A small estate affidavit can only be used to collect personal property (e.g., tangible assets, bank accounts, safety deposit boxes, stocks), not real estate. Furthermore, if the successor wants to collect a vehicle, they must use a specific small estate affidavit form provided by the DMV. In Colorado, a decedent’s estate is considered “small” if the total fair market value of all property owned by the decedent at the time of death does not exceed $80,000.

Laws

- Statute: Title 15, Part 12

- Maximum estate value (§§ 15-12-1201(1)(a), 15-11-403): $82,000 (adjusted annually based on cost of living adjustment calculated in § 15-10-112(2))

- Mandatory waiting period (§ 15-12-1201(1)): Ten (10) days

- Where to file: No filing requirements.

How to Record (3 Steps)

Step 1 – Requirements

A small estate affidavit can be used to collect personal property (not real property) by a successor of a decedent or a person acting on their behalf. The person filing the affidavit must make sure the following requirements are met:

- The value of the estate is $82,000 or less.

- At least ten (10) days have elapsed since the decedent’s death.

- No appointment for a personal representative is pending or has been granted.

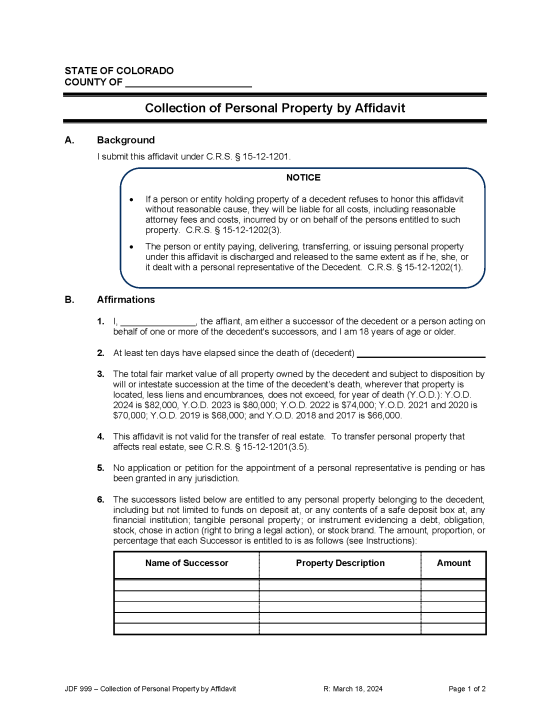

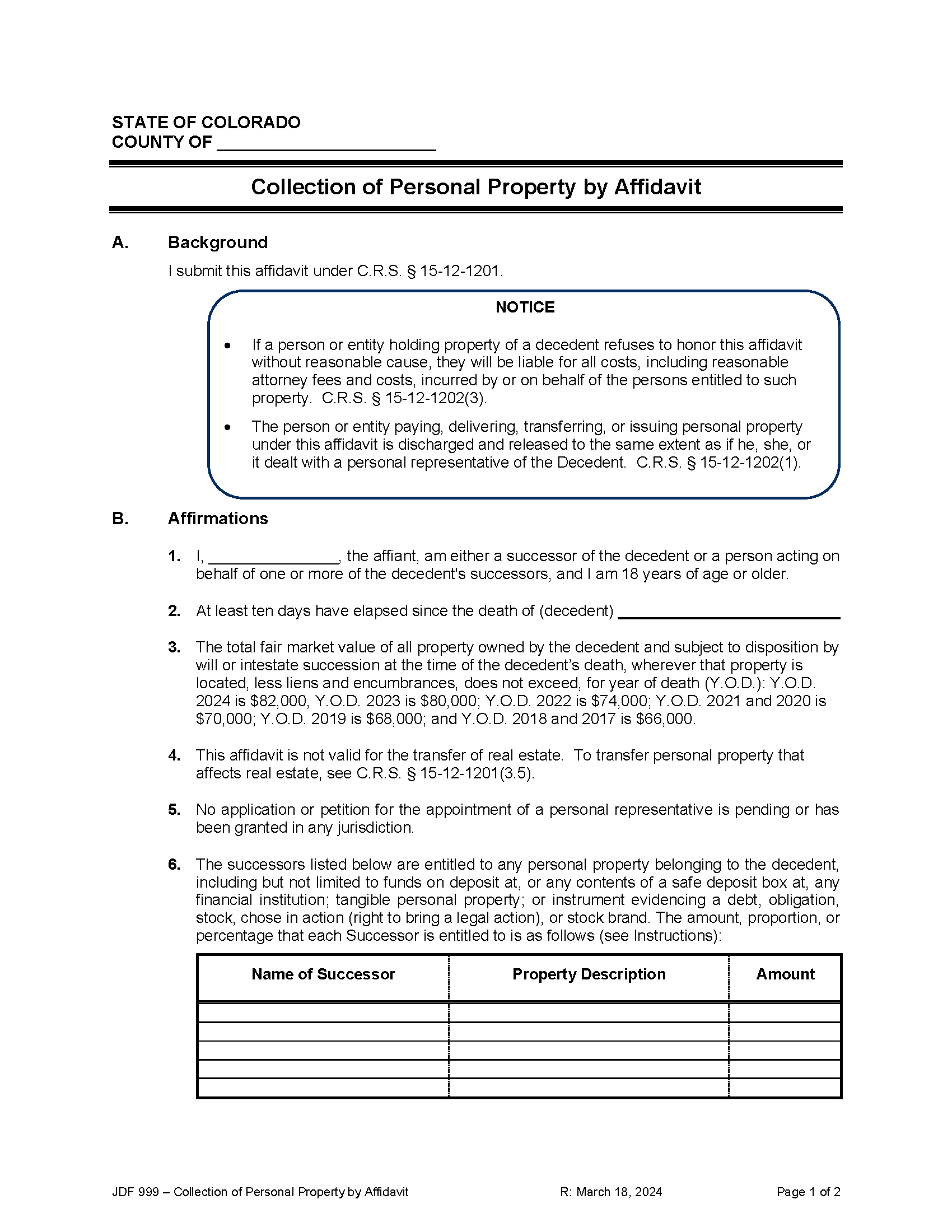

Step 2 – Complete Affidavit

The successor or representative of the successor must complete the Affidavit for the Collection of Personal Property of a Decedent and have it notarized. A copy of the death certificate should be attached to the affidavit (some entities may require that the copy be certified). The documents do not need to be filed with probate court, they can be presented to the person or entity indebted to the decedent or in possession of the personal property.

Note: If the successor is attempting to collect vehicles left by the decedent, they must use the small estate affidavit provided by the DMV, called the Affidavit for Collection of Personal Property Pursuant to Small Estate Proceeding (Form DR 2712).

Step 3 – Collect Property

The successor or representative can take the completed affidavit and use it to collect the decedent’s personal property, such as bank account balances, the contents of a safety deposit box, instruments of debts or obligations, or stocks. If the person or entity does not honor the affidavit, the successor can petition for the courts to get involved, and the person/entity will be ordered to hand over the property and possibly pay the associated costs.