An employee loan agreement is a contract that creates the framework of a loan borrowed by an employee from the company they work for. It establishes important terms such as the amount loaned, the interest rate, the length of the contract, and the rules regarding payments. By drafting a loan agreement template, a company can establish a standard lending process for their employees, ensuring terms remain fair and consistent from one loan to the next.

Contents |

Sample

Download: PDF, Word (.docx), OpenDocument (.odt)

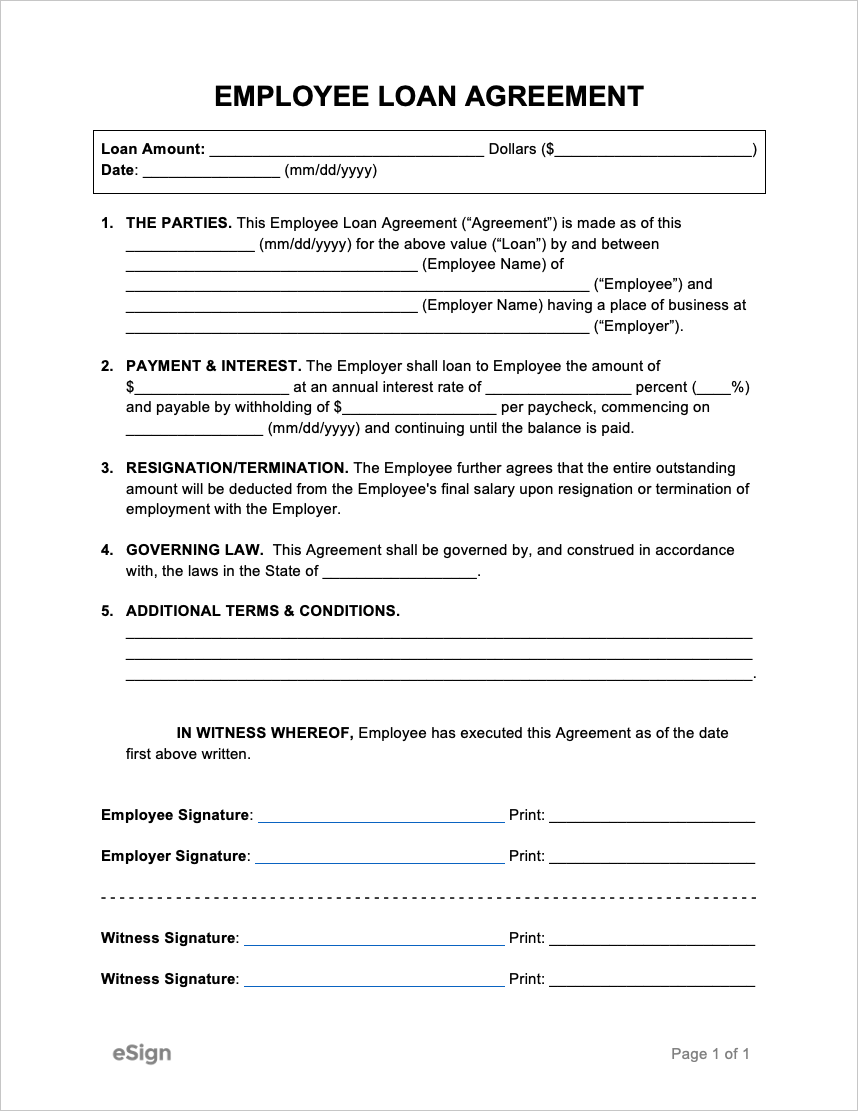

EMPLOYEE LOAN AGREEMENT

Loan Amount: [AMOUNT]

Date: [MM/DD/YYYY]

1. THE PARTIES. This Employee Loan Agreement (the “Agreement”) is made as of this [MM/DD/YYYY] for the above value (the “Loan”) by and between [EMPLOYEE NAME] of [EMPLOYEE ADDRESS] (the “Employee”) and [EMPLOYER NAME], having a place of business at [EMPLOYER ADDRESS] (the “Employer”).

2. PAYMENT & INTEREST. The Employer shall loan to Employee the amount of $[LOAN AMOUNT] at an annual interest rate of [INTEREST RATE] percent and payable by the withholding of $[AMOUNT] per paycheck, commencing on [MM/DD/YYYY] and continuing until the balance is paid.

3. RESIGNATION/TERMINATION. The Employee further agrees that the entire outstanding amount will be deducted from the Employee’s final salary upon resignation or termination of employment with the Employer.

4. GOVERNING LAW. This Agreement shall be governed by, and construed in accordance with, the laws in the state of [STATE].

5. ADDITIONAL TERMS & CONDITIONS.

[ENTER ANY ADDITIONAL TERMS AND CONDITIONS HERE].

6. SIGNATURES. IN WITNESS WHEREOF, Employee has executed this Agreement as of the date first above written.

Employee Signature: ___________________________

Print Name: [EMPLOYEE NAME]

Title: [EMPLOYEE TITLE]

Employer Signature: ___________________________

Print Name: [EMPLOYER NAME]

Title: [EMPLOYER TITLE]

What is an Employee Loan Agreement?

An employee loan agreement is a form used to record that an amount of money was lent by a business to one of its employees. The money can be provided to aid an employee with a major life expense (e.g., school tuition, homeownership), to near-term expenses they can’t afford due to a financial crisis (such as rent, food, or car payments). Regardless of the reason the employee was provided money, they will be expected to pay back the loan over a specific amount of time, most likely with interest.

Pros & Cons of Lending to Employees

(PRO) Improves employer-employee relations – Helping an employee in need aids in breaking down the corporate wall between employer and employee, and can help form strong bonds with employees.

(PRO) Increases employee productivity – Financial worries are a major burden for people, and providing loans can reduce employee stress levels and increase productivity.

(PRO) Promote company image – While this should be an afterthought for the business that decides to loan to their employees, it is a welcome benefit.

(CON) Could face more loan requests – If employees learn that another employee received a loan, they could make the same request to the employer. A company should not offer a loan to an employee unless they’re willing to offer a loan to all employees.

(CON) Risk of losing the loaned money – There’s always a chance that the employee defaults on the loan. This risk is decreased if the employer deducts loan payments from the employee’s paycheck – but the risk of them quitting (and leaving the loan unpaid) remains the same.

(CON) Can complicate taxes – If the employer doesn’t issue the loan correctly or they fail to match the AFR for loans over $10,000, they can complicate their taxes significantly.

(CON) Discrimination issues – If an employer grants a loan to one employee, but denies a loan to another employee (even if the reason is valid), the company can open itself up to a potential discrimination lawsuit.

How to Loan to an Employee (5 Steps)

The steps below outline the process of loaning money to an employee.

Step 1 – Understand the Employee’s Needs

Before deciding to loan to an employee or not, understand exactly why they need the money. If the employee has deep-seated money management issues, a loan will most likely serve as a temporary fix for their issues, and could even worsen their financial situation. However, as an example, if the employee was faced with a medical crisis and is in debt, a loan could make a major difference in their life. At the end of the day, the decision is up to the employer.

Step 2 – Establish a Lending Procedure

To simplify any future loans the company may issue, they should establish a standardized policy that clearly informs employees of the types of loan terms they qualify for, what the disqualifying criteria are (if any), and the maximum amount ($) that can be lent. Also included in the policy should be the names of those that can grant authorization for a loan and the exact process employees need to follow in order to acquire a loan.

Step 3 – Set the Rate

For loans above $10,000, the employer will need to charge the employee an interest rate at or above the current AFR (Applicable Federal Rate). A list of the current rates can be found on the IRS’ Index of Applicable Federal Rates Rulings.

Step 4 – Create & Sign the Loan Agreement

The loan agreement will need to establish the major terms of the loan, including the following items:

- The names of the employer and employee.

- The date the parties are entering into the agreement.

- The amount ($) of the loan.

- The interest rate (%).

- The amount ($) the employer will deduct from the employee’s paycheck to pay for the loan.

- The date of the first payment.

- What happens should the employee default on the loan.

- The signatures of the employer and employee.

The employer should keep a version of the loan agreement as a template. By pre-filling out fields that will often remain unchanged (such as the company name and address), the company can use the document repeatedly for any future loan agreements they enter into.

Step 5 – Keep Records

Regardless of the amount loaned, employers should keep diligent records of every loan made to an employee. A copy of the loan agreement should be kept in a secure place, and the loan itself should be accounted for in the company’s books. If the loan will be paid within a year, the company should list the loan as a “current asset” on its balance sheet. If the term is more than a year, it should be considered a “long-term asset.”