Laws

- Maximum Estate Value: $30,000[1]

- Mandatory Waiting Period: Not mentioned in state statutes.

- Where to File: District Court

How to File (3 Steps)

Step 1 – Estate Requirements

To bypass estate administration, the petitioner must first ensure that the following conditions apply:

- The estate is valued at $30,000 or less

- The estate does not include any real property

- The decedent is survived by their spouse or children

- Administration costs, funeral expenses, and debts have been paid

- The petitioner is the surviving spouse, surviving child, or preferred creditor of the decedent

What is a Preferred Creditor?

A preferred creditor is an individual who has paid for the decedent’s estate administration, funeral arrangements, debts, taxes, and other expenses deemed admissible by the court.

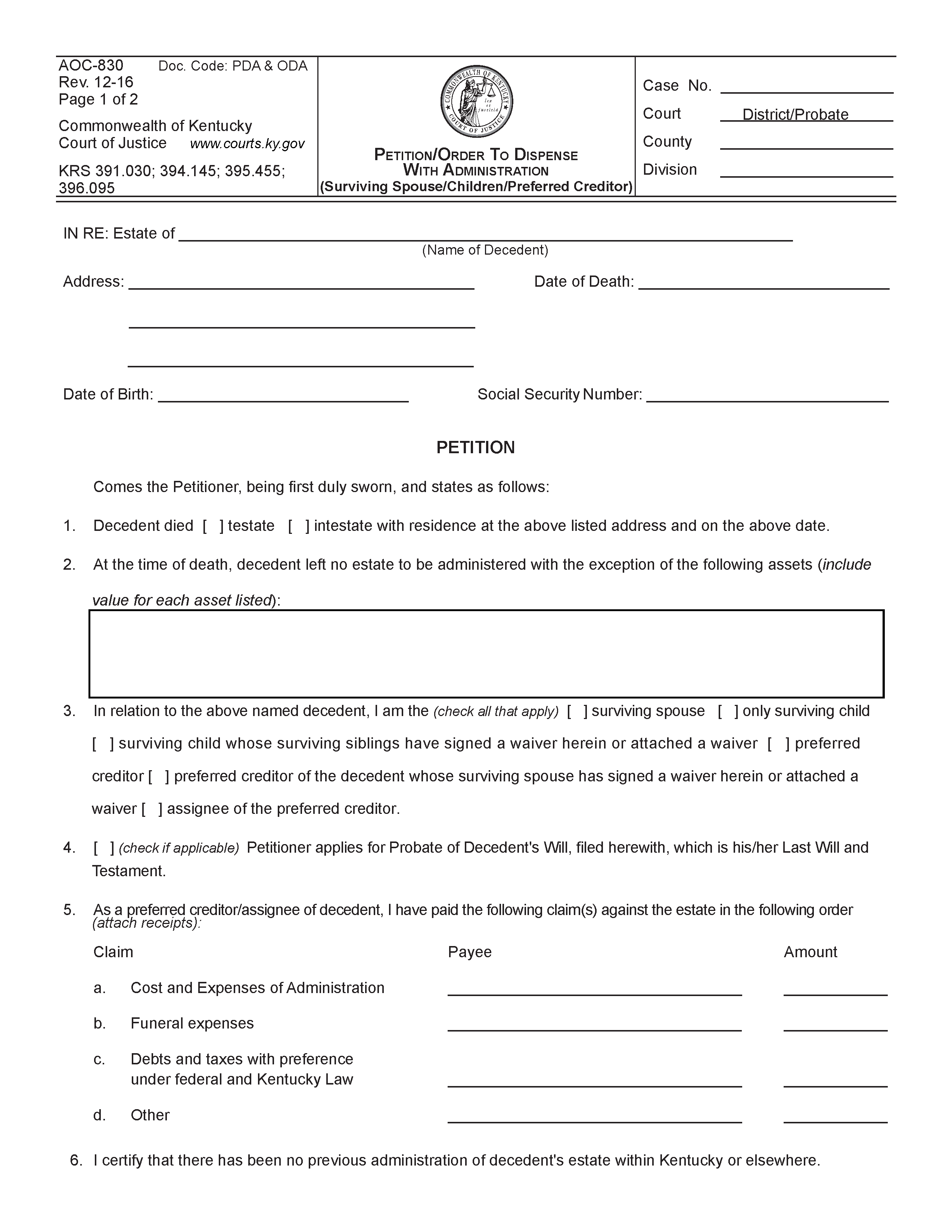

Step 2 – Affidavit Filing

The small estate affidavit, officially known as the Petition to Dispense with Administration, can be filled out by the surviving spouse, child, or preferred creditor of the decedent.

Once prepared, the Petition must be notarized and filed with the District Court for the county in which the decedent resided.

Step 3 – Distribution of Assets

If the request is granted, a judge will sign the order that’s included in the Petition. The petitioner will then receive a certified copy of the order, which may be used to collect the decedent’s property and distribute it to creditors and heirs.