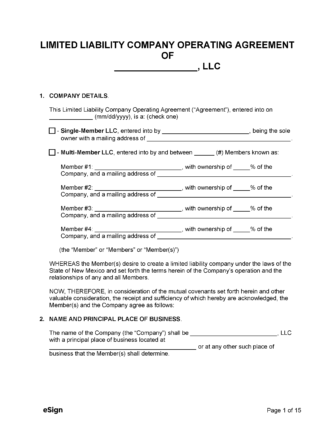

Is an Operating Agreement Required?

No – LLCs aren’t legally required to create an operating agreement. Nevertheless, it is in the best interest of the owners to execute one to ensure the company is structured to suit its needs.

Types (2)

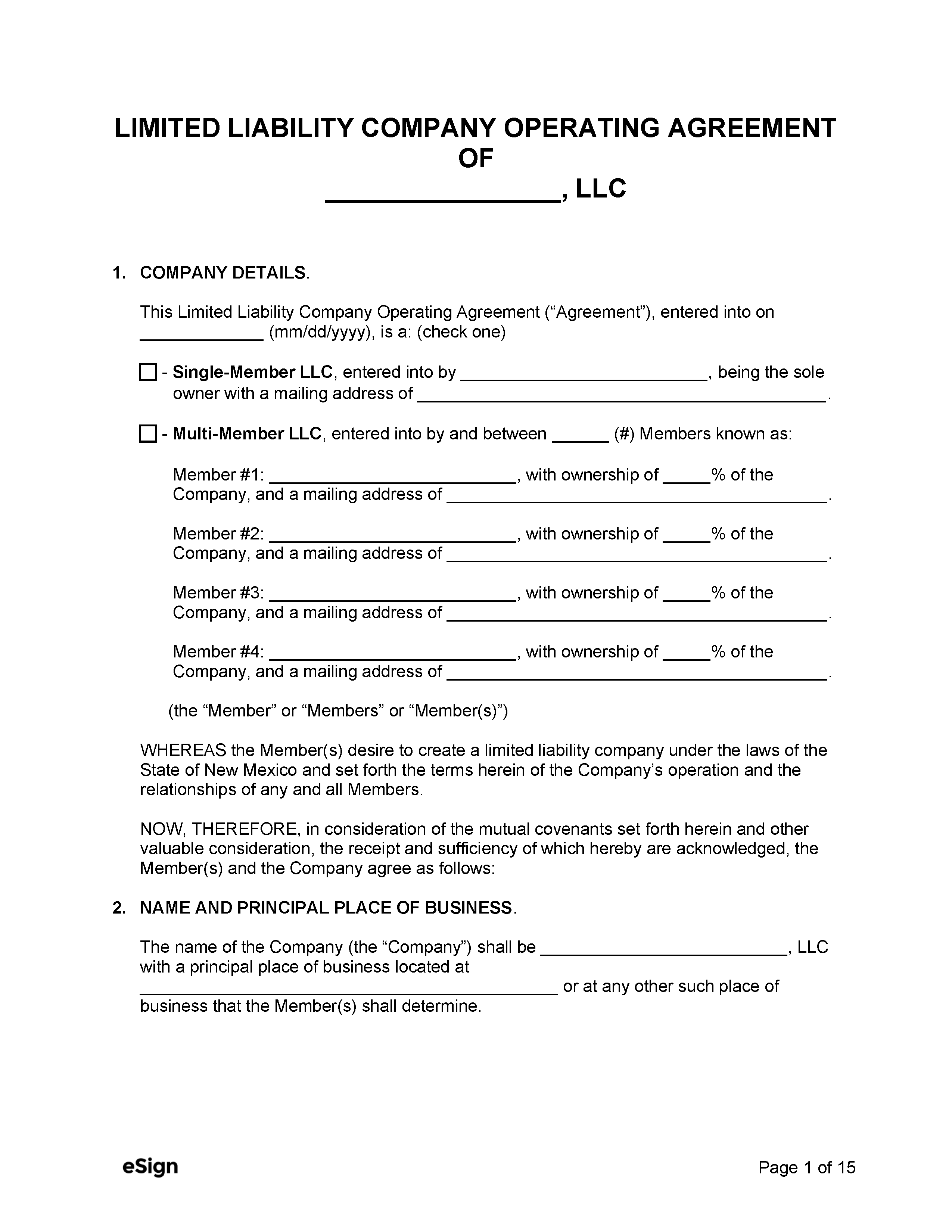

Single-Member LLC Operating Agreement – Used for LLCs that have one sole owner. Single-Member LLC Operating Agreement – Used for LLCs that have one sole owner.

|

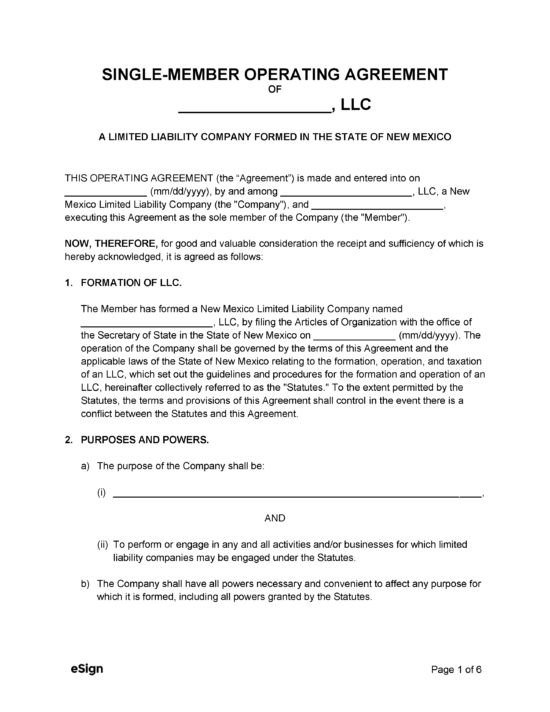

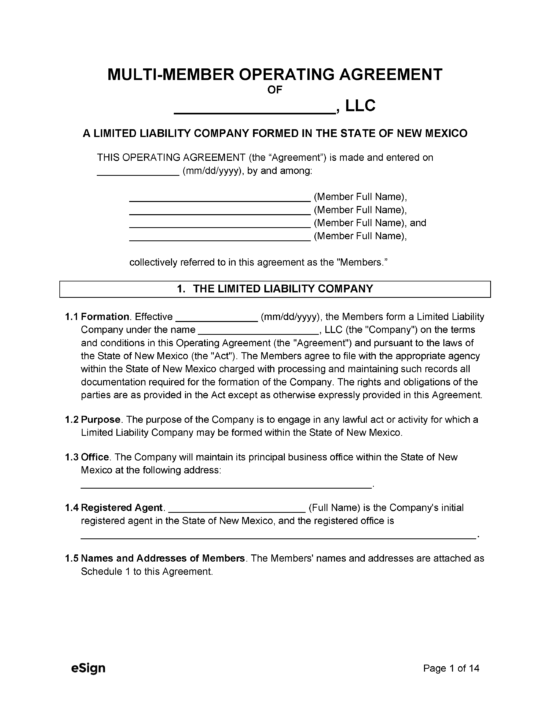

Multi-Member LLC Operating Agreement – Details the rules and functions of an LLC with two or more members. Multi-Member LLC Operating Agreement – Details the rules and functions of an LLC with two or more members.

|