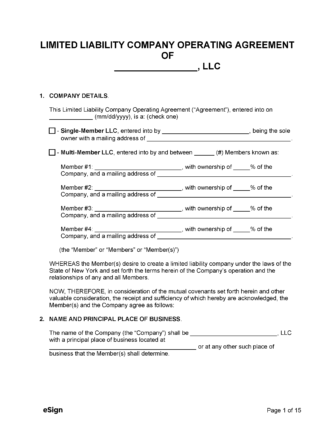

Is an Operating Agreement Required?

Yes – LLCs in New York are legally required to create an operating agreement before, at the time of, or within 90 days of the company’s formation.[1]

Types (2)

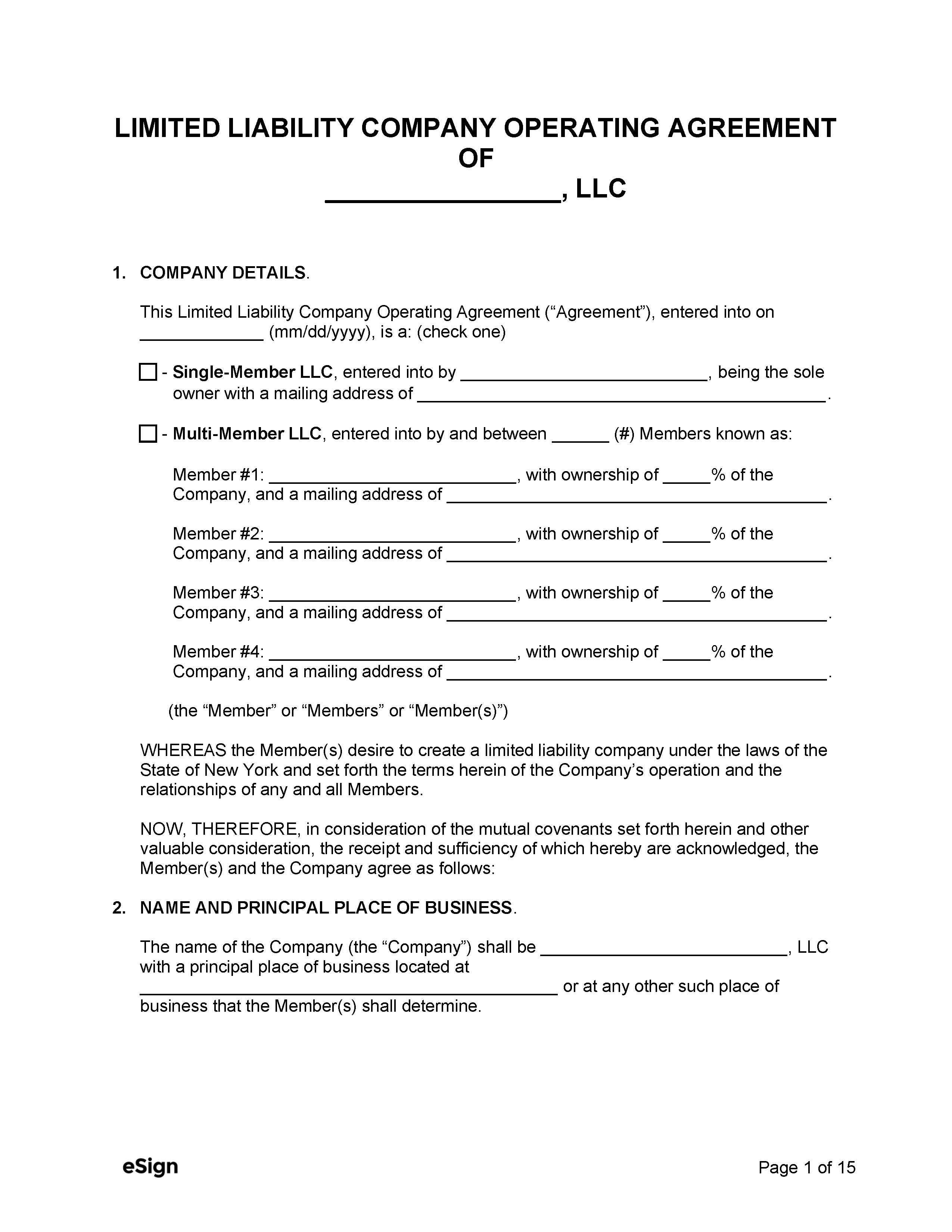

Single-Member LLC Operating Agreement – If the company has one sole owner, they can use this simplified form. Single-Member LLC Operating Agreement – If the company has one sole owner, they can use this simplified form.

|

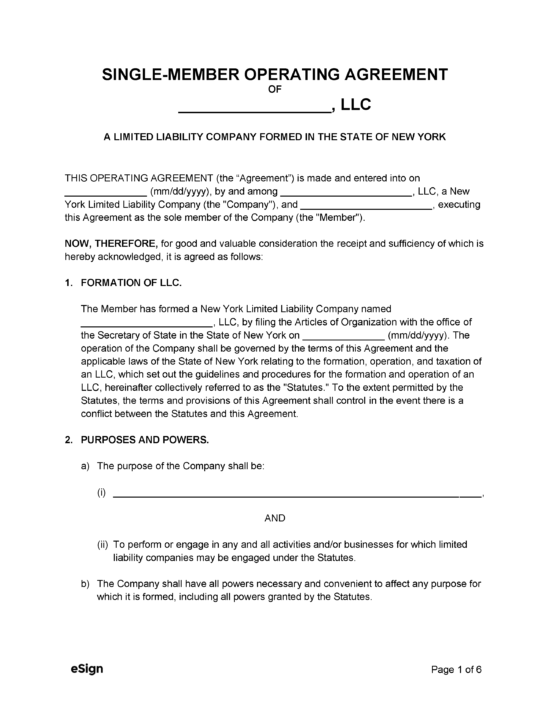

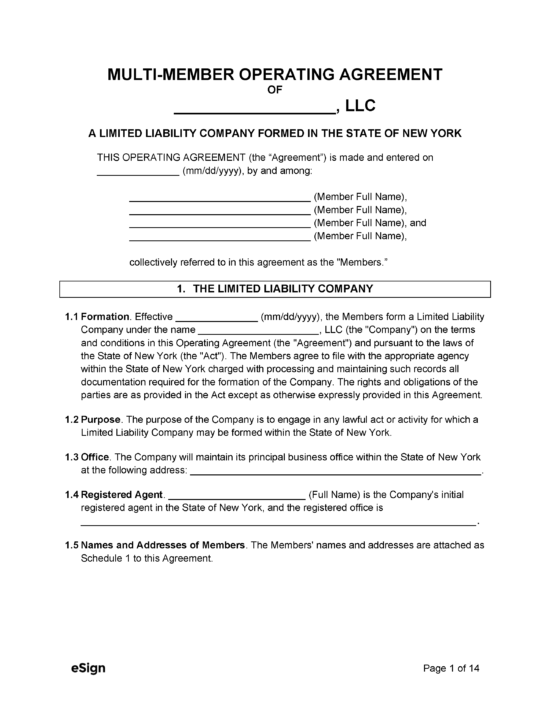

Multi-Member LLC Operating Agreement – For use by companies that have more than one member. Multi-Member LLC Operating Agreement – For use by companies that have more than one member.

|