Laws

- Statute: Disposition of Personal Property Without Administration (Chapter 735, Part II)

- Maximum Estate Value:

- Exempt Property (§ 732.402)

- Furniture, furnishings, and appliances that do not exceed $20,000 in value

- Two (2) vehicles

- Tuition programs (§§ 1009.98 and 1009.981)

- Teacher/school administrator death benefits

- Non-Exempt Property with Will (§ 735.301) – Cannot exceed final expenses (medical bills, funeral costs, etc.).

- Non-Exempt Property without Will (§ 735.304) – Cannot exceed the sum of final expenses and $10,000.

- Homestead (Sec. 4(c)) – If the deceased has a surviving spouse or minor children, any owned residence will not be included in the value of the estate.

- Exempt Property (§ 732.402)

- Mandatory Waiting Period: Not mentioned in state statutes.

- Where to File: Clerk of Court’s Office

How to File (3 Steps)

Step 1 – Qualifications

To qualify for a Disposition of Personal Property without Administration, the decedent’s estate, excluding any exempt property or homestead, cannot exceed “final costs.” Final costs are defined as any funeral and medical expenses incurred during the last sixty (60) days of the decedent’s life (and after).

Note: If there is no will, the disposition cannot be filed until one (1) year has passed since the date of death and non-exempt assets cannot exceed the sum of $10,000 and final expenses.

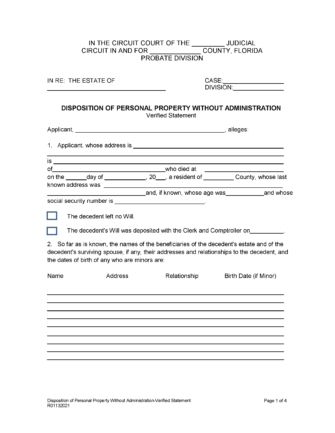

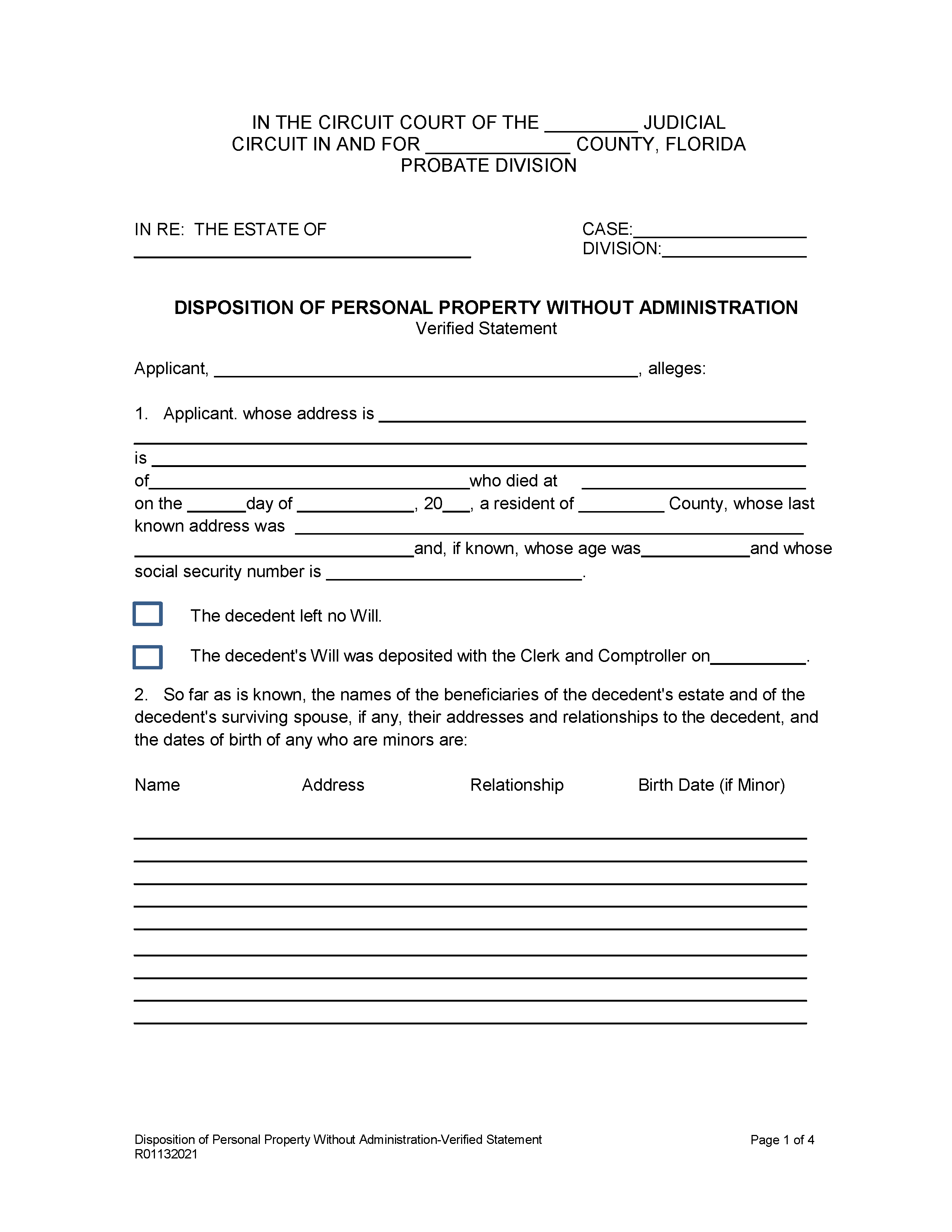

Step 2 – File Disposition

The applicant will need to complete and execute the Disposition of Personal Property without Administration form. They will also need to assemble the following documents before filing the verified statement:

- Decedent’s death certificate

- Decedent’s original will (if applicable)

- Affidavit of Heirship (obtained from county clerk)

- Copies of funeral and medical bills

- Documentation of assets

All of the required forms must be submitted to the Clerk of Court’s Office in the jurisdiction of the decedent’s last residence.

Step 3 – Distribution of Assets

If the applicant’s statement is approved, the court will authorize the payment, transfer, and disposition of the decedent’s assets. The verified statement can then be used to claim estate property from the decedent’s bank, local motor vehicle service center, and any other asset holders.