Without an LLC operating agreement in place, the entity will be governed by the statutes outlined in the Limited Liability Company Act, which are quite broad and may not cover the intricacies of every type of business should a lawsuit or other legal liability arise.

Contents |

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Limited Liability Company Act

- Definitions: § 48-249-102

- Formation: § 48-249-201

- Naming of LLCs: § 48-249-106

How to File

- Step 1 – Name LLC

- Step 2 – Registered Agent

- Step 3 – Register LLC

- Step 4 – Operating Agreement

- Step 5 – Employer Identification Number (EIN)

Step 1 – Name LLC

A limited liability company must have a business name that is different from other existing entities in Tennessee.

The Secretary of State (SOS) provides a Business Name Availability search engine that allows users to find out if their business name is unique.

The name of the LLC must contain the words “limited liability company,” L.L.C.,” or “LLC” in order to fulfill state requirements (a full list of requirements can be found in § 48-249-106 of the Tennessee Code).

Name Reservation

An LLC name can be reserved with the Secretary of State for four (4) months, allowing the members to file the Articles of Organization without losing the name to another entity. The Application for Reservation of Limited Liability Company Name must be completed and mailed to the address below with a $20 check for the filing fee.

Corporate Filings

312 Rosa L. Parks Avenue

6th Floor, William R. Snodgrass Tower

Nashville, TN 37243

Step 2 – Registered Agent

An LLC must nominate a registered agent to take care of state and federal legal documents and service of process on behalf of the entity.

A registered agent can be any individual over the age of eighteen (18) with a Tennessee address. The LLC can also hire a a business entity, a professional registered agent service, that operates within the state.

Step 3 – Register LLC

To form an LLC in Tennessee, the member(s) must file the Articles of Organization with the Secretary of State. Registration can be done online or by mail.

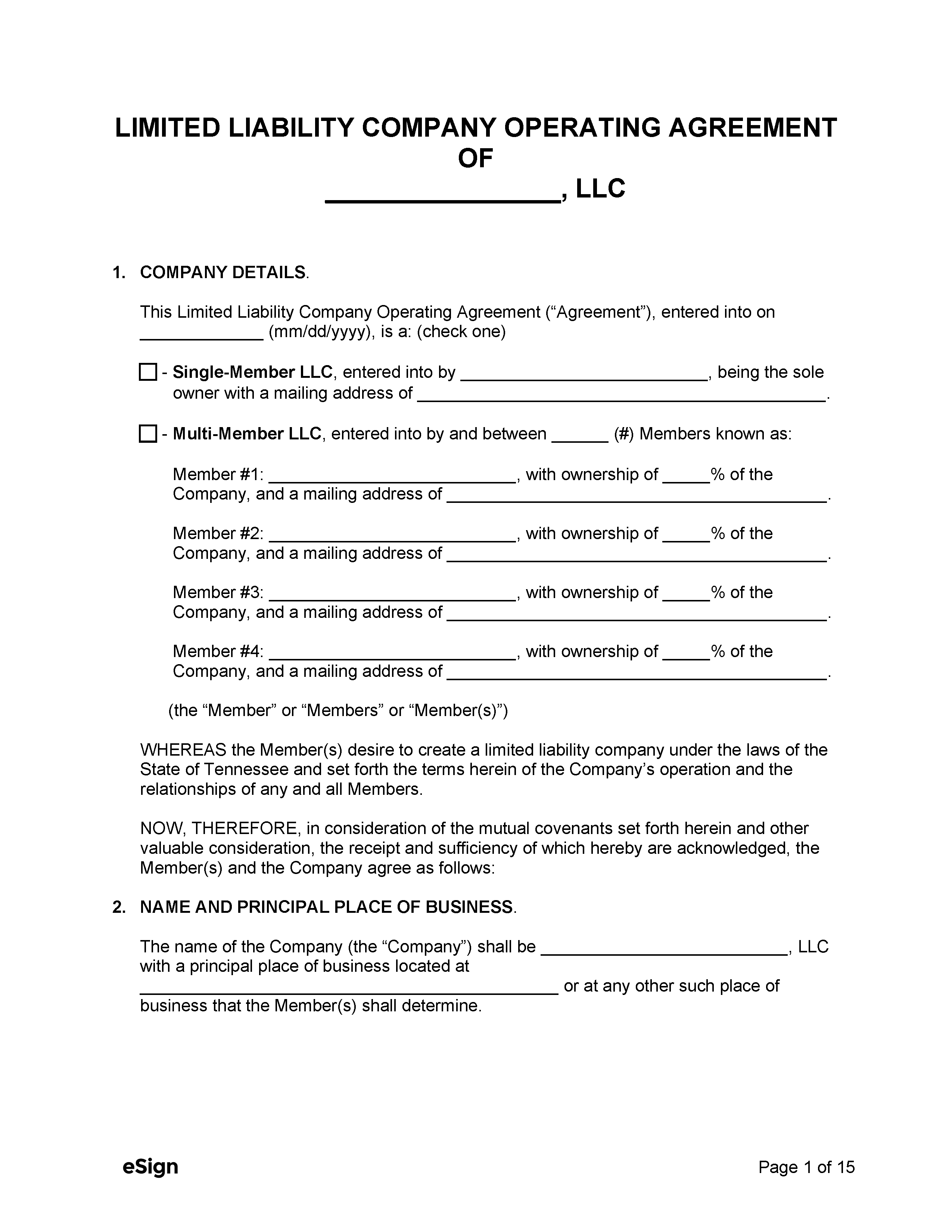

Online

- Proceed to the Online Business Registration webpage on the SOS website and select Limited Liability Company from the dropdown menu, then click Continue.

- There are seven (7) segments that must be completed which make up the entirety of the Articles of Organization.

- The last segment will require payment for registering the LLC; the fee is $50 per member (min. $300, max. $3,000), which does not include transaction fees.

By Mail

- Download, complete and print the Articles of Organization form.

- Attach a check for the filing fee ($50 per member) to the document.

- Mail the document and check to the following address:

Business Services Division

Secretary of State’s Office

312 Rosa L. Parks Avenue

6th Floor, William R. Snodgrass Tower

Nashville, TN 37243

Note on Foreign LLCs:

Foreign LLCs (out-of-state companies expanding into Tennessee) must complete the Application for Certificate of Authority form instead of the Articles of Organization (the filing costs are the same). This form can be filed online or sent to the same address as above. A Certificate of Good Standing or Certificate of Existence issued within the past sixty (60) days by the entity’s state of origin must be attached to the application.

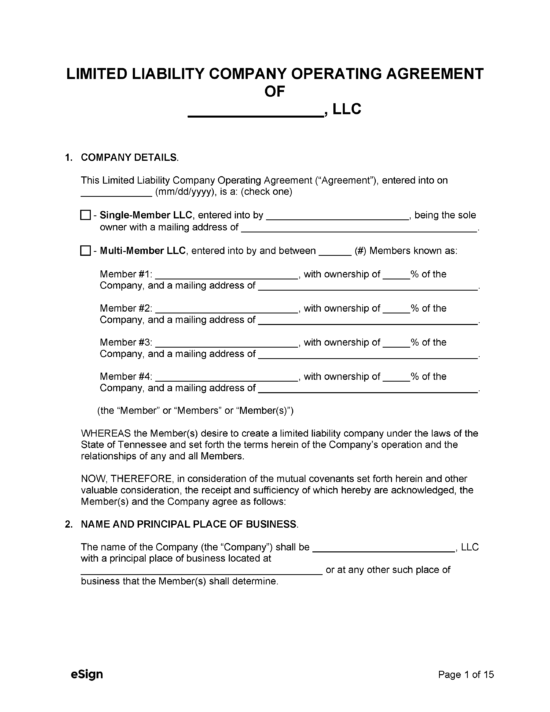

Step 4 – Operating Agreement

An LLC operating agreement can be drafted anytime during or after the process of filing the Articles of Organization. As previously mentioned, an operating agreement isn’t legally required in order for the LLC to be an official entity, but it will help establish the structure of the business and solidify the rights and obligations of the members.

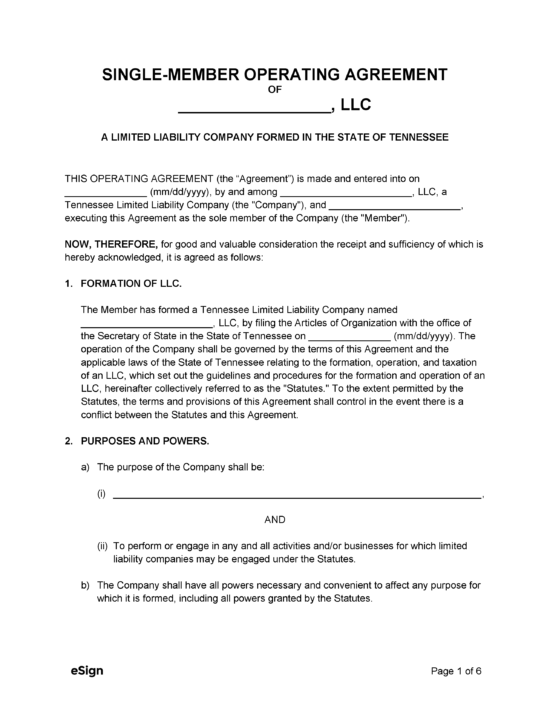

- Single-Member Operating Agreement

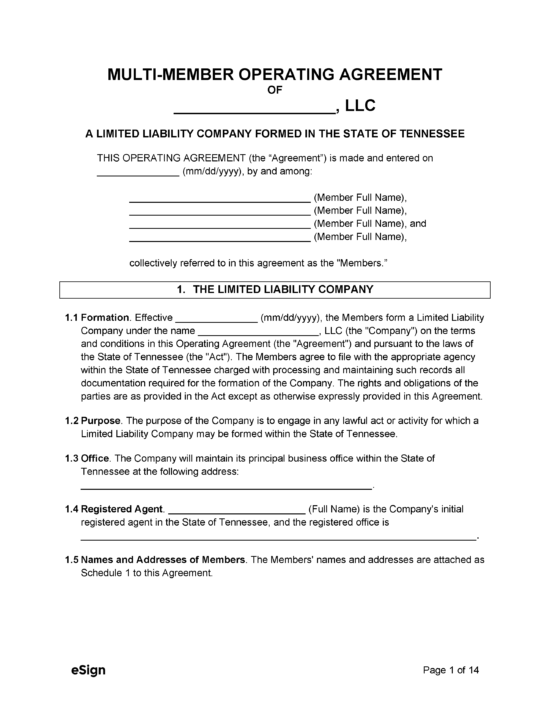

- Multi-Member Operating Agreement

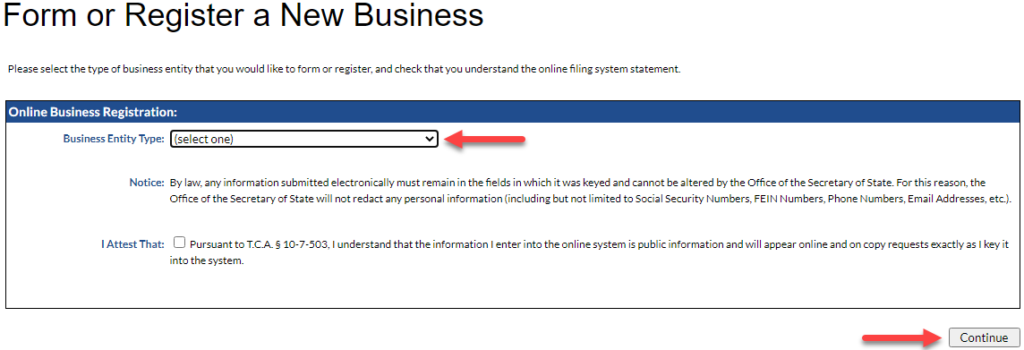

Step 5 – Employer Identification Number (EIN)

All business entities in the US, with a few exceptions, must have an Employer Identification Number (EIN). This is a 9-digit number assigned to the LLC by the IRS so the company can file returns, pay taxes, open bank accounts, etc. An EIN can be obtained by applying online for free through the IRS website or completing the Application for Employer Identification Number (Form SS-4) and mailing it to Internal Revenue Service, EIN Operation, Cincinnati, OH, 45999.

ResourcesFiling Options: Online or by Mail Costs:

Forms:

Links:

|