How to Use (3 Steps)

Step 1 – Verify Eligibility

A small estate affidavit can be used to collect personal property (not real property) by a successor of the decedent. Before proceeding, the successor must ensure that all of the following requirements are met:

- The fair market value of the decedent’s property is $86,000 or less

- At least 10 days have passed since the date of death

- No petition or application to appoint a personal representative has been granted or is pending

- The successor is entitled to receive the property

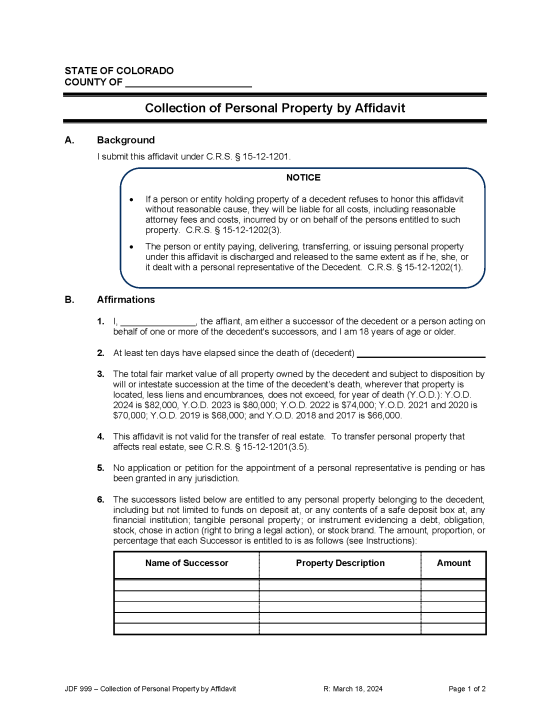

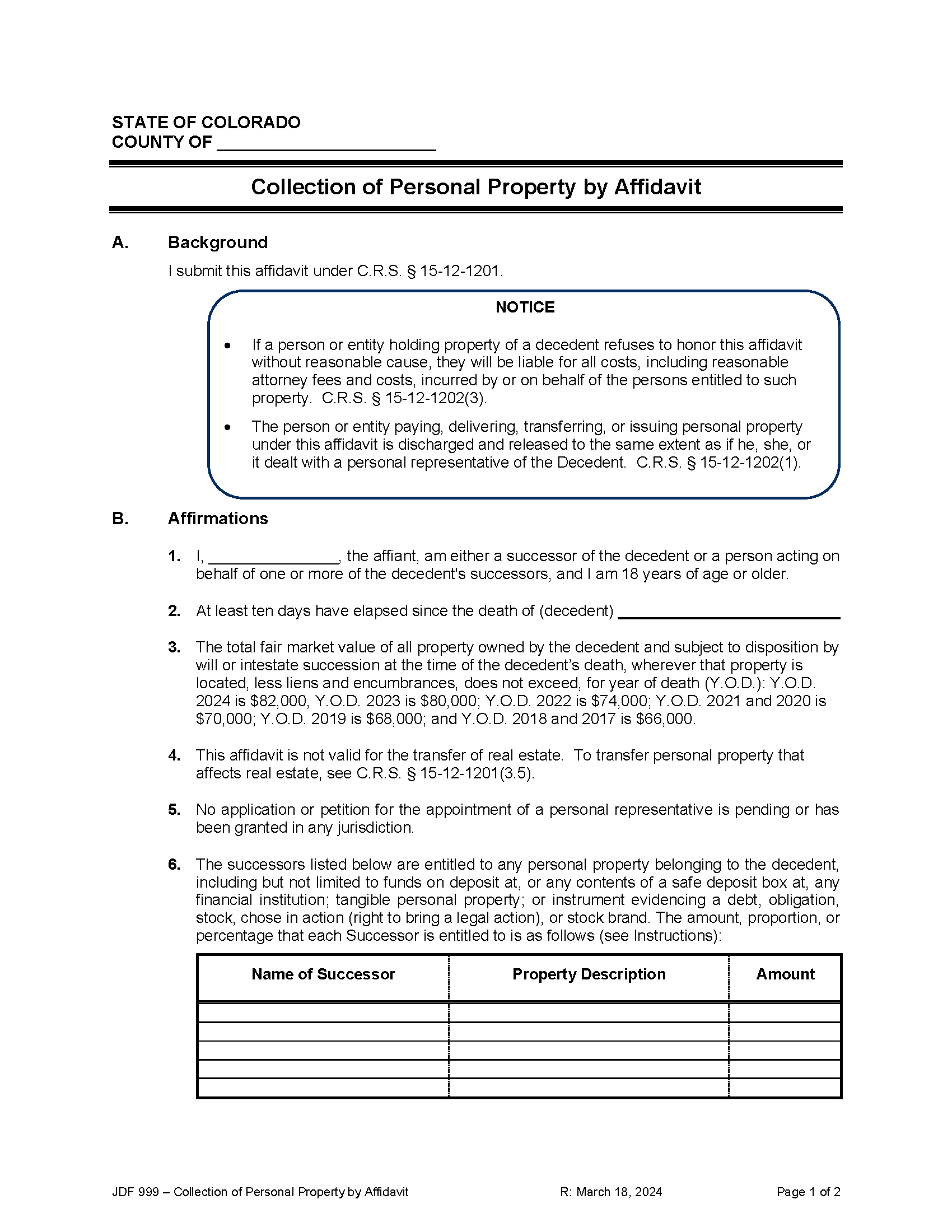

Step 2 – Complete Affidavit

The successor must complete the Affidavit for the Collection of Personal Property of a Decedent and have it notarized. A copy of the death certificate should be attached.

Note: To transfer a motor vehicle, the successor must use the DMV’s small-estate form, Affidavit for Collection of Personal Property Pursuant to Small Estate Proceeding (Form DR 2712).

Step 3 – Collect Personal Property

The completed Affidavit can be presented to any person or institution holding the decedent’s personal property. If a holder refuses to accept the Affidavit, the successor may petition the court to order the release of the property.[3]