Laws

- Maximum Estate Value: The maximum value (excluding exempt property) varies depending on whether the decedent left a will:

- Exempt Property: The following property is excluded from the estate value[3]:

-

- $20,000 in household furniture, furnishings, and appliances

- Two motor vehicles

- Tuition programs

- Teacher/school administrator death benefits

- Homestead

-

- Mandatory Waiting Period: If the decedent died without a will, filing cannot take place until one year after the date of death.

- Where to File: Clerk of Court Office

How to File (4 Steps)

Step 1 – Small Estate Qualifications

An estate qualifies as a small estate in Florida only if all of the following are true:

- No probate case has been initiated

- The decedent did not own real estate other than a homestead

- The value of non-exempt property does not exceed the final expenses, defined as funeral costs and medical bills incurred during the last 60 days of the decedent’s life

If the decedent died without a will, the following additional requirements apply:

- The Disposition may not be filed until one year has passed since the date of death

- The value of non-exempt property cannot exceed $10,000 plus final expenses

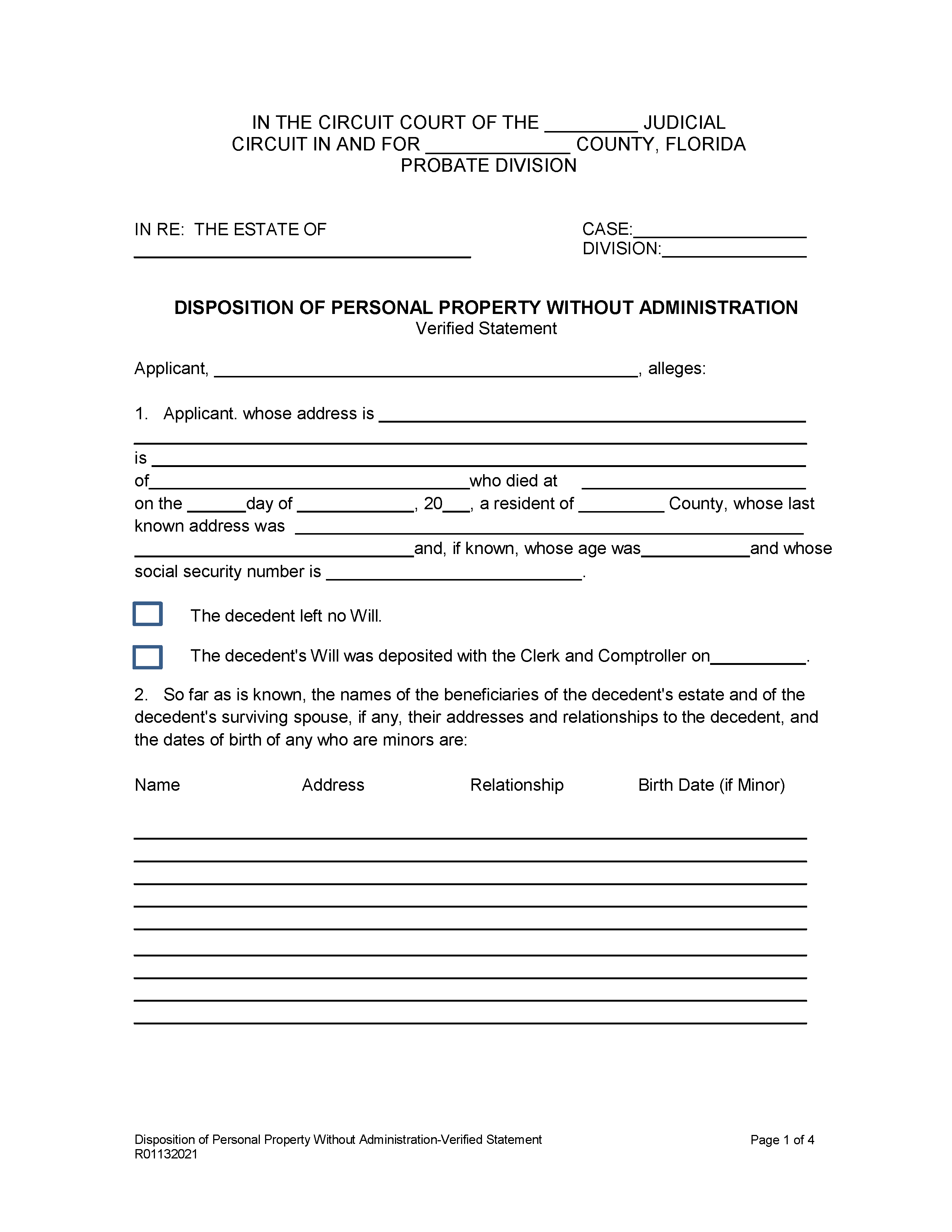

Step 2 – Disposition Form

The applicant will need to complete the Disposition of Personal Property Without Administration and attach the following:

- Certified copy of the death certificate

- Decedent’s original will (if applicable)

- Copies of funeral and medical bills

- Documentation of asset ownership

- Statement Regarding Creditors

- Consent to Disposition of Personal Property – Must be signed by all heirs who consent to the transfer.

- Affidavit of Hiers (Sample) – A county-specific version may be obtained from the court.

Step 3 – Filing and Notification

The required forms must be submitted to the clerk of court’s office in the county of the decedent’s last residence. The clerk will issue a copy of the Disposition, which must be served on the following parties[4]:

- All known creditors

- Any heirs who did not sign the Consent to Disposition

- Florida Agency for Health Care Administration – Only required if decedent was over age 55.

After serving the Disposition, proof of service must be filed with the clerk’s office.

Step 4 – Approval

If the filings are approved, the court will issue an Order authorizing the applicant to collect the decedent’s assets. The Order can then be used to claim estate property from the decedent’s bank and any other asset holders.