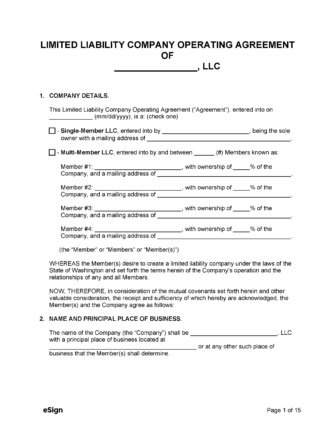

It is always recommended that LLCs draft an operating agreement as it can prevent conflicts between the members and managers, as well as with outside parties. The contract covers issues such as the contributions and distributions of the members, how profits and losses are shared, the management structure and how it could be affected, and what to do when a member dies or wishes to leave the LLC.

Contents |

Types (2)

Download: PDF, Word (.docx), OpenDocument

Download: PDF, Word (.docx), OpenDocument

Laws

- Chapter: Chapter 25.15

- Definitions: § 25.15.006

- Formation: Chapter 25.15, Article II

- Naming of LLCs: Chapter 23.95, Article III

How to File (6 Steps)

- Step 1 – Establish a Name

- Step 2 – Select Registered Agent

- Step 3 – File Certificate of Formation

- Step 4 – File Initial Report

- Step 5 – Draft Operating Agreement

- Step 6 – Obtain Employer Identification Number

Step 1 – Establish a Name

Before an LLC can be registered with the state, a unique name must be chosen that includes the words or abbreviations “limited liability company,” “LLC,” or “L.L.C.” and meets the other requirements specified in § 23.95.300 and § 23.95.305(5)(a).

If the member(s) want to reserve the name before forming the company so that it cannot be used by another entity, they can mail a Name Reservation form, with a check for $30 attached thereto, to the Secretary of State (SOS) at the following address:

Secretary of State

Corporation Division

801 Capitol Way S

PO Box 40234

Olympia WA 98504-0234

Note on Performing a Name Search:

An advanced business search can be conducted to ensure the desired LLC name is available for use through the Corporations and Charities Filing System on the SOS website.

Step 2 – Select Registered Agent

The next stage of the formation process should be appointing a registered agent for the LLC.

This agent will receive service of process and other important government and legal documents on behalf of the entity.

The SOS website provides a list of all commercial registered agents in the state; however, the LLC can select an individual as their registered agent, as long as they have a permanent address in Washington and are authorized to do business in the state.

Step 3 – File Certificate of Formation

With a name picked and a registered agent appointed, the members can now have an organizer register the entity with the Secretary of State either online or by mail.

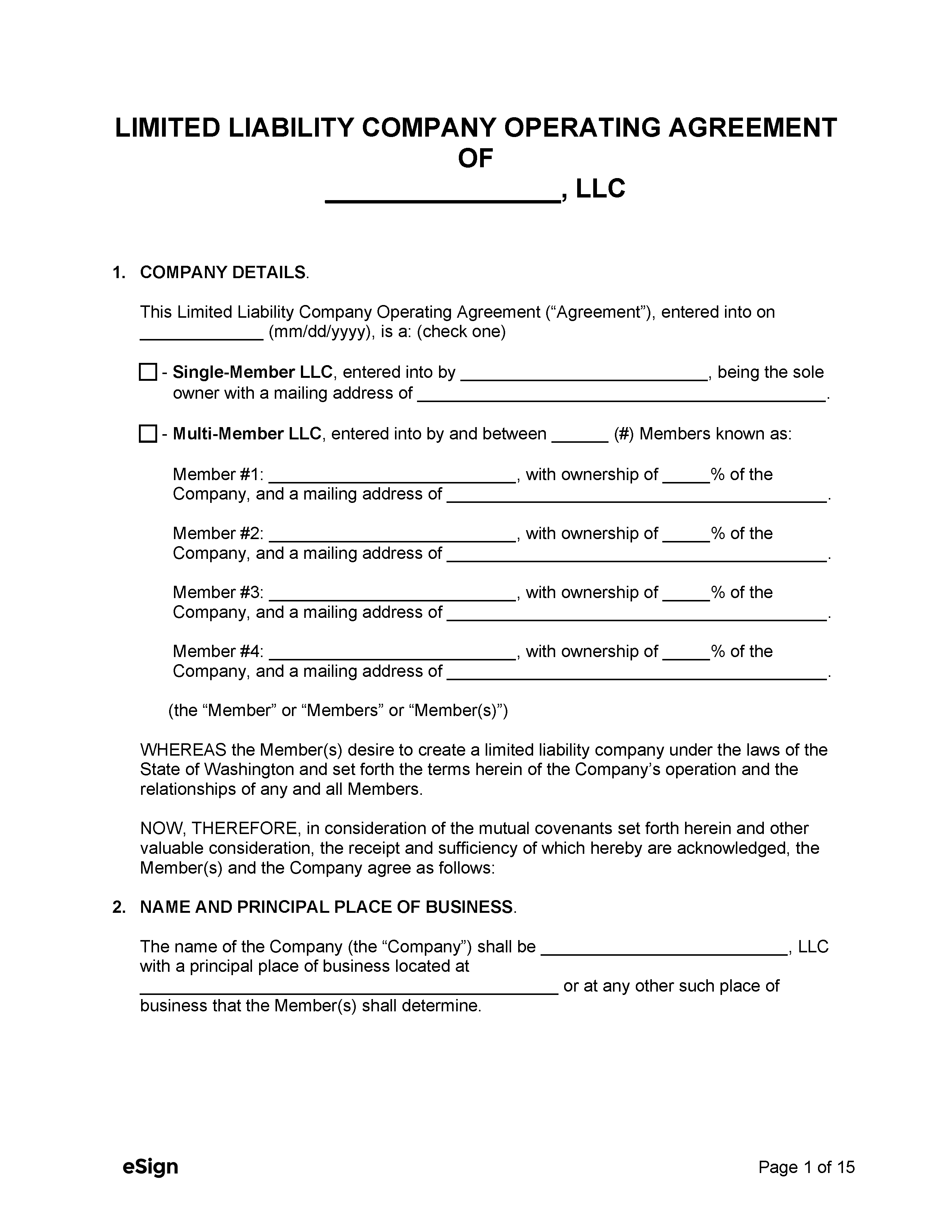

Online

Both foreign and domestic LLCs can register online using the Corporations and Charities Filing System for a $200 fee. An account can be created by clicking Create a User Account. Once logged in, the Certificate of Formation (domestic) or Registration Statement (foreign) can be submitted and the filing fee paid.

By Mail

- Download and complete the appropriate registration form:

- Certificate of Formation (domestic)

- Registration Statement (foreign)

- Write a check or buy a money order for $180 payable to the Secretary of State. (An additional $50 can be added to the total filing fee for companies that want an expedited filing.)

- Mail the document and check/money order to the address below.

Secretary of State

Corporation Division

PO Box 40234

Olympia WA 98504-0234

Step 4 – File Initial Report

An initial report is essentially the entity’s first annual report, and includes the company name, address, members, and registered agent.

An Initial Report document must be completed and submitted to the SOS (using the online filings system or the mailing address mentioned in Step 3) within one hundred and twenty (120) days of registering a domestic LLC. The fee is $10, unless the report is filed at the same time as the Certificate of Formation, in which case there is no extra cost.

Note on Foreign LLCs:

While foreign LLCs don’t have to file an initial report, they are required to file an annual report just like all other domestic and foreign entities.

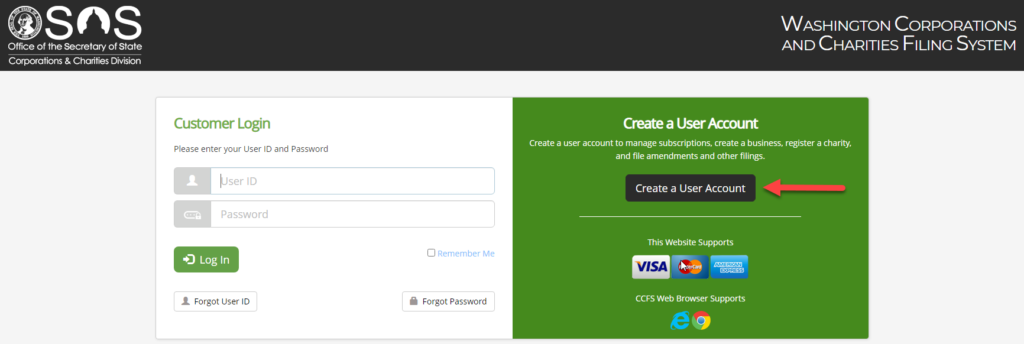

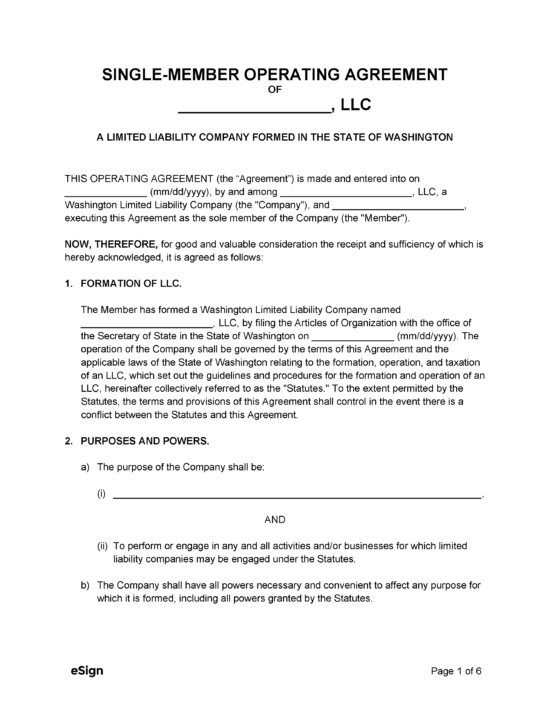

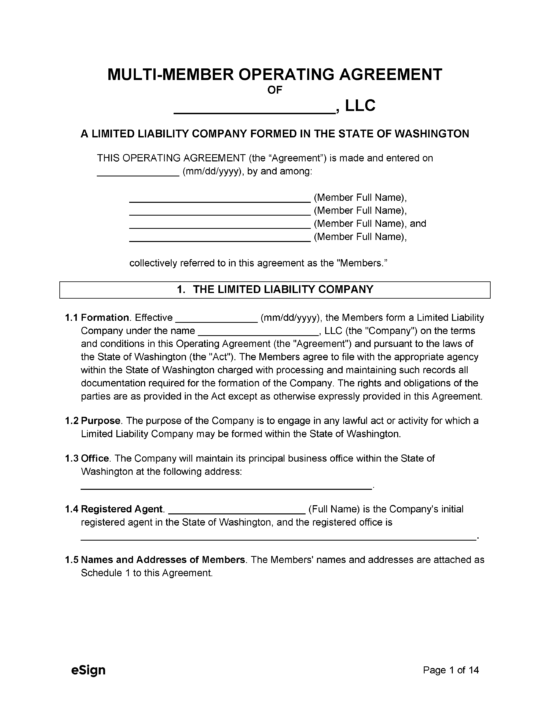

Step 5 – Draft Operating Agreement

An LLC operating agreement should be drafted at some point before, during, or after registering the entity with the Secretary of State. The document does not need to be filed with the SOS, but each member should retain a copy for their records.

- Single-Member Operating Agreement

- Multi-Member Operating Agreement

Step 6 – Obtain Employer Identification Number

All entities, with a few exceptions, must apply for an Employer Identification Number (EIN) with the IRS for the purpose of filing and reporting taxes. The application can be accomplished online or by mail.

- Online: Visit the EIN Assistant page on the IRS website and click Begin Application.

- By Mail: Complete Form SS-4 – Application for Employer Identification Number and mail it to the following address:

Internal Revenue Service

ATTN: EIN Operation

Cincinnati, OH 45999

ResourcesFiling Options: Online or by Mail Costs:

Forms:

Links:

|