How to Use (3 Steps)

Step 1 – Check Requirements

An Affidavit for Collection of Personal Property of Decedent can be only used to avoid the probate process if all of the following apply:

- 30 days have passed since the decedent died

- No application or petition for the appointment of a personal representative is pending or has been granted

- The value of the decedent’s personal property is equal to or less than $50,000

- The value of the vehicles owned by the decedent is equal to or less than $100,000

- The decedent did not own real property at the time of their death, unless the property automatically transferred to another person

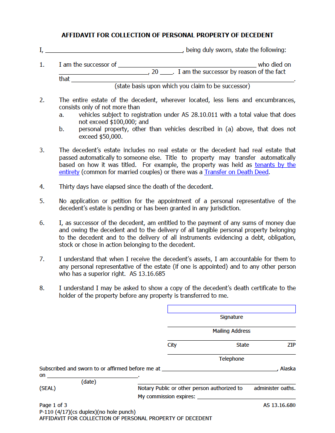

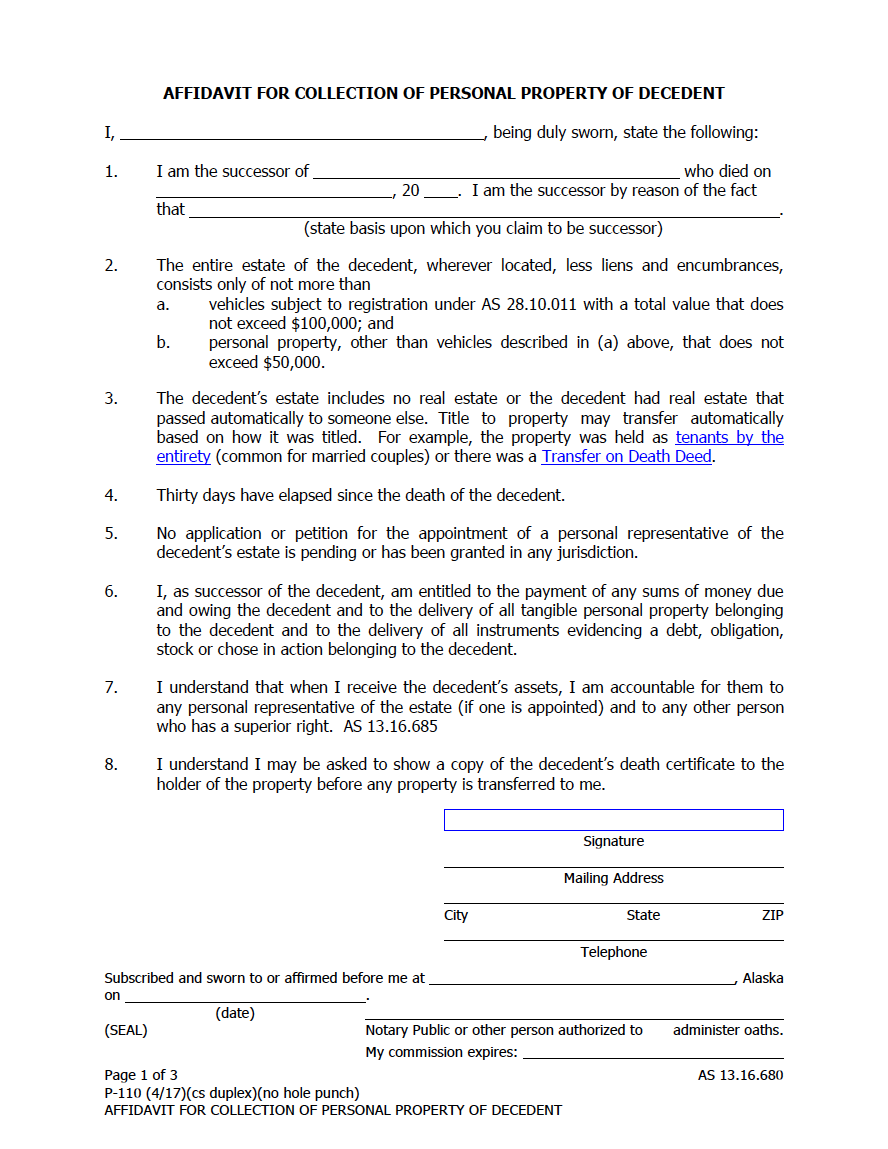

Step 2 – Complete Affidavit

The person using the Affidavit for Collection of Personal Property of Decedent (Form P-110) is called the “successor,” who can be any of the following:

- Any beneficiary named in the decedent’s will

- The personal representative named in the decedent’s will

- An heir of the decedent if they died intestate (without a will)

The successor must complete the Affidavit and sign it in the presence of a notary public.

Step 3 – Collect and Distribute Property

The successor may deliver copies of the Affidavit to any individual or business holding the decedent’s property and require them to release it. The successor must then distribute the property to the appropriate beneficiaries, heirs, or to a personal representative if one is later appointed by the court.[3]