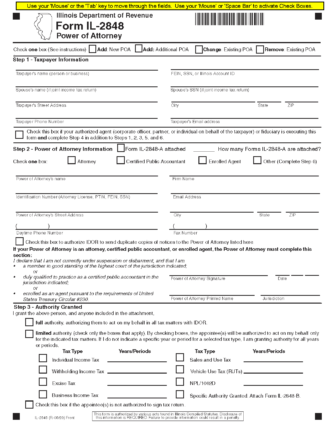

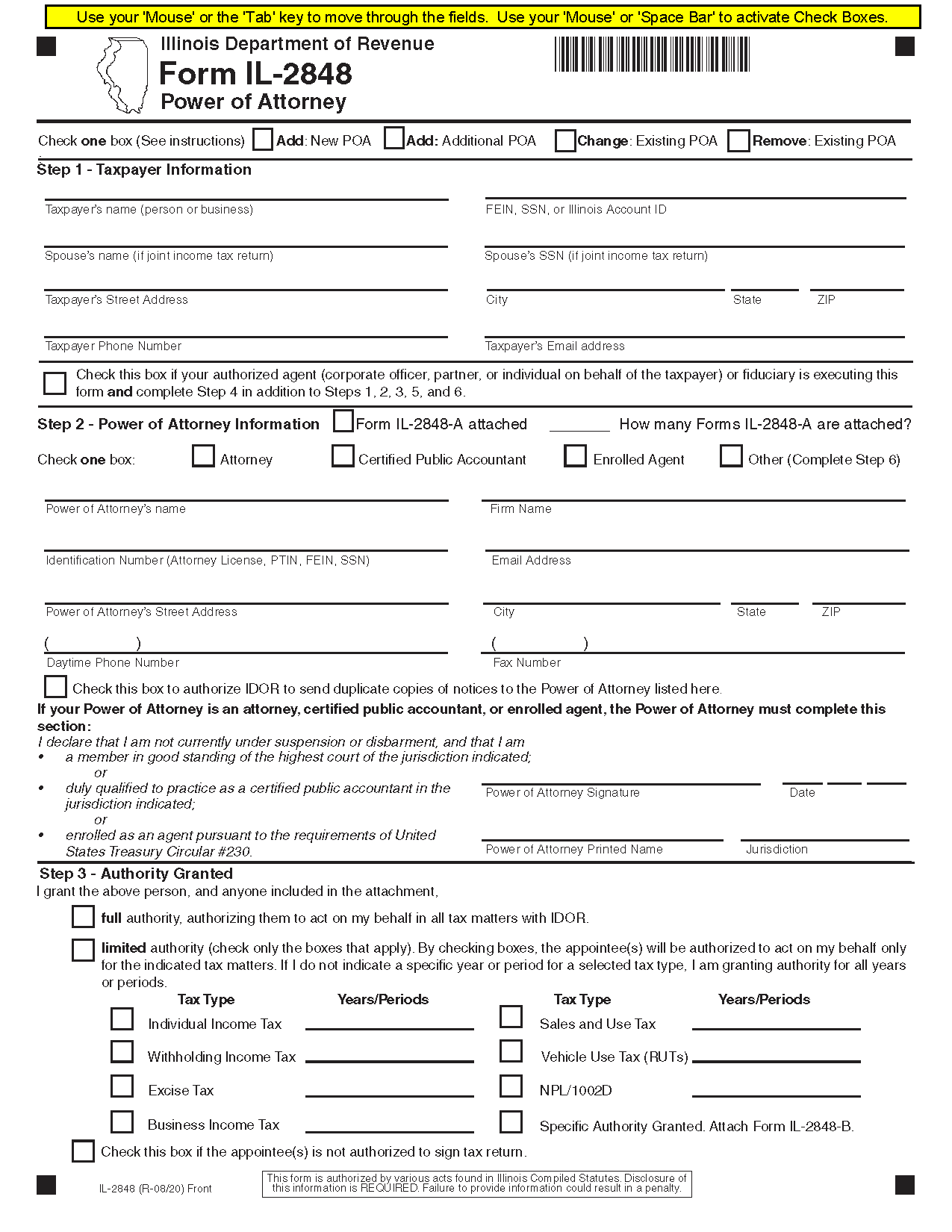

Signing Requirements

The taxpayer(s) or their authorized agent must sign this form.

If the taxpayer appoints someone other than an attorney, certified public accountant, or enrolled agent as a power of attorney, two witnesses or a notary public must sign the document.