Laws

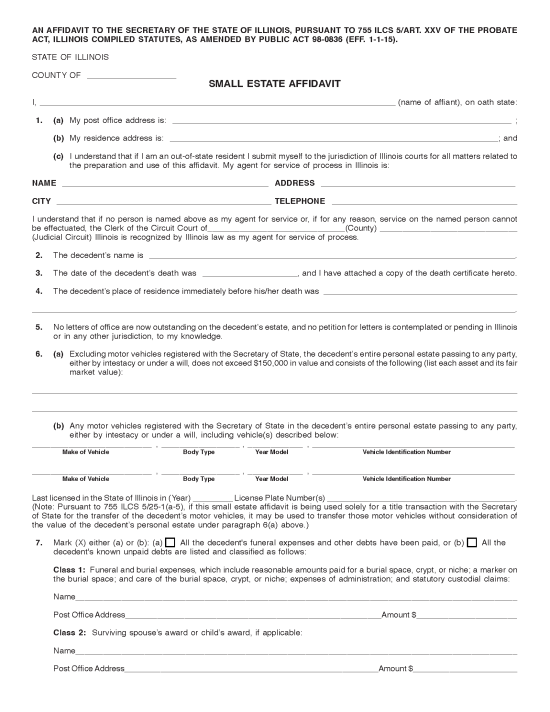

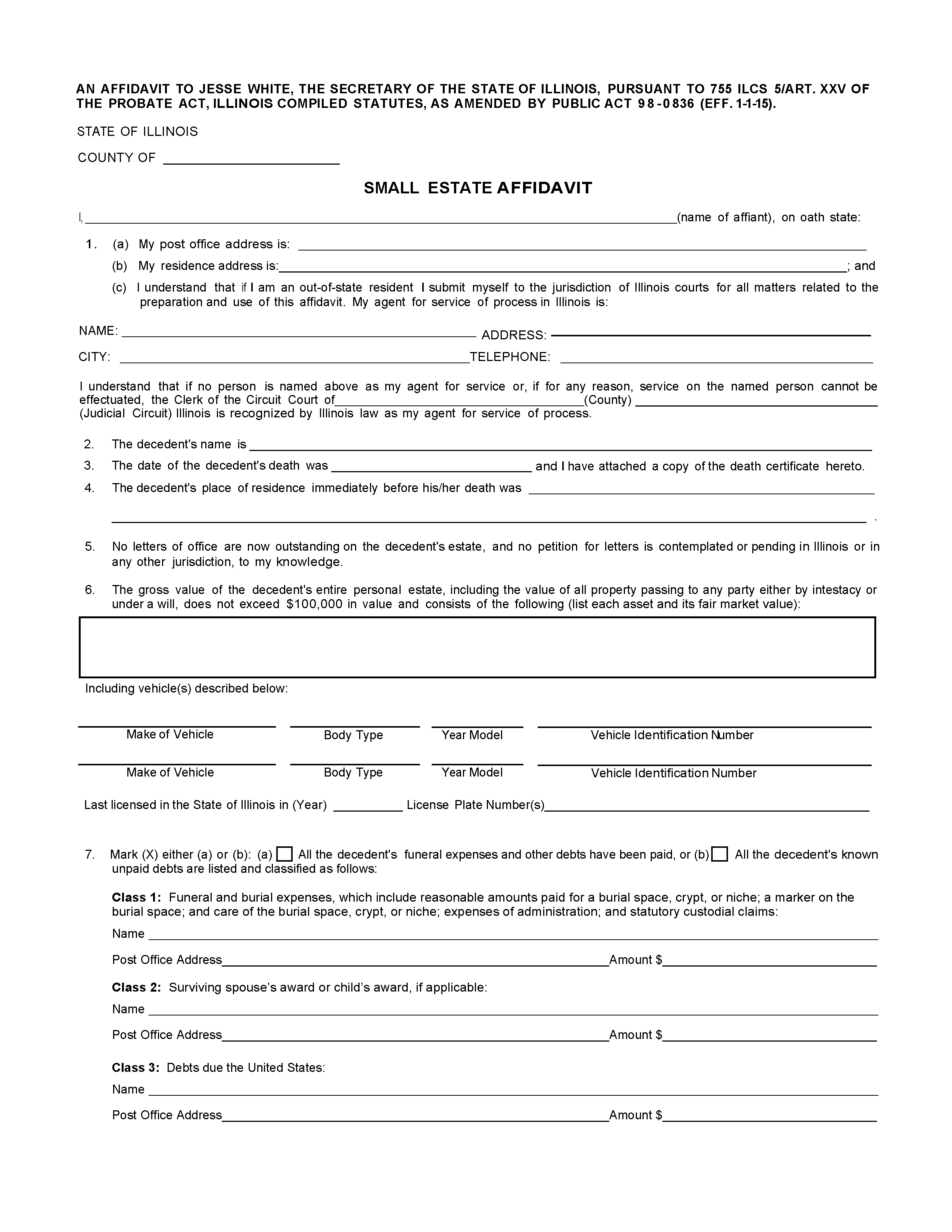

- Maximum Estate Value: $150,000 (excluding motor vehicles)[1]

- Mandatory Waiting Period: Not mentioned in state statutes.

- Where to File: No filing required.

How to Use (3 Steps)

Step 1 – Requirements

To be considered eligible for an Illinois small estate affidavit, all of the following must apply to the decedent’s estate[2]:

- The estate value, excluding registered motor vehicles, does not exceed $150,000

- The estate does not include real property

- No probate case is pending and no letters of office have been issued

Step 2 – Complete the Affidavit

The affiant must complete the Illinois Small Estate Affidavit and present it to a notary public for notarization. A certified copy of the death certificate and, if applicable, the decedent’s will must be attached to the Affidavit at the time of notarization.

Note: If the affiant is an out-of-state resident, an agent or circuit court clerk will need to be assigned to receive court paperwork.[3]

Step 3 – Collect Property

Once the Affidavit has been notarized, the affiant may present it to the individuals or entities holding the decedent’s assets in order to collect them for distribution. However, before distributing property to heirs, the affiant must ensure that all valid creditor claims are paid.[4]