How to Use (3 Steps)

Step 1 – Confirm Estate Eligibility

Each of the following conditions must be met for a successor to use a small estate affidavit in Indiana[3]:

- The total value of the estate does not exceed $100,000 (not including liens, encumbrances, and funeral expenses)

- At least 45 days have passed since the death of the decedent

- There is no pending or granted appointment of a personal representative

- The affiant is the decedent’s legal heir

- The affiant has informed any other beneficiaries of their intention to use the affidavit

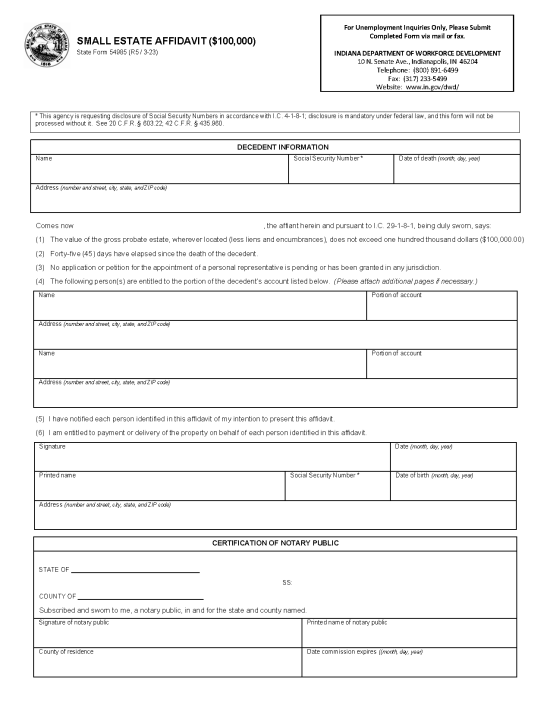

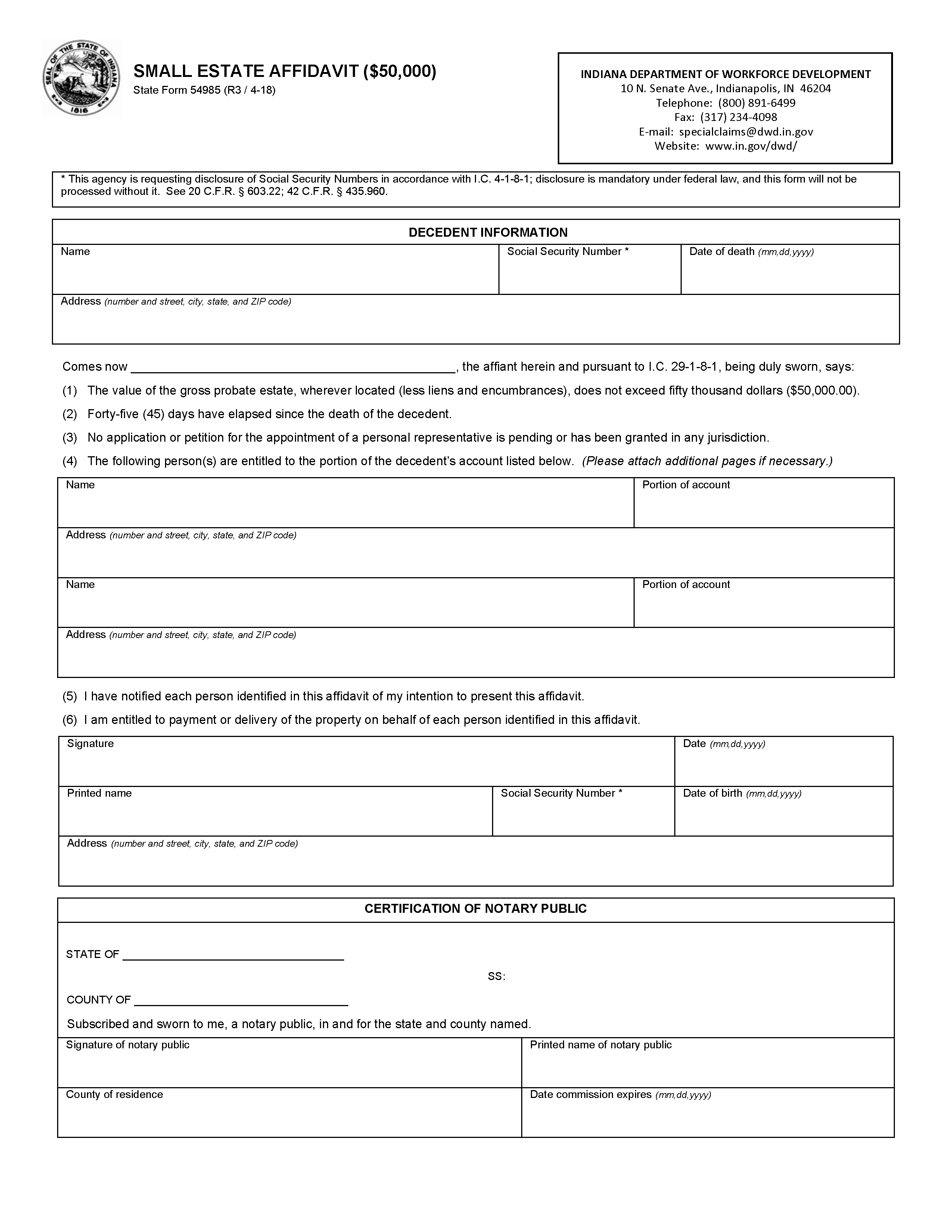

Step 2 – Complete Affidavit

An heir of the decedent must fill out the Small Estate Affidavit and attach the following documents:

- Certified copy of the death certificate

- The decedent’s will (if one exists)

Once completed, the Affidavit must be notarized by a notary public.

Step 3 – Distribute Assets

The affiant can use the notarized Affidavit to collect the decedent’s property from any person, bank, or institution holding it. If the estate includes motor vehicles or watercraft, the affiant will need to complete the Affidavit for Transfer of Certificate of Title and submit it to the Bureau of Motor Vehicles.[4]