In New Mexico, LLCs aren’t legally required to create an operating agreement or file one with the Secretary of State. Nevertheless, it is in the best interest of the company’s owners to execute an operating agreement that establishes a logistical, financial, and ownership structure that they all agree upon.

Contents |

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Chapter 53, Article 19: Limited Liability Companies

- Definitions: § 53-19-2

- Formation: § 53-19-7

- Naming of LLCs: § 53-19-3 and § 53-19-4

How to File (5 Steps)

- Step 1 – Select a Business Name

- Step 2 – Designate Registered Office and Agent

- Step 3 – Register Limited Liability Company (LLC)

- Step 4 – Create Operating Agreement

- Step 5 – Apply for Employer Identification Number (EIN)

Step 1 – Select a Business Name

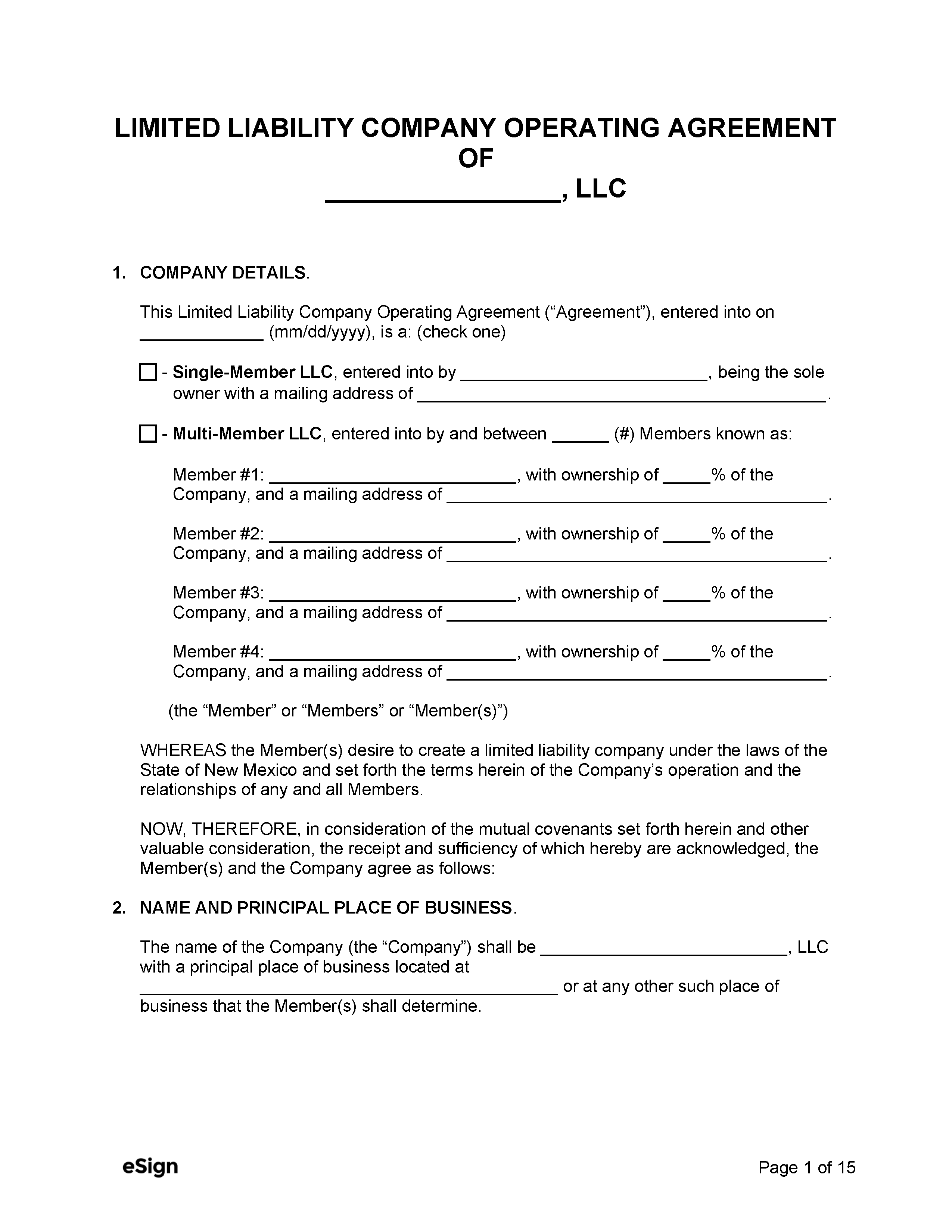

Before a limited liability company (LLC) can be registered, the founders must create and designate a unique business name. New Mexico law requires that the name include the words “limited liability company” or “limited company” (may be abbreviated as “LLC” or “LC,” and the words “limited” and “company” may be abbreviated as “ltd.” and “co.”).

After selecting a name, it can be verified by searching for an exact match in the Business Search portal provided by the Secretary of State. If the name is already in use, another one must be found.

Once a unique business name has been chosen, the company can reserve it for a 120-day period by completing an LLC name reservation form and filing it with the Secretary of State for a $20 fee (names can also be reserved online).

- Application for Reservation of a Domestic Limited Liability Company Name

- Application for Reservation of a Foreign Limited Liability Company Name

If the company wishes to apply for registration immediately or doesn’t wish to reserve a business name before filing, there is no requirement for them to file the name reservation form.

Step 2 – Designate Registered Office and Agent

Both foreign and domestic LLCs are legally required to select and register an office and agent for the company (§ 53-19-5). The designated agent will be authorized to receive service of process and other legal documents on the company’s behalf.

The agent must be either an individual who is a resident of New Mexico or a domestic/foreign business (LLC, corporation, partnership) with a place of business in the state that is the same as the registered office. Before the company files a Foreign Application for Registration, the agent will need to sign a Statement of Acceptance of Appointment.

Step 3 – Register Limited Liability Company (LLC)

Domestic LLC

New LLCs must register with the Secretary of State online as follows:

- Register an account with the Secretary of State online division.

- Complete the online Articles of Organization.

- Upload the Statement of Acceptance of Appointment (signed by the agent).

- Pay the $50 filing fee (credit card required).

Foreign LLC

Any LLC that is already registered in another state and expanding its operations into New Mexico will need to follow the below steps to file by mail (cannot file online).

- Obtain a Certificate of Good Standing from the LLC’s state of registration (must be issued within thirty (30) days of the filing date).

- Complete the Statement of Acceptance of Appointment (signed by the agent).

- Download and complete the Foreign LLC Application for Registration.

- Mail the completed documents and $100 filing fee (check or money order made out to “New Mexico Secretary of State”) to the below address.

New Mexico Secretary of State

Business Services Division

325 Don Gaspar, Suite 300

Santa Fe, NM 87501

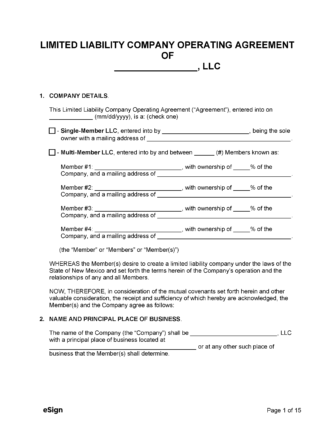

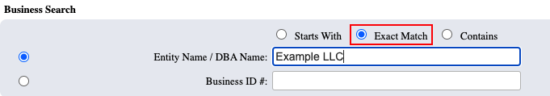

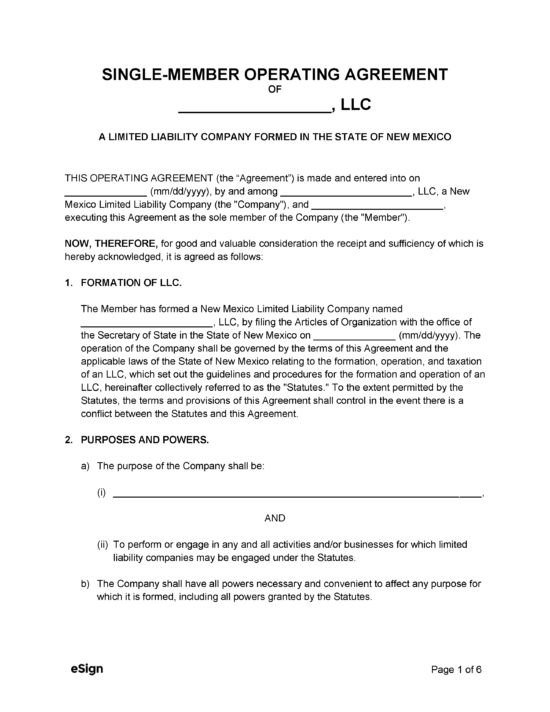

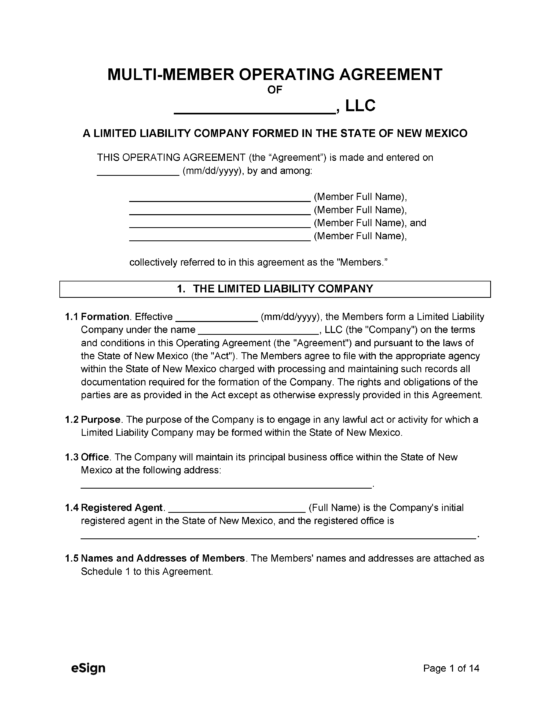

Step 4 – Create Operating Agreement

State law doesn’t require the creation of an operating agreement to form an LLC. However, it is still recommended that the company drafts an operating agreement to establish the rights and responsibilities of its members and how the LLC will operate. If no operating agreement is made, the LLC’s operations will be dictated by state law.

Step 5 – Apply for Employer Identification Number (EIN)

Once a company’s LLC has been approved by the Secretary of State, they will need to apply for an Employer ID Number (EIN) from the IRS so they can be identified for tax purposes. An EIN is required for all LLCs that have two (2) or more members, even if they don’t technically employ anyone.

EIN applications can be completed online through the IRS website at no charge.

ResourcesFiling Options:

New Mexico Secretary of State Costs:

Forms:

Links:

|