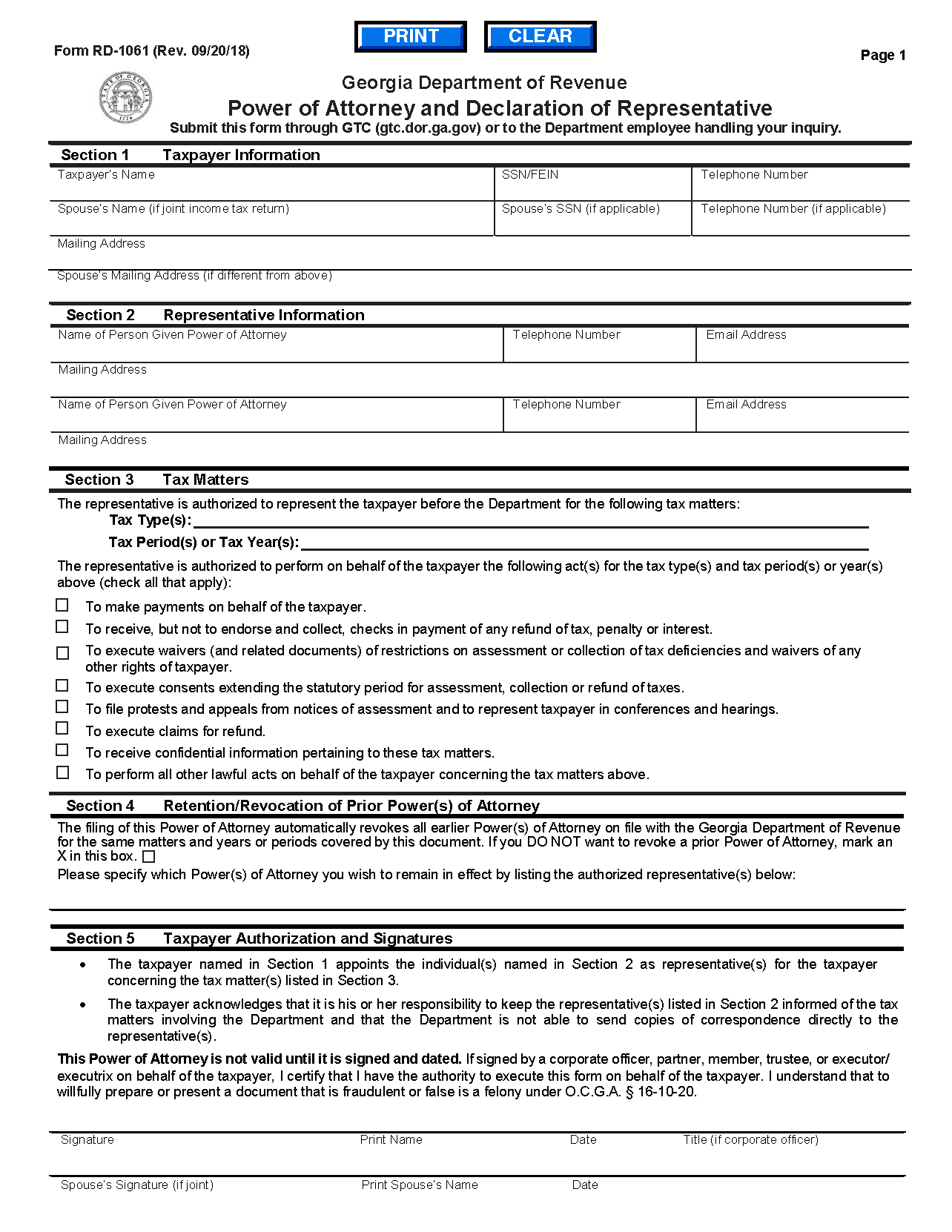

Signing Requirements

The taxpayer will need to sign the power of attorney.

The taxpayer’s signature must be acknowledged before a notary public unless the representative is a licensed tax professional (e.g., a certified public accountant or an attorney-at-law).

Licensed tax professionals must include their signature, bar/license/certification number, and the licensing jurisdiction or licensing authority.