Common Reasons for a Business Loan

- To fund a startup.

- To recruit new employees.

- To expand the company or a specific department.

- To purchase property, equipment, or machinery.

- To increase inventory.

Contents |

Types of Business Loans

Term Loans

A term loan is the most common type of business loan. The borrower receives the loaned funds in full, which they’ll be required to pay off by a certain date in weekly, monthly, or bi-monthly increments (although other repayment timelines can be negotiated).

- Amount: $50,000 to $600,000

- Term: 1 – 5 years

- Avg. Rate: 5 – 30%

SBA Loans

An SBA (Small Business Administration) loan is when the SBA acts as a partial guarantor for a loan provided by a traditional bank or credit union. The SBA is a government agency dedicated to assisting small businesses. And because the SBA guarantees they’ll pay part of the loan if the business defaults on the payments, banks are more willing to loan to businesses that would otherwise be deemed too high a risk to lend to.

- Amount: <$10,000 to $5,000,000

- Term: 5 – 25 years

- Avg. Rate: 6.5 – 13%

Business Line of Credit

Similar in function to a credit card, a business line of credit provides companies with a loan they can use whenever needed. Because the business doesn’t receive money upfront, interest is only applied to the amount the business is currently using. If the business pays off all (or a portion) of their balance, they will not owe any interest and they’ll continue to have access to the full amount. The main difference between a business line of credit and a business credit card is that the line of credit can be applied to a wider range of expenses.

- Amount: $5,000 to $200,000

- Term: 1 – 5 years

- Avg. Rate: 15 – 50%

Microloans

These often take the structure of a term loan and are used by startups and other companies that don’t qualify for traditional loans, as well as businesses that don’t need significant amounts of funding. They are provided by the SBA and many online lenders.

- Amount: Up to $50,000

- Term: 3 months – 7 years

- Avg. Rate: 5 – 20%

Invoice Financing

This method of loaning money is a type of short-term financing for companies that issue invoices. The borrowing company can borrow “against” any outstanding invoices they have. For example, if a company has a $50,000 outstanding invoice that the client has 45 days to pay, the company could borrow 85% against the invoice. This gives the borrower a means of paying their employee’s salary and any other expenses they’re relying on the invoice to cover. Once the client pays the invoice, the lender returns the 15% they held.

- Amount: Dependent on the invoice value

- Term: Until the client pays off the invoice (typically 30-90 days)

- Avg. Rate: A processing fee of ~3% is often charged, as well as a weekly factoring fee. Altogether, expect 3-6% of the invoice amount in total.

How to Write

Download: PDF, Word (.docx), OpenDocument

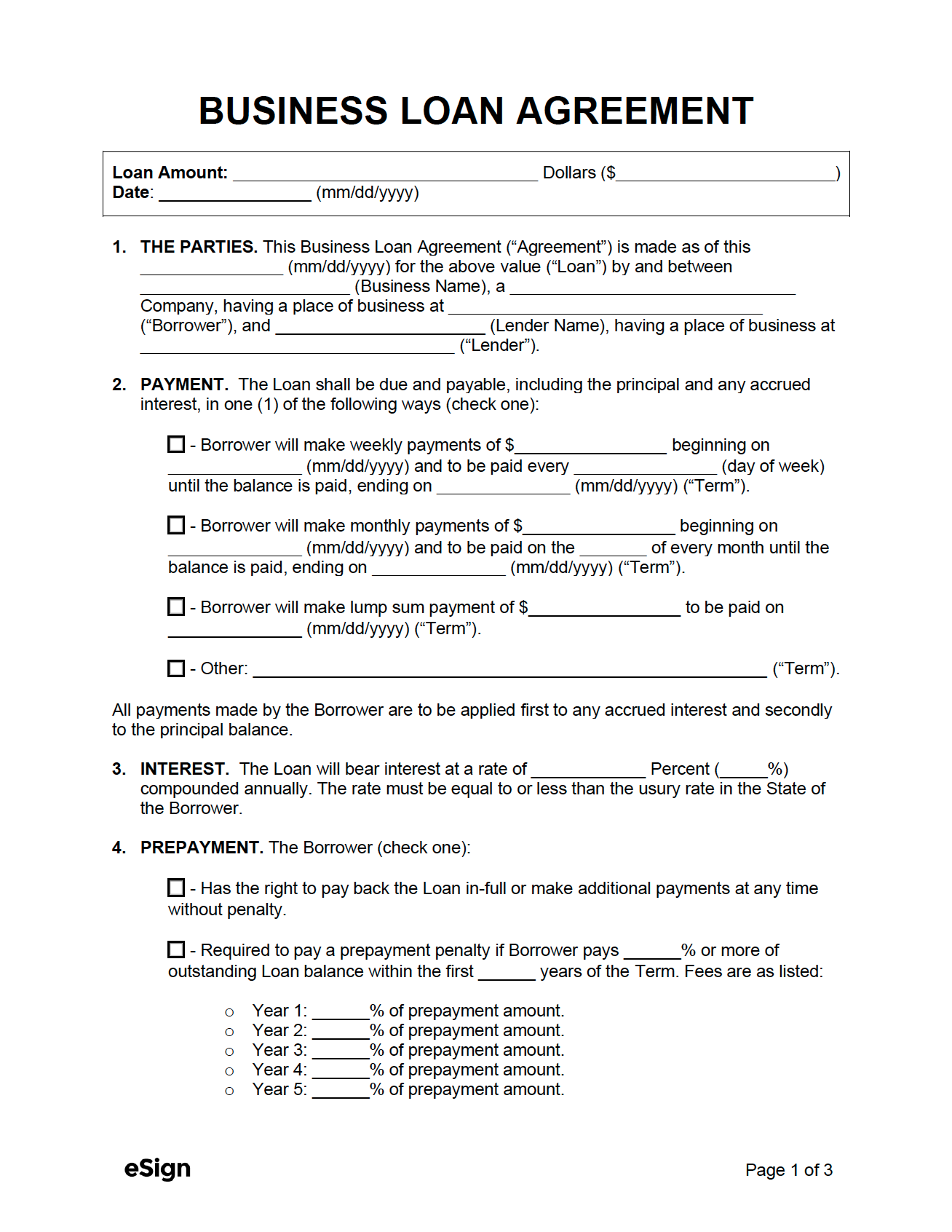

Step 1 – Basic Loan Information

In the box at the top of the form, enter the amount of the loan. The first field is for writing the amount of the loan in words (e.g., “One-hundred thousand dollars”). The second field is for writing the amount of the loan numerically (e.g., “$100,000.00”). The third field within the box is for the date the agreement is being completed (the current date).

Step 2 – The Parties

The “Parties” refers to two (2) entities – the borrower and the lender. Because this loan agreement is for a business, the “Borrower” name will be the name of the business. This section will require the lender to enter the following information:

- Agreement date (same as in Step 1).

- Business name.

- Business type (e.g., “Limited Liability Company”).

- Business principal address.

- Lender name.

- Lender address.

Step 3 – Payment

There are a total of four (4) options when it comes to how the borrower can pay back the loan, but only one (1) option can be selected. The first two (2) options are used if the borrower will make weekly or monthly payments to the lender. Both options are fixed terms (i.e., they have start and end dates). The third option is reserved for situations where the borrower will pay back the entire sum upon a certain date. And the last option is used if an alternative payment method will be implemented.

Step 4 – Interest

Enter the amount of interest that the borrower will be required to pay on the loan. The first field is for the percent written out in words (e.g., “Five”), and the second field is for writing out the interest as a number (e.g., “5”).

Step 5 – Prepayment

Oftentimes loans require the borrower to pay a prepayment penalty if they make too many payments or too large a payment before the payment date. If the lender will not demand a prepayment penalty, the first option should be selected. If they will demand a penalty, the second box should be checked and the following information provided in the appropriate fields:

- Enter the percentage (%) the borrower has to pay at one time in order to trigger the penalty.

- Enter the number (#) of years the penalty will be active.

- Enter the fee percentage (%) for each year following the start date of the loan.

The fee percentage comes off of the amount the borrower is paying, not the full amount of the loan.

Step 6 – Attorneys’ Fees

Enter the name of the state in which the agreement is being completed.

Step 7 – Governing Law

Enter the name of the state who’s laws will govern the loan agreement.

Step 8 – Additional Terms & Conditions

If the lender wishes to include any other loan terms, they can do so in the “Additional Terms & Conditions” section.

Step 9 – Signatures

The parties will need to sign the loan agreement in order to make it legally binding. Both the lender and borrower will need to print their name, date their signature, and sign the form (either digitally with eSign or by hand). If the parties will have witnesses observe their signatures, then the parties will need to sign in their presence and the witnesses will sign after them.