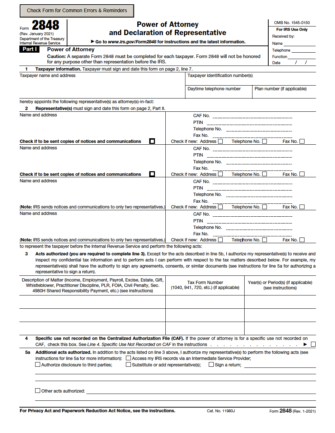

Signing Requirements

The signature on a power of attorney must be signed by the taxpayer and representative.

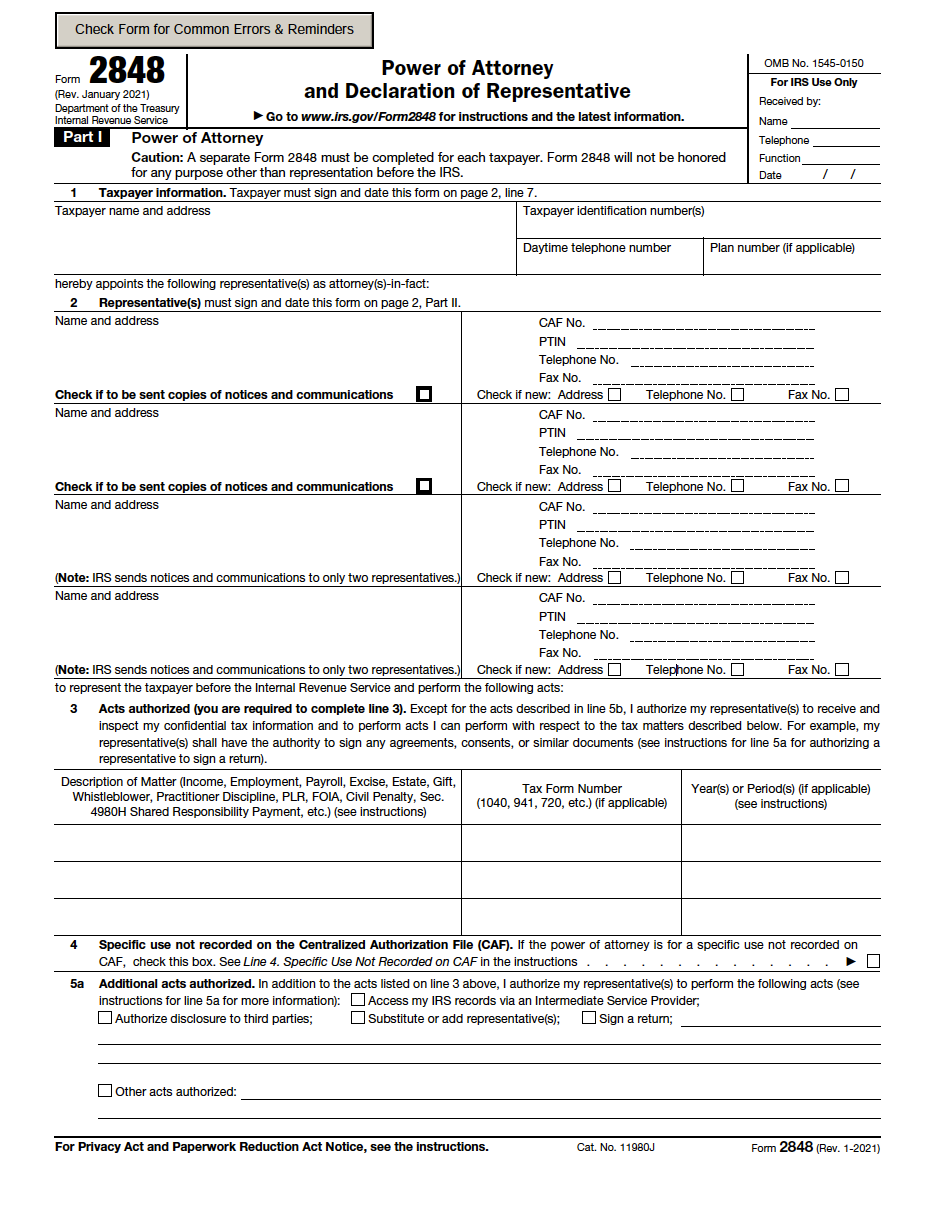

Delaware Authorization to Release Tax Information – To authorize the receipt and inspection of documents issued by the Delaware Division of Revenue.

Delaware Authorization to Release Tax Information – To authorize the receipt and inspection of documents issued by the Delaware Division of Revenue.

Download: PDF