While the structure of an LLC may not be as complex as a corporation, forming this type of entity and operating agreement shouldn’t be taken lightly. It’s advised that the members seek legal counsel to ensure the contract accounts for the intricacies of the specific business being established.

Contents |

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Title 13.1, Chapter 12

- Definitions: § 13.1-1002

- Formation: Article 2

- Naming of LLCs: § 13.1-1012

How to File (5 Steps)

- Step 1 – Name Company

- Step 2 – Appoint Registered Agent

- Step 3 – Register Company

- Step 4 – Execute Operating Agreement

- Step 5 – Apply for EIN

Step 1 – Name Company

Before a limited liability company can be registered, the member(s) must choose a name for the business.

There are a lot of companies operating in Virginia, so performing a business name search to ensure the name is unique might be necessary. This can be accomplished using the State Corporation Commission Name Check Availability search engine.

If the LLC name is available, it can be reserved for one hundred and twenty (120) days by filing the Application for Reservation or Renewal of Reservation of a Business Entity Name (Form SCC631) along with a $10 filing fee with the Corporation Commission at the address below. (Name reservation applications can also be completed and filed online be creating a CIS account, as set forth in Step 3.)

State Corporation Commission

Clerk’s Office

P.O. Box 1197

Richmond, VA 23218-1197

Step 2 – Appoint Registered Agent

All LLCs must have a registered agent on file with the State Corporation Commission as the individual/entity authorized to receive service of process on behalf of the company.

A registered agent can be a member/manager of the LLC, or the company can hire a registered agent service to handle these tasks for them.

Whether the registered agent is an individual or a business entity, their office address must be in Virginia.

Step 3 – Register Company

After a name has been chosen and a registered agent appointed to the company, the members can have an organizer file the Articles of Organization (or Application for Certificate of Registration if a foreign LLC) with the State Corporation Commission.

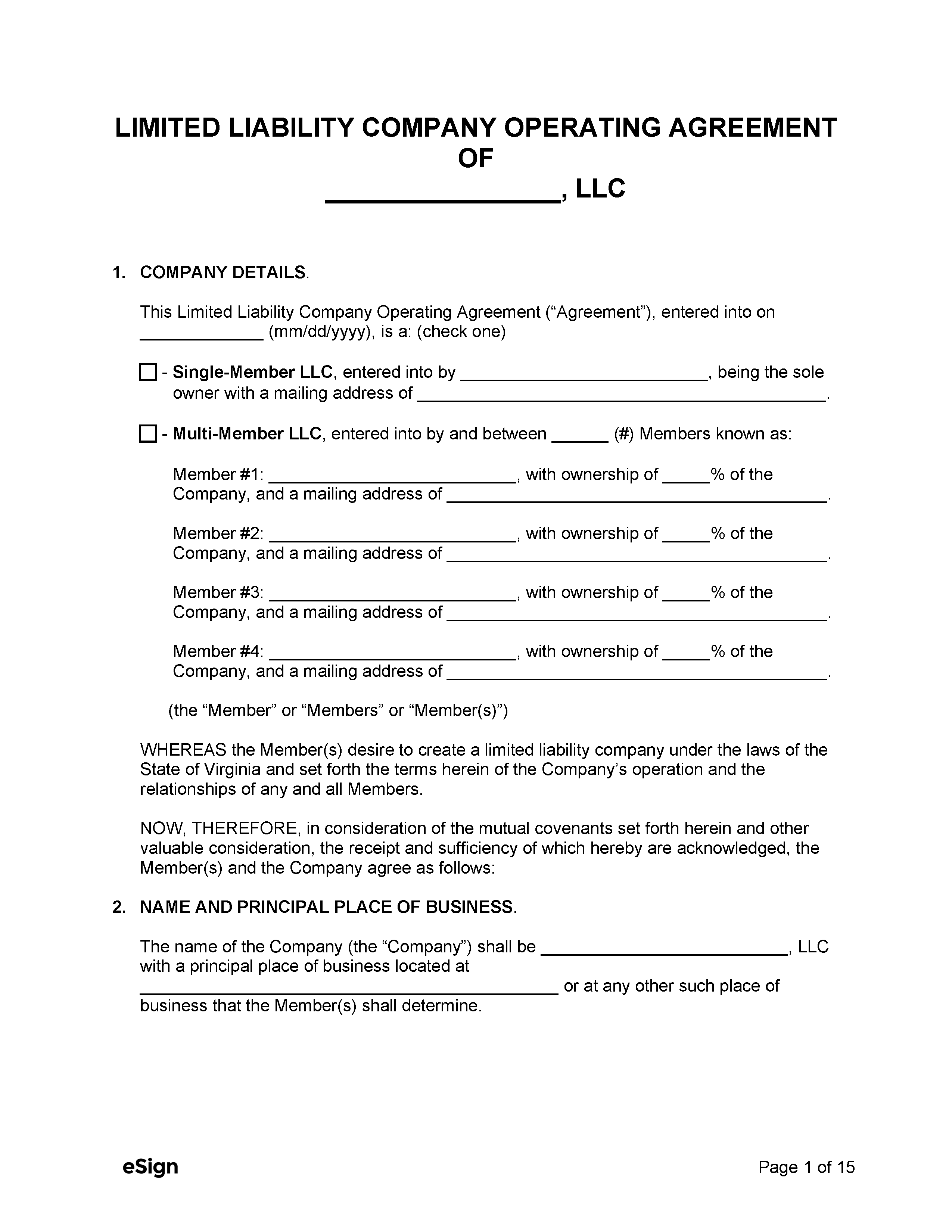

Online registration is made possible through the State Corporation Clerk’s Information System (CIS). Users will have to create an account to complete the registration process in this manner.

The Articles of Organization (domestic LLC) and Application for Certificate of Registration (foreign LLC) can also be downloaded as a PDF file, completed online, and mailed to the address below.

State Corporation Commission

Clerk’s Office

P.O. Box 1197

Richmond, VA 23218-1197

Note on Filing Fees:

The cost of registering a domestic or foreign LLC either online or by mail is $100. There is also an annual registration fee of $50 which can be paid online (through the same CIS portal) every year on the last day of the month in which the company was registered.

Step 4 – Execute Operating Agreement

An LLC operating agreement can be drafted at any point during or after the registration process.

Unlike the Articles of Organization, an LLC operating agreement does not need to be filed with the State Corporation Commission; however, a copy of the agreement should be kept in a secure place by each owner/member of the company.

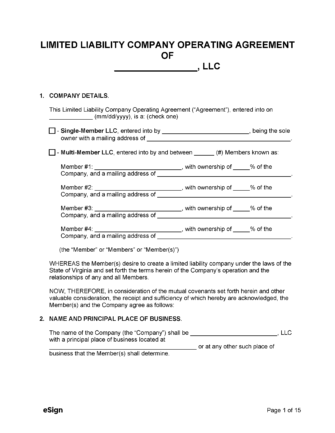

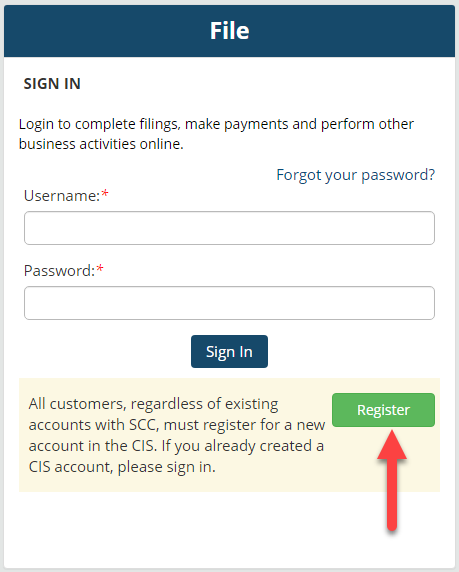

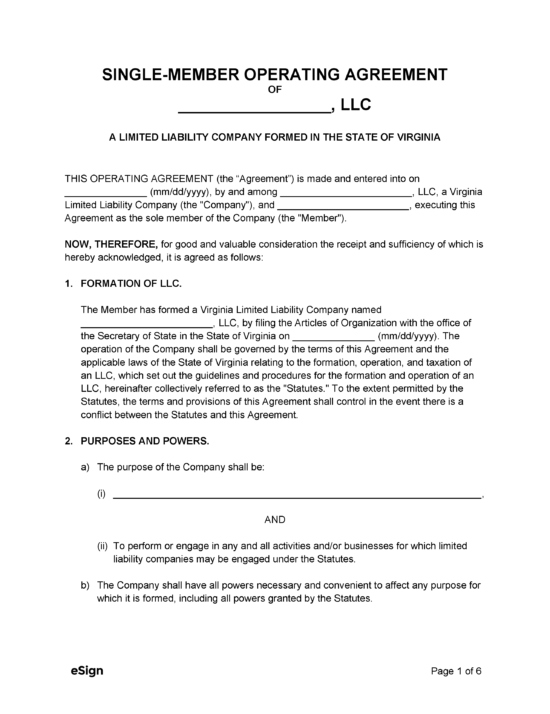

- Single-Member LLC Operating Agreement

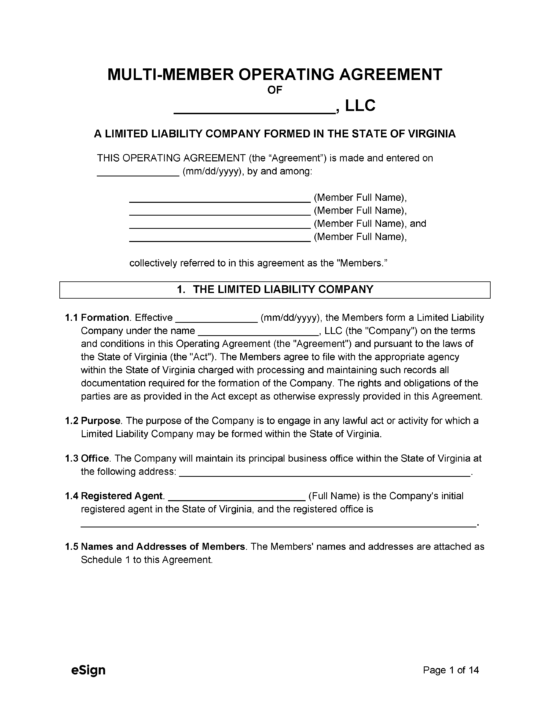

- Multi-Member LLC Operating Agreement

Step 5 – Apply for EIN

The IRS requires that all businesses have an EIN, or Employer Identification Number, for opening bank accounts, filing taxes, and hiring employees.

If the company is a single-member LLC and does not intend on employing anyone, an EIN is not required.

All other entities can apply for an EIN online using the IRS EIN Assistant webpage or by mailing a completed Application for Employer Identification Number (Form SS-4) to the following address:

Internal Revenue Service

ATTN: EIN Operation

Cincinnati, OH 45999

ResourcesFiling Options: Online or by Mail Costs:

Forms:

Links:

|