Laws

- Maximum Estate Value: $100,000 (not including vehicles)[1]

- Mandatory Waiting Period: Not mentioned in state statutes.

- Where to File: No filing required.

How to Use (3 Steps)

Step 1 – Confirm Eligibility

To qualify as a small estate that can bypass probate, the following requirements must be met:

- The estate must be valued at $100,000 or less, excluding motor vehicles

- The estate cannot include any real property

- The affiant must be the decedent’s successor

- There can be no pending or approved appointment of a representative in Hawaii

Step 2 – Complete Affidavit

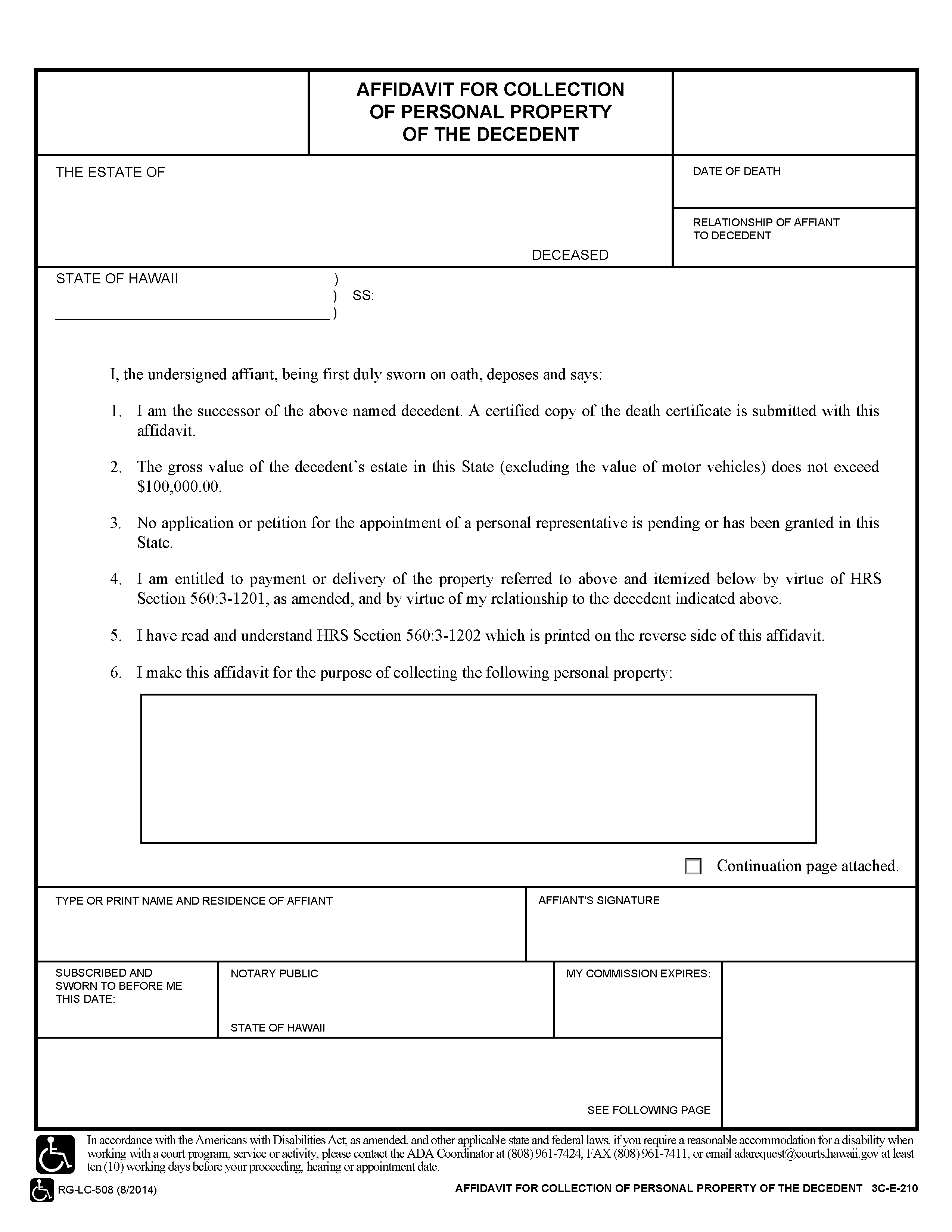

An individual seeking to collect the decedent’s property must complete the Affidavit for Collection of Personal Property of the Decedent, have it notarized, and attach a certified copy of the death certificate.

Step 3 – Collect Property

The notarized Affidavit can be presented as proof when taking possession of the decedent’s personal property. If any party refuses to pay, transfer, or deliver the decedent’s assets, the affiant can take legal action against them.[2]

Motor Vehicles – Vehicles may be transferred by completing an Affidavit for Collection of Personal Property (Automobile) of Decedent and presenting it to the local DMV.