Is an Operating Agreement Required?

No – However, in the absence of an operating agreement, NJ state laws will govern the LLC’s management, which might not be ideal or beneficial in every case.

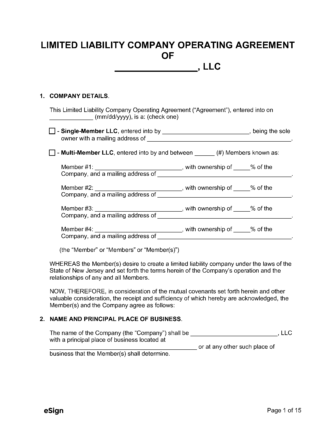

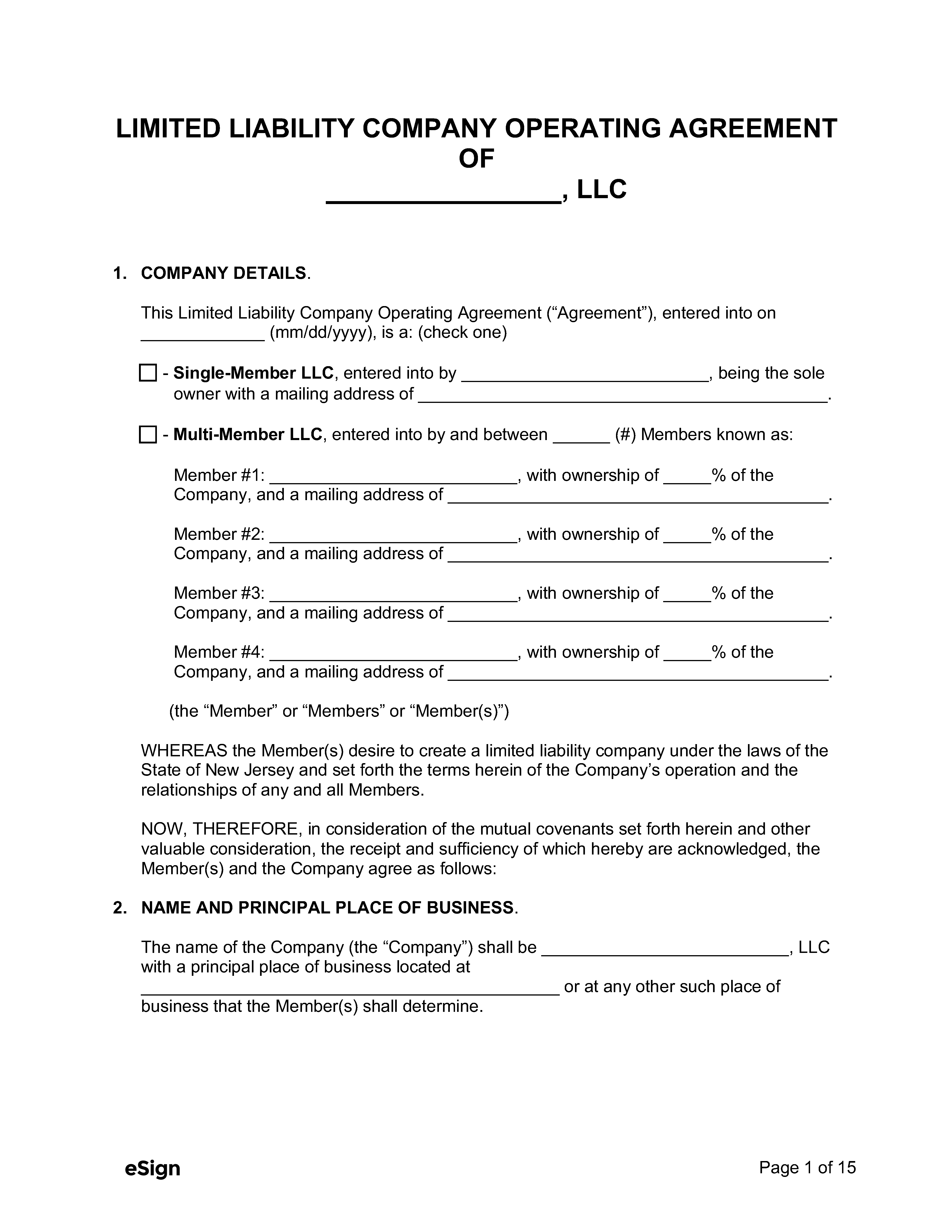

Types (2)

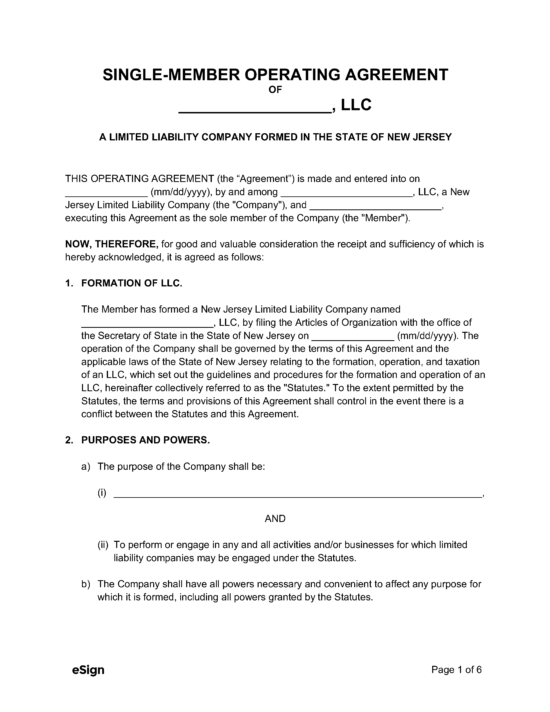

Single-Member LLC Operating Agreement – LLCs with only one owner should use this document. Single-Member LLC Operating Agreement – LLCs with only one owner should use this document.

|

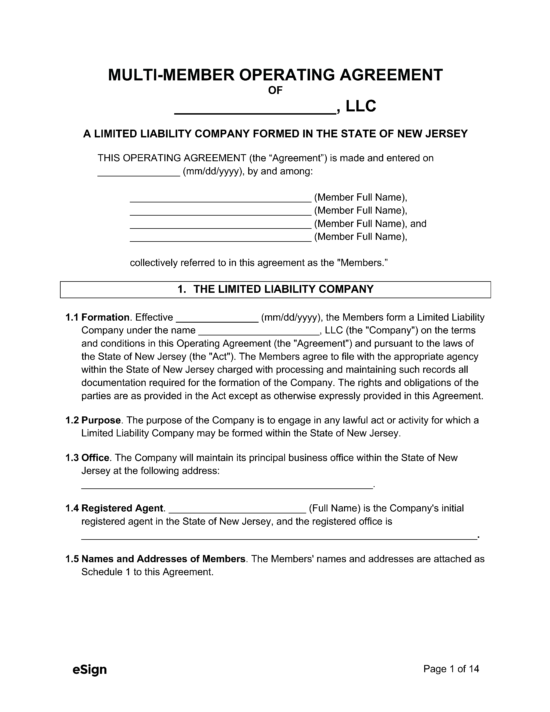

Multi-Member LLC Operating Agreement – LLCs with two or more owners should use this operating agreement. Multi-Member LLC Operating Agreement – LLCs with two or more owners should use this operating agreement.

|