Is an Operating Agreement Required?

No – Tennessee statutes do not require operating agreements, but having one in place is common practice.

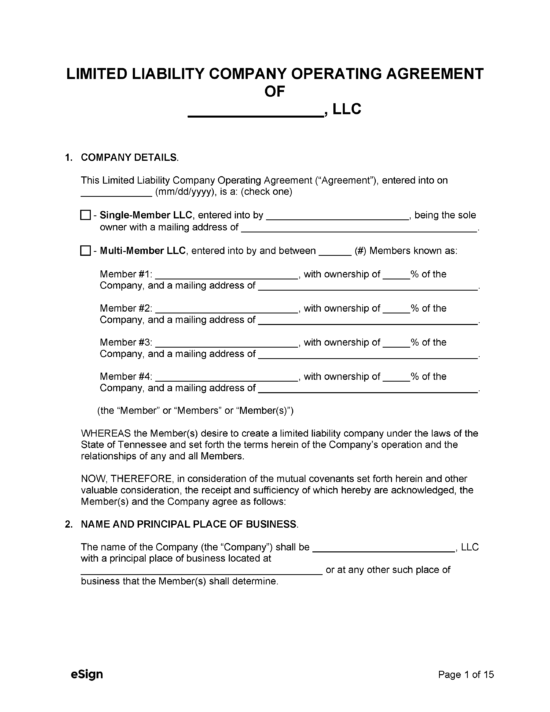

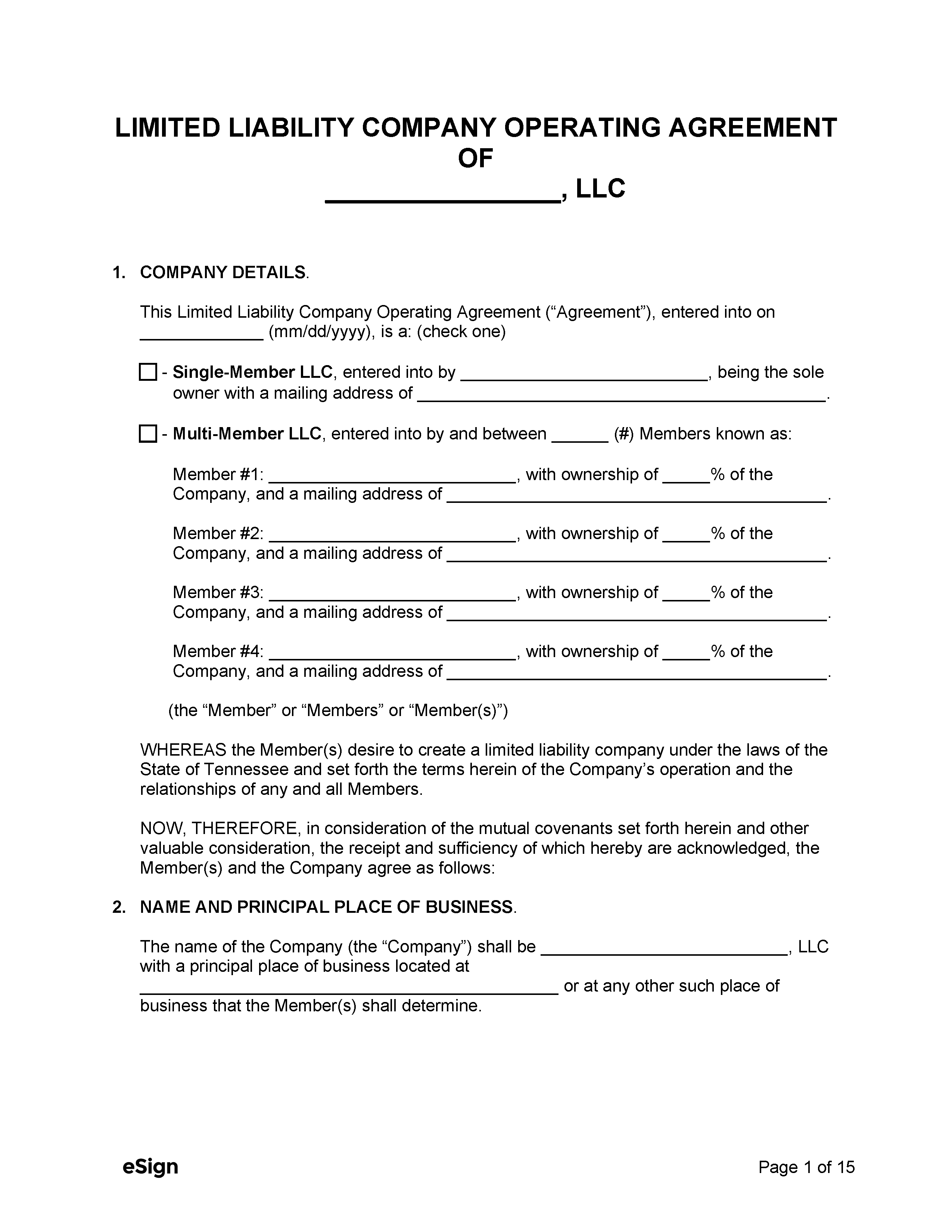

Types (2)

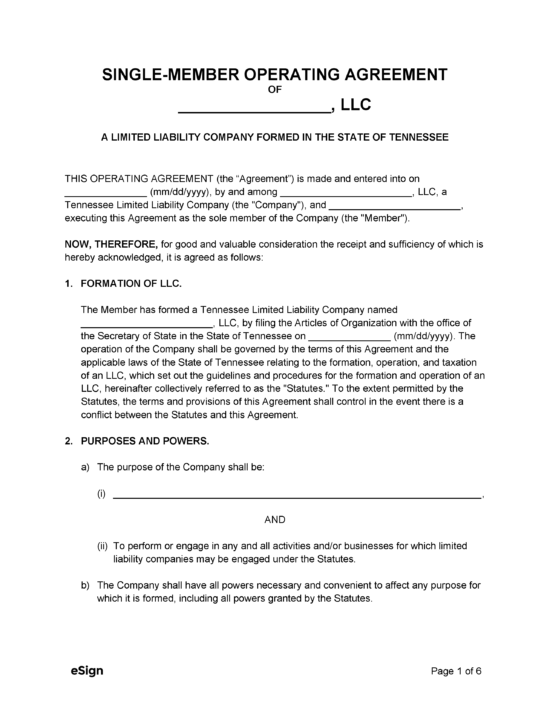

Single-Member LLC Operating Agreement – For individuals establishing an LLC without other members. Single-Member LLC Operating Agreement – For individuals establishing an LLC without other members.

|

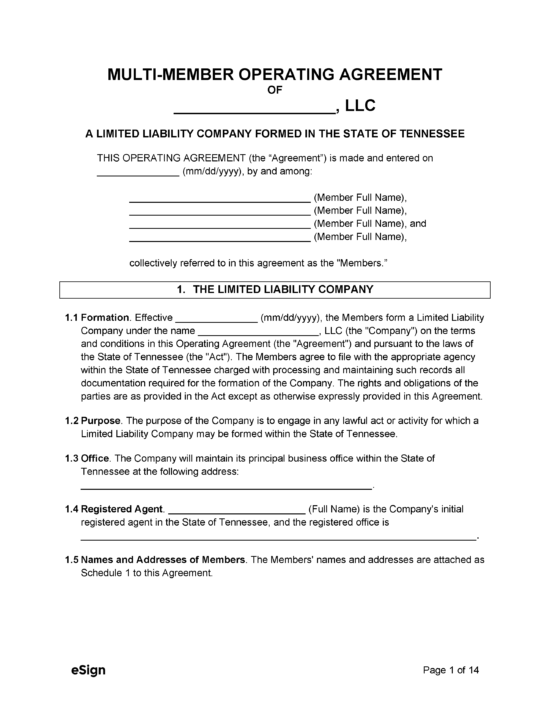

Multi-Member LLC Operating Agreement – An operating agreement established by an LLC that has two (2) or more members. Multi-Member LLC Operating Agreement – An operating agreement established by an LLC that has two (2) or more members.

|