Contents |

Why use a Family Loan Agreement?

If a family member asks for money in a time of need, it may be tempting to provide the funds with only a verbal agreement to pay back the loan. One might think requiring their family member to sign formal documentation could damage their relationship or make the lender come off as untrusting. In reality, requiring written documentation in the form of a family loan agreement promotes greater family unity and respect more than any verbal agreement can provide.

Like all types of loans, lending to family members comes with its own set of benefits and risks.

Benefits

- Flexible terms – Unlike standard loans, the agreement can be structured however the parties wish. Additionally, the lender can alter the terms of the loan to accommodate changes in the borrower’s life.

- Lower interest rate – Even if the borrower has a great credit score, rates offered by banks don’t come close to the lowest rate that can be charged among family members (know as the AFR, or “Applicable Federal Rate”).

- Helping hand – For family members suffering a financial crisis, the loaned money can serve as a lifeline in a time of dire need.

Risks

- Ruined relationship – Although a loan agreement helps to reduce fractured relationships, verbal arguments and distrust can prevail if the borrower doesn’t respect the terms they agreed to.

- Taxes – For loans over a certain value, the IRS requires taxes to be paid on the interest collected. If the lender charges an interest rate that is lower than the AFR, the lender is still required to pay taxes on both the interest earned as well as the difference between the AFR and the interest rate that was charged.

- Missed payments – Arguably, the most obvious risk is that the borrower can stop (or refuse) to make payments on the loan. If one wants to avoid taking a family member to court, there are not many other options for the lender to collect the money lent.

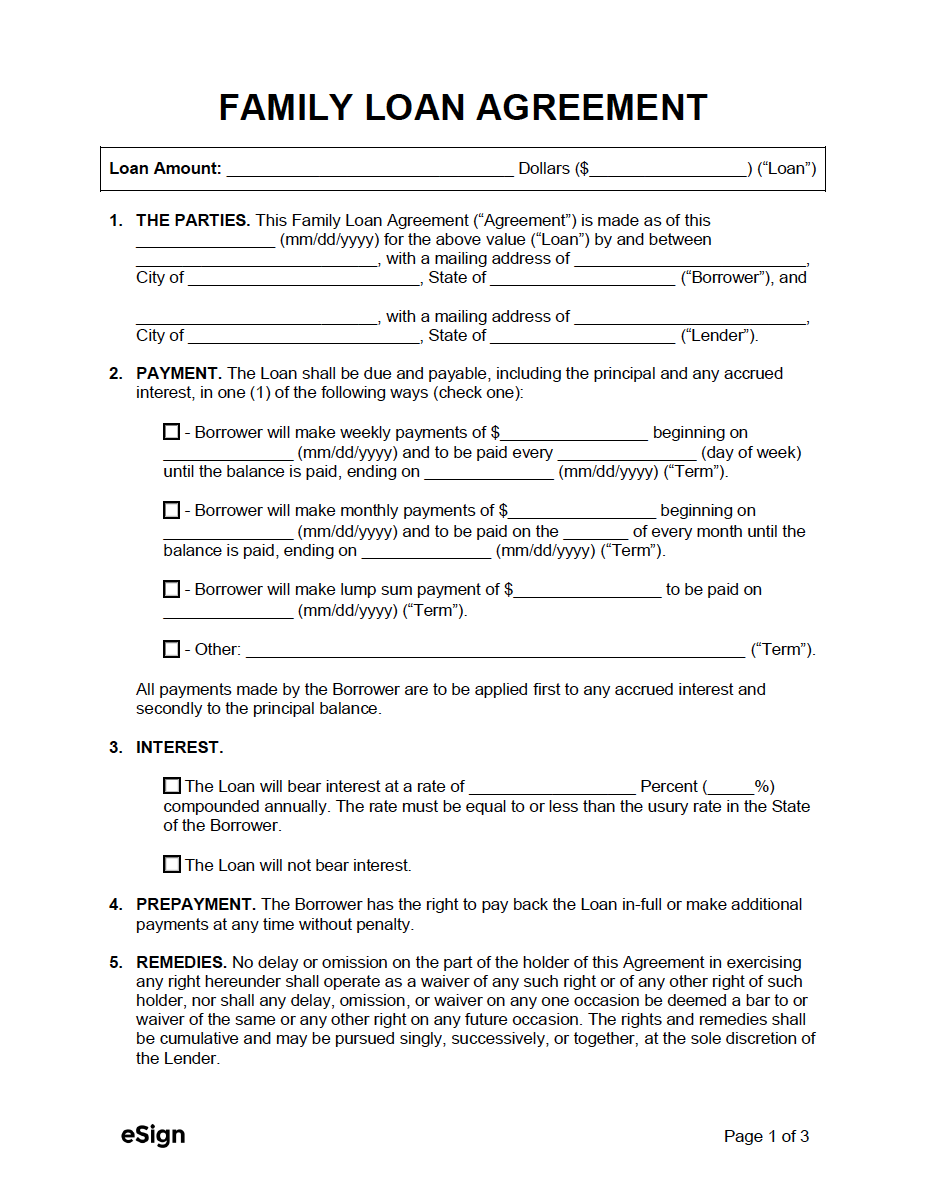

Sample Agreement

Download: PDF, Word (.docx), OpenDocument

FAMILY LOAN AGREEMENT

This Loan Agreement is made and entered into as of [DATE] by and between [BORROWER NAME] of [BORROWER ADDRESS] and [LENDER NAME] of [LENDER ADDRESS].

1. TERMS. Subject to the terms and conditions set forth herein, the Lender agrees to loan the Borrower the principal sum of $[LOAN AMOUNT] (the “Loan”). The Loan shall be provided to the Borrower in the form of a check, cash, or bank transfer at the Lender’s discretion.

2. REPAYMENT. The Borrower agrees to repay the Loan, plus any applicable interest, in full by [DATE OF LOAN REPAYMENT]. The Borrower may also prepay the Loan in full at any time without penalty.

3. INTEREST. The Loan shall bear interest at a rate of [INTEREST RATE] percent ([#]%), calculated on a monthly basis and due at the time of repayment.

4. LATE PAYMENT. If the Borrower fails to repay the Loan on or before the due date, the Borrower shall pay the Lender a late fee of $[LATE FEE AMOUNT].

5. DEFAULT. If the Borrower defaults on the repayment of the Loan, the Lender shall have the right to take legal action against the Borrower to recover the amount of the Loan, plus any applicable interest and late fees.

6. GOVERNING LAW. The terms of this Loan Agreement shall be governed by and interpreted in accordance with the laws of [STATE].

7. SIGNATURES. The parties hereto agree to the terms and conditions of this Loan Agreement by their signatures below.

__________________________ Date: [SIGNING DATE]

[BORROWER NAME]

__________________________ Date: [SIGNING DATE]

[LENDER NAME]

How to Lend to Family (4 Steps)

Step 1 – Weigh the Pros & Cons

The first thing a person should do before loaning money to a family member is consider their reasoning for requiring a loan. When it comes to money, removing emotion from the equation is recommended. Use the lending checklist below to aid in making a fair and reasonable decision on whether or not the family member deserves a loan:

Lending Checklist

Before lending money to a family member, the following questions should be considered to determine if they’re a good fit to receive funds:

- What would the borrower use the money for?

- Are they responsible with their money?

- Are they currently in debt?

- Has a loan been provided to them in the past?

- Did they pay back the loan?

- Did they do it in a timely manner?

- Will loaning money cause jealousy among other family members?

- Are all parties on board (i.e., significant others)?

- Would the lender be okay with losing the loaned money?

The last question on that list is arguably the most important. One should not loan money with the expectation of getting it back if they value their relationship with their family member. That is how familial relationships are damaged, sometimes permanently.

By mentally considering the loan as a gift, the lender is not emotionally devastated if the loan goes unpaid. Having said that, the lender should not share this thought with the borrower; this is merely a mindset that the lender should have prior to lending money.

Step 2 – Create the Loan Agreement

The loan agreement establishes several important points regarding the lent money. By requiring that the borrower sign the agreement, it helps to ensure they understand the seriousness of the arrangement, and that they’re required to follow the terms of the contract. It also serves as a record of the deal, letting the lender look back on the terms they offered should they receive another request for money from another family member.

At a minimum, the agreement should include the following information:

- Loan amount ($).

- The date the money was lent to the borrower.

- Both the names and addresses of the lender and borrower.

- The repayment structure for the loan:

- Date of the first payment.

- Amount ($) of each payment.

- Day of the week or month payments are due.

- Whether interest will be charged (and, if so, what percentage).

- The signatures of the borrower and lender.

Once the agreement is signed, a copy should be kept by both the lender and the borrower.

Step 3 – Provide the Money

The lender can now provide the borrower with the amount ($) as stated in the loan agreement. This should be done by providing cash, a check, depositing the money in their bank, wiring the money, or paying for the expense directly.

Alternatively, the lender can allocate portions of the loan as the borrower needs it. This can help ensure the borrower allocates the money towards the expenses they agreed to use the money for. However, if the lender intends to do this, it must be clearly stated in the loan agreement that they intend to pay the borrower in this fashion.

Step 4 – Monitor

Once the money has been provided, the parties should revert to the terms and conditions as stated in the loan agreement. The lender should keep a record of all payments, noting the time they were made, the amount paid towards interest and principal, and the remaining balance owed. If the borrower is late on a payment, the lender should contact the borrower to see why. If they simply forgot (and they make the payment in full shortly after), the lender shouldn’t treat it as a big deal. However, to establish the importance of the loan terms, the next payment due date should remain the same – not pushed back to a later date.