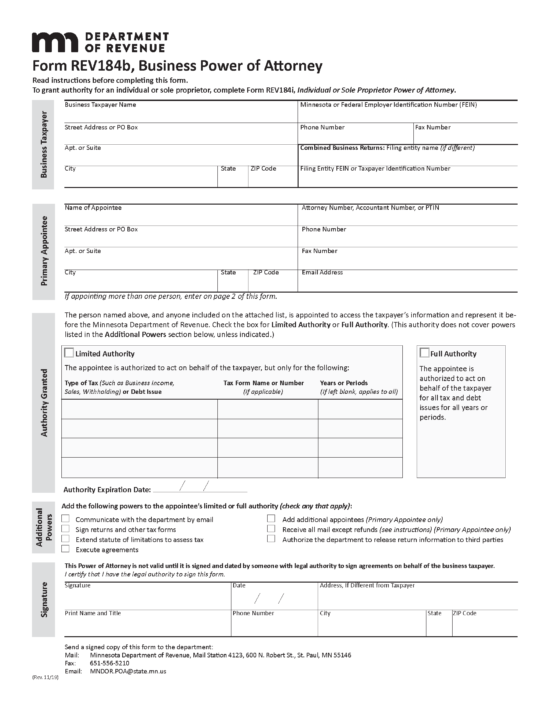

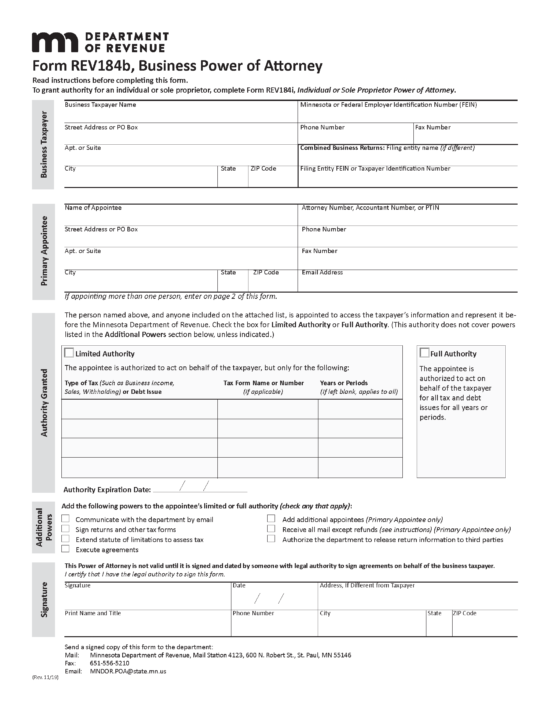

Minnesota Business Tax Power of Attorney (Form REV184b) – This form must be used instead of Form REV184i if the taxpayer is a business entity and not an individual or sole proprietor.

Minnesota Business Tax Power of Attorney (Form REV184b) – This form must be used instead of Form REV184i if the taxpayer is a business entity and not an individual or sole proprietor.

Download: PDF

The Minnesota tax power of attorney (Form REV184i) allows a taxpayer to appoint someone, typically an attorney or accountant, to represent them before the Minnesota Department of Revenue. This form can be used by either individuals or sole proprietors, enabling them to nominate up to six appointees.

The Minnesota tax power of attorney (Form REV184i) allows a taxpayer to appoint someone, typically an attorney or accountant, to represent them before the Minnesota Department of Revenue. This form can be used by either individuals or sole proprietors, enabling them to nominate up to six appointees.

Minnesota Business Tax Power of Attorney (Form REV184b) – This form must be used instead of Form REV184i if the taxpayer is a business entity and not an individual or sole proprietor.

Minnesota Business Tax Power of Attorney (Form REV184b) – This form must be used instead of Form REV184i if the taxpayer is a business entity and not an individual or sole proprietor.

Download: PDF