety (90) days of the application filing date. The filing fee is $135.

Other LLCs

- Professional LLC – Can only be formed by professionals who are licensed by the state to practise their profession. For example lawyers, architects, and medical practitioners.

- Farm/Ranch LLC – Must be engaged in farming, which is defined as: cultivating land for the production of agricultural crops or livestock, raising or producing livestock and livestock products, or producing fruit/horticultural products.

File Online

The Articles of Organization or Certificate of Authority Application must be filed online by carrying out the following:

- Navigate to the FirstStop business forms webpage.

- Click the appropriate link:

- Business Limited Liability Company Articles of Organization

- Professional Limited Liability Company Articles of Organization

- Foreign Business Limited Liability Company Certificate of Authority Application

- Foreign Professional Limited Liability Company Certificate of Authority Application

- Farm/Ranch Limited Liability Company Articles of Organization and Initial Farm Report

- Out-of-State Farm/Ranch Limited Liability Company Certificate of Authority Application

- Click File Online.

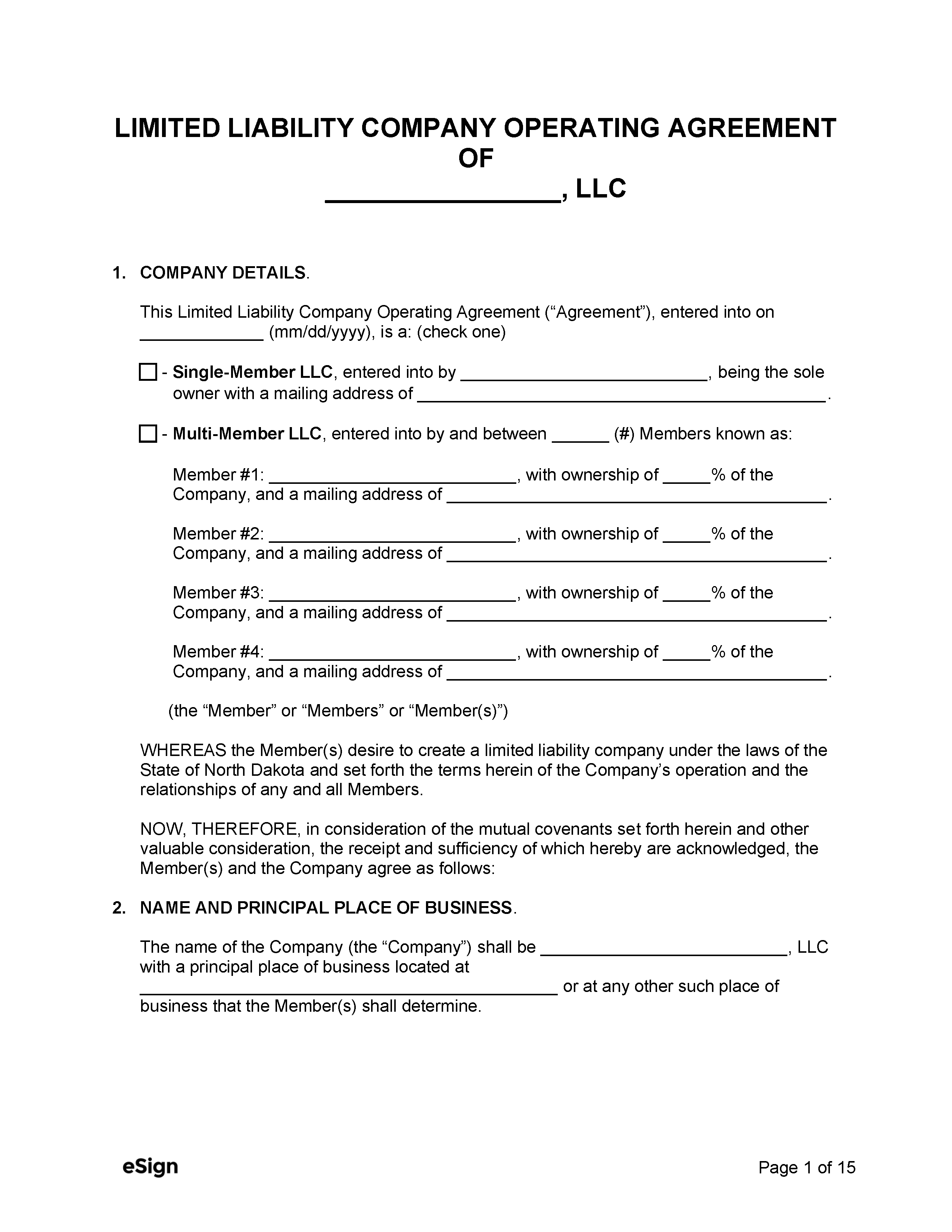

- Log in, or register by clicking Business Account (see image below).

- Follow the prompts to complete the registration form.

- Pay the $135 filing fee

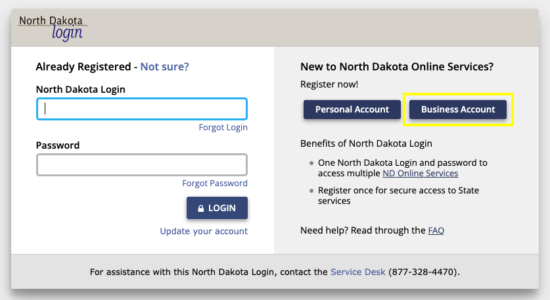

Step 4 – Create Operating Agreement (Optional)

Although it isn’t legally required, creating an operating agreement for a newly founded LLC will be essential in laying out the legal and financial framework of the company, including its ownership, management, rules, and regulations.

Step 5 – File Annual Report

In North Dakota, LLCs are required to file an annual report on November 15th of each year. The first report is due the year after the LLC is created.

The report must be filed on the FirstStop business portal along with payment of a $50 filing fee.

ResourcesFiling Options: Online Costs:

Forms:

Links:

|