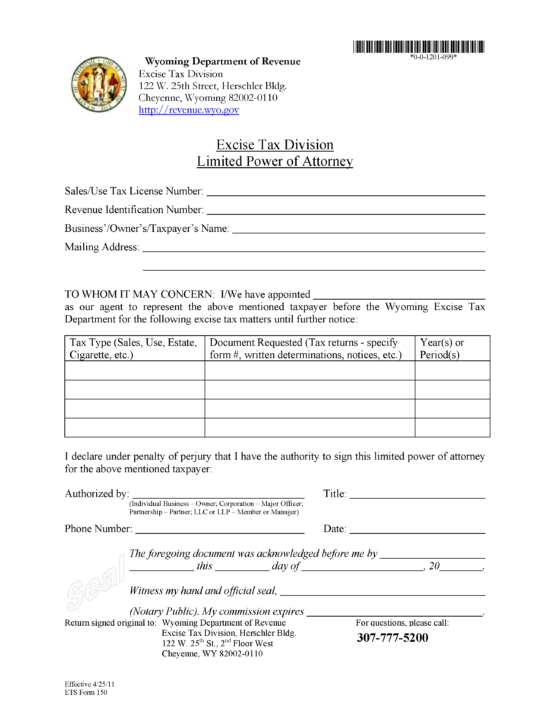

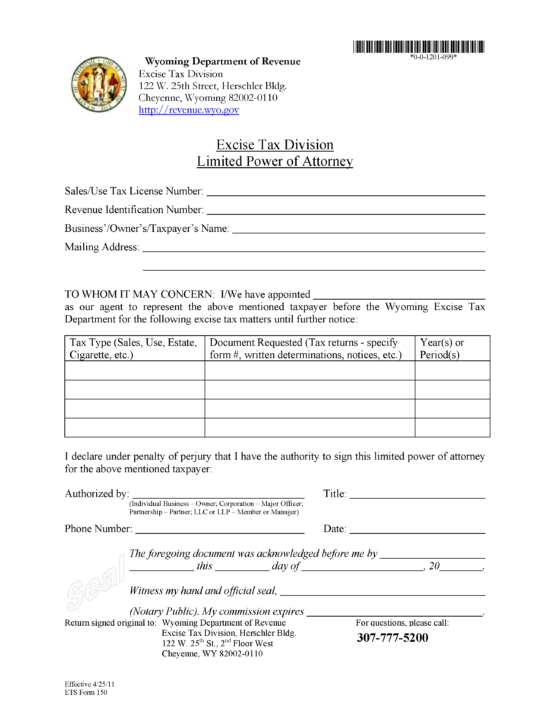

ETS Form 150 Limited Power of Attorney – For sales and use tax issues with the DOR, businesses can use this form to appoint a representative.

ETS Form 150 Limited Power of Attorney – For sales and use tax issues with the DOR, businesses can use this form to appoint a representative.

Download: PDF

A Wyoming tax power of attorney appoints a representative to handle tax matters with the IRS on behalf of another individual. It outlines the parties’ information and the tax types and years delegated to the representative. Unlike many other states, Wyoming has no income state tax, so taxpayers only need to file with the IRS.

A Wyoming tax power of attorney appoints a representative to handle tax matters with the IRS on behalf of another individual. It outlines the parties’ information and the tax types and years delegated to the representative. Unlike many other states, Wyoming has no income state tax, so taxpayers only need to file with the IRS.

ETS Form 150 Limited Power of Attorney – For sales and use tax issues with the DOR, businesses can use this form to appoint a representative.

ETS Form 150 Limited Power of Attorney – For sales and use tax issues with the DOR, businesses can use this form to appoint a representative.

Download: PDF